The New Zealand dollar suffered from a damp mood in global financial markets and slid from the highs, with the falls accelerating late in the week. The upcoming week features 3 releases. Here is an analysis of fundamentals and an updated technical analysis for NZD/USD.

The worrying signs from China and the Mid-East tensions hurt risk currencies such as the kiwi. Milk prices had an impact on the kiwi as well, this time to the downside, with a fall of 1.6% recorded. In the US, the NFP was great, and this also helped the greenback against the struggling commodity currencies.

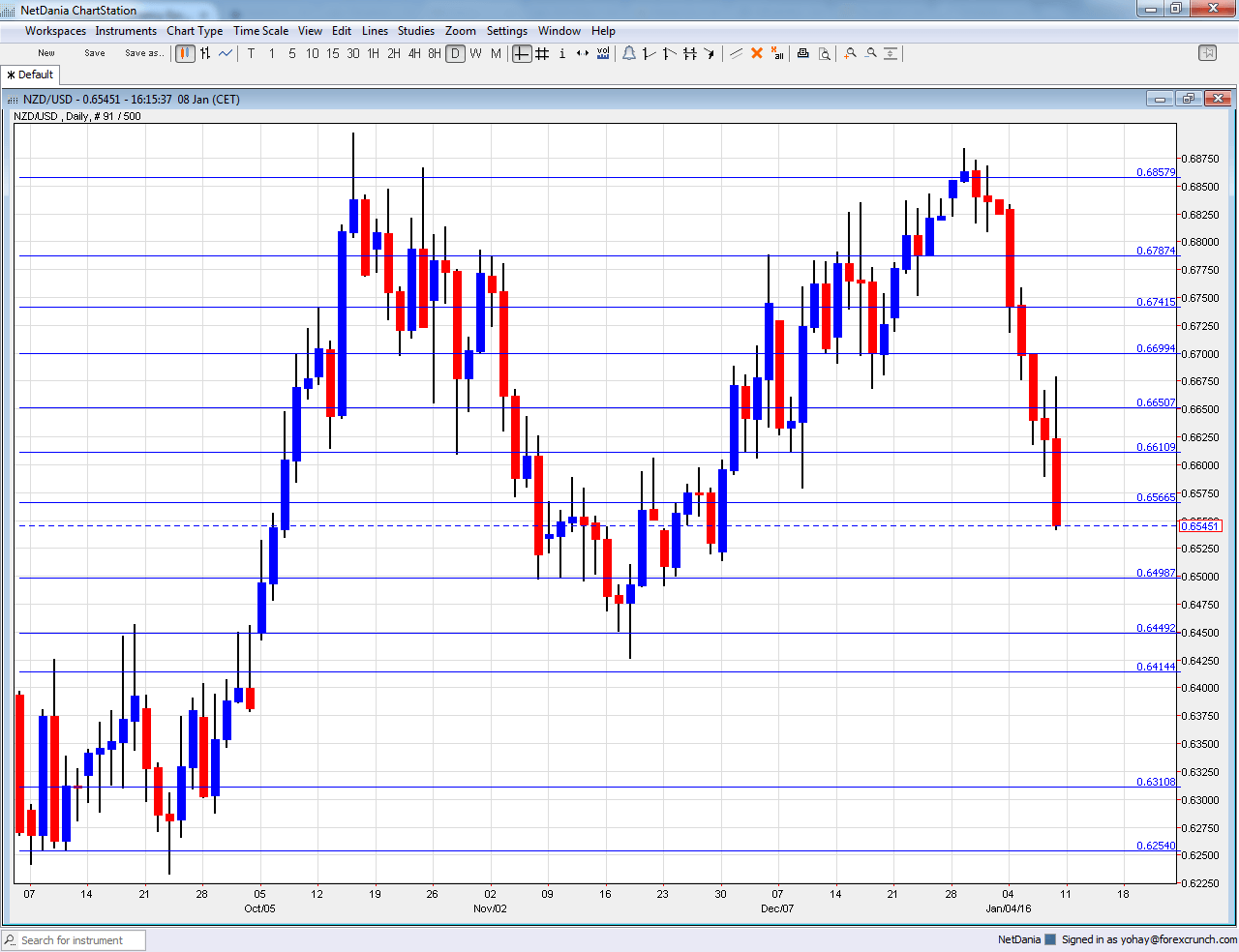

[do action=”autoupdate” tag=”NZDUSDUpdate”/]NZD/USD daily graph with support and resistance lines on it. Click to enlarge:

- Building Consents: Sunday, 21:45. This figure is quite volatile, but still has an impact on markets. After a rise of 5.1% in October, we could see a slide now.

- ANZ Commodity Prices: Tuesday, 00:00. This measure of commodity prices provides a wide measure for New Zealand’s soft commodity exports. A big drop of 5.6% was seen in November and now we get fresh data for December.

- FPI: Thursday, 21:45. New Zealand exports food, making this publication of importance, despite the prominence of the GDT data. A small slide of 0.2% was reported in November.

NZD/USD Technical Analysis

Kiwi/dollar started off the week with a drop below 0.6790 (mentioned last week). It then began a free fall.

Technical lines, from top to bottom:

We begin from lower ground this time. The low of 0.6940 allowed for a temporary bounce. The round 0.69 level has switched positions to resistance.

0.6860 was a low point as the pair dropped in June 2015. It is followed by 0.6790 that capped the pair in recent months.

It is followed by the round level of 0.67 that works nicely as support. Another line worth noting is 0.6640, which capped the pair in November.

The post crisis low of 0.6560 is still of importance. Below, the round 0.65 level is of high importance now, serving as support.

Below, we find 0.6425, whcih was the low point in November, as support. The last line for now is 0.63, which had a role in the past.

I am neutral on NZD/USD

The bad mood has taken over markets and it knocks down the kiwi, despite the optimism. These forces remain at play for another week, and they could balance each other.

In our latest podcast we explain China and grill the Fed

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast.