The real votes coming in from across the US favor the Republican candidate, and markets are panicking. The dollar is selling off against the yen, pound and the euro. Update: Trump has a wider and wider path and it’s all but certain.

The states that were expected to go for Clinton are too close to call and Florida leans towards Trump. This was seen as ending early with Clinton winning Florida. Update: Trump was declared the winner in Florida and could take Michigan, Wisconsin and Pennsylvania. Follow the live blog

Trump wins. It’s official – markets devastated – all currency updates

More: full preview and all the updates

Clinton hardly wins Virginia and also struggles to win states in her firewall.

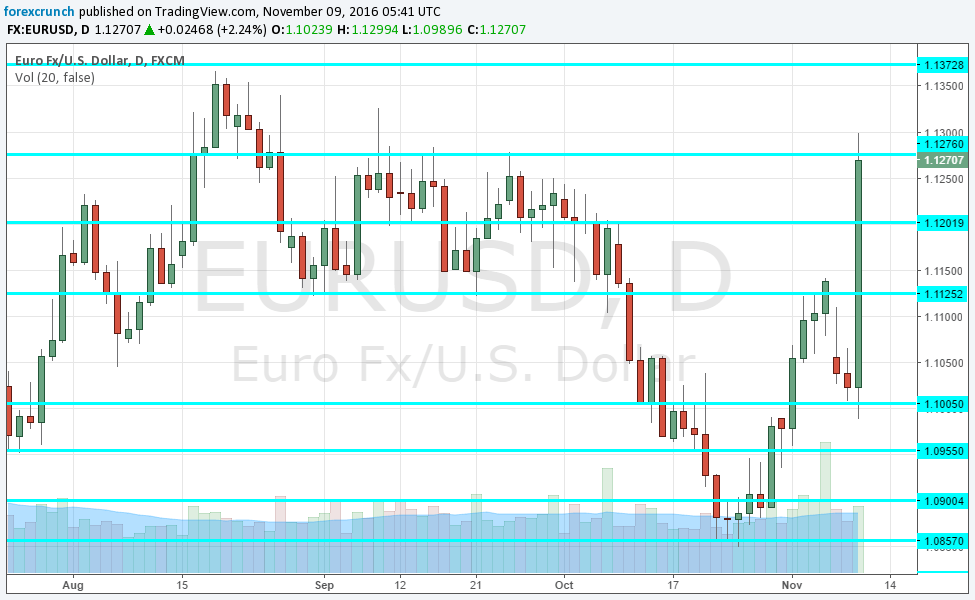

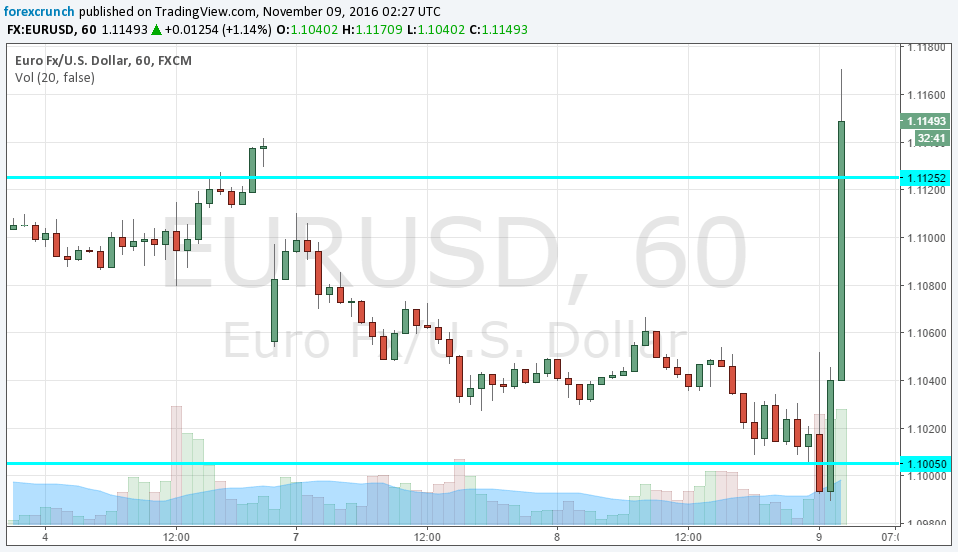

EUR/USD broke above the very tough 1.1125 line of resistance. Here is the chart. Update: the pair continues above another resistance line: 1.1220. The next level to watch is 1.1280. Remember that the euro is not a “classic” safe haven pair and if Trump indeed makes it to the Oval Office, the euro’s fate could change.

Further resistance is at 1.1375, followed by the classic 1.1460 and then the high of the year, 1.1616. The high level of 2015 is 1.1712.

On the downside, 1.12 is the immediate support, followed by 1.1120. 1.10 follows. As aforementioned, Euro/dollar could also turn down once the dust sinks.

Update: EUR/USD slides back down towards 1.12 despite Trump winning Pennsylvania. It could even end the week lower.

Trump wins. It’s official – markets devastated – all currency updates

Here is the initial reaction in EUR/USD.