Prices advanced by 0.1% m/m in October, significantly less than 0.3% expected. Year over year, price gains slowed down from 1% to 0.9%. Also Core CPI is moving down: 1.2% instead of 1.4% expected and 1.5% last time. Clothing and university tuition fees are responsible for the slide.

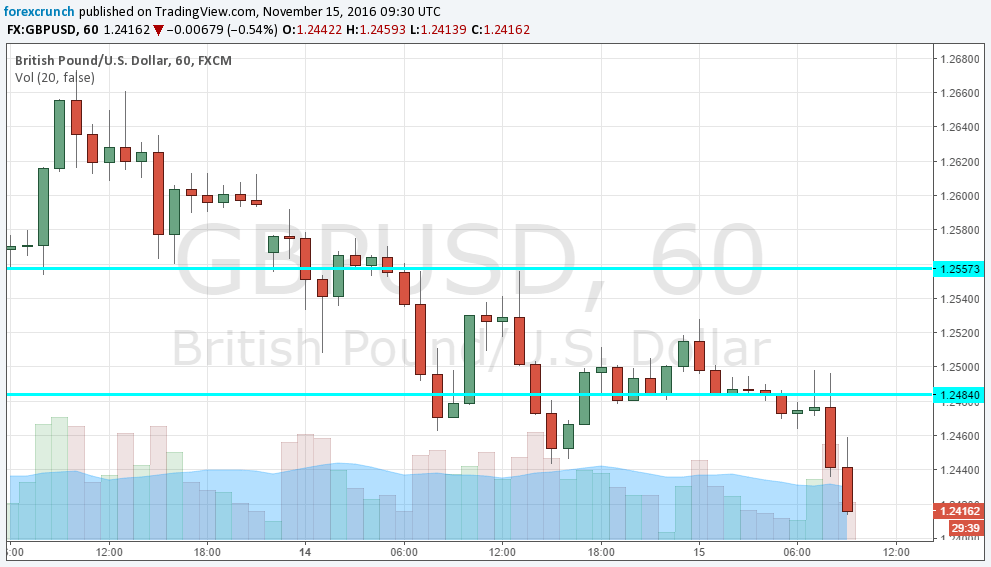

GBP/USD is dropping fast, trading at 1.2420.

The Bank of England recently updated its forecasts, seeing higher inflation on the back of Brexit-driven weaker pound. So, the data either shows things are not moving in a straight line, or that inflation is not rising so quickly, perhaps due to poor demand.

The United Kingdom was expected to report a rise in the annual inflation rate, with CPI climbing from 1% to 1.1%. Month over month, a rise of 0.3% was on the cards after 0.2% beforehand. Core CPI carried expectations for a small slide from 1.5% to 1.4%.

GBP/USD was attempting a recovery after the greenback took a break from the rally it enjoyed after Trump’s Triumph. While the pound was surprisingly strong at first, weathering the storm, it eventually surrendered.

Here is the quick drop on the cable chart. The pound’s fall comes in stark contrast to the slide of the dollar across the board. EUR/GBP is surging over 1% to 0.87.

More: GBP – targets for the “pain trade”