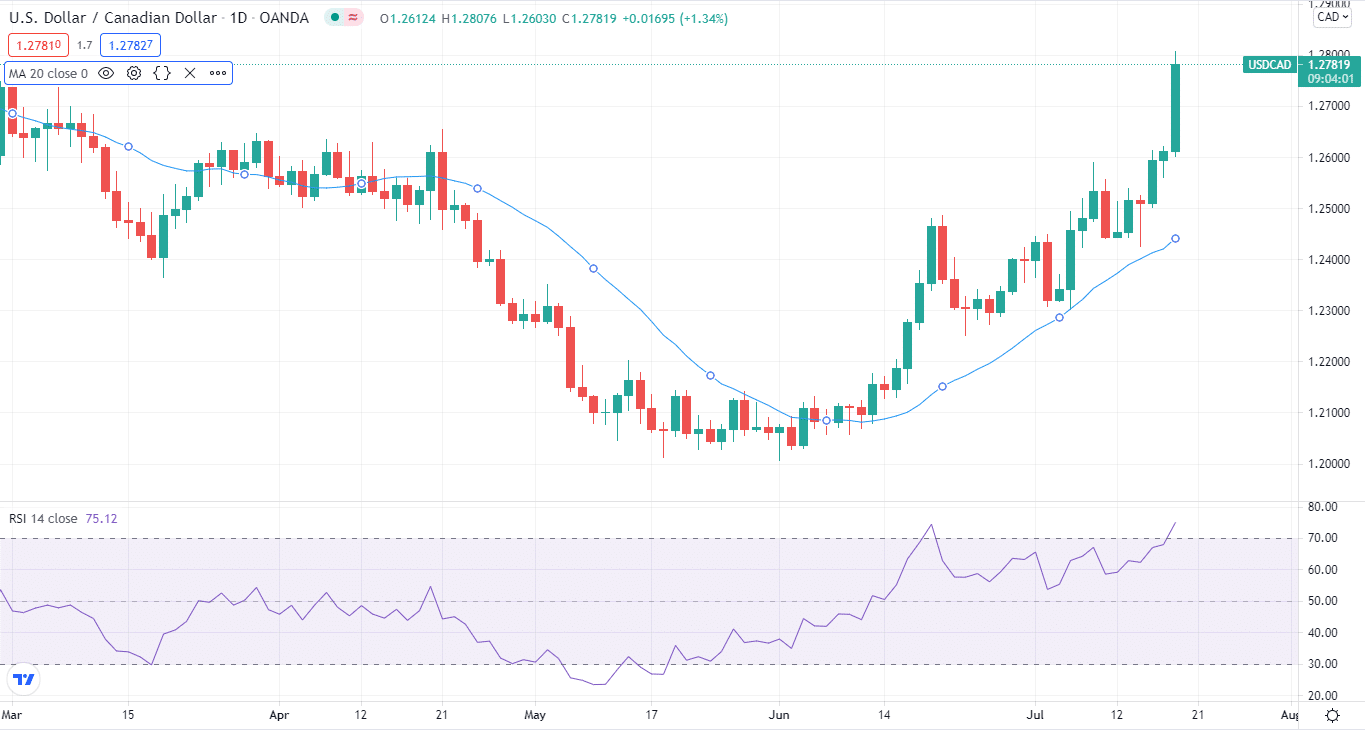

- USD/CAD hits three months high, going beyond the 1.2700-mark.

- DXY is benefiting from a risk-off mindset as a result of COVID concerns.

- The Loonie has reclaimed its 20-day moving average, implying that further gains are on the way.

On Monday, July 19, USD/CAD analysis started the week with a bang. The pair has crossed its 3-months high and is looking to target various resistances around the 1.2800 level.

USD/CAD fundamental analysis

The USD/CAD broke over three-month highs, soaring to 1.2800, as the bulls remained relentless after three consecutive days of gains on Monday.

-Looking for high probability free forex signals? Let’s check out-

The currency pair is supported on two fronts. The first is the US dollar moving higher on the risk-aversion wave, owing to an increase in Delta covid variant cases globally.

Things are looking good for the greenback, as it is supported by a strong jump in US Treasury bond yields, as well as expectations that the Fed will tighten monetary policy sooner than expected.

The Fed’s unwillingness to modify policy will negatively influence inflation expectations in the United States. This is because consumers perceive the central bank to be tolerant of the daily price rises, they face.

WTI prices are also contributing to the Loonie’s upside. The WTI fell more than 1% to break $71 after OPEC, and its partners (OPEC+) agreed over the weekend to increase oil supplies to combat the price surge. However, the drop in oil prices has harmed sentiment surrounding the resource-linked WTI.

Fundamentals in both countries are largely balanced. As a result, the US economy will grow quicker, but the benefits will extend over the border due to its close relations with its northern neighbor.

Looking ahead, broader market sentiment will continue to be the primary market driver due to a lack of important economic news and the looming threat of COVID and inflation.

-Are you interested to find high leverage brokers? Check our detailed guide-

USD/CAD technical analysis: Key levels in action

The pair’s daily chart shows that the recent uptrend has prompted the rates to capture the strongly bullish 20-day moving average at 1.2760.

The 14-day RSI is holding firmer, currently testing the overbought region, implying that there is still room for more highs.

If the bulls can hold their position at higher levels, a further advance towards the horizontal trendline will not be out of the question with resistance at 1.2800.

On the other hand, the 20-day moving average “” could limit the drop, while the 1.2700 round number could protect the downside. The previous substantial support is located at Friday’s low of 1.2561.

Overall, the trend remains bullish for now.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.