- Markets expect a 75bps rate hike from BoC.

- Canada’s record-low unemployment gives BoC room to be aggressive.

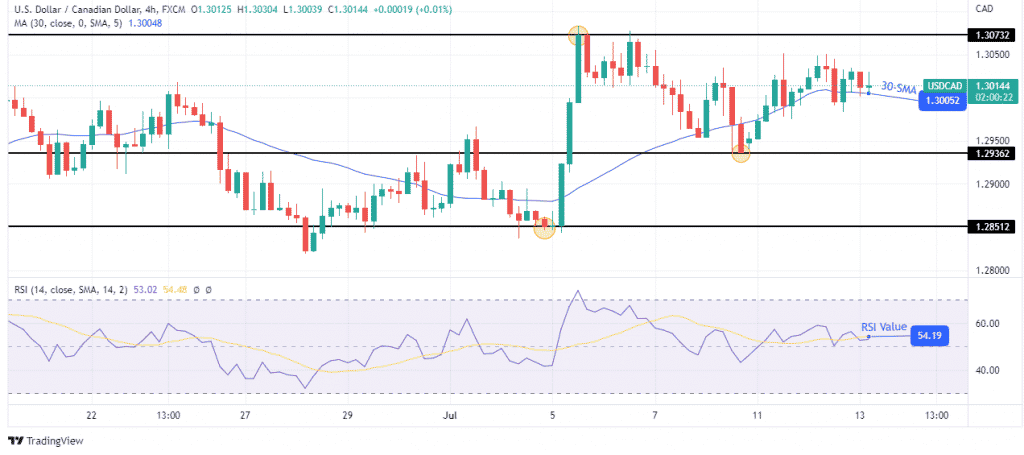

- The price is consolidating in the charts.

Today’s forecast for USD/CAD is bullish as the markets have already priced in a 75bps rate hike from the Bank of Canada. USD/CAD will need a surprise hike if it is to fall.

–Are you interested to learn more about forex options trading? Check our detailed guide-

Canada’s largest banks have forecasted a 75 basis point rate hike later today. The BoC will follow in the path of the Federal Reserve in delivering such a significant rate hike.

“The market has priced in a three-quarters-of-a-point increase because that’s what the US Federal Reserve delivered,” said Craig Alexander, chief economist at Deloitte Canada.

Canada’s economy is facing a recession, especially after Friday’s jobs report showed a significant decline in employment. Is it possible for the bank to surprise the markets?

“We’re sitting at record low unemployment and very high inflation. There’s no reason, right now, for interest rates to be below that long-run neutral range,” said Nathan Janzen, senior economist at RBC Capital Markets.

“We’re leaning towards a 75 basis point hike being the most likely,” he added. “But, by the same logic, 100 basis points would still only get you into the midpoint of their neutral range.”

USD/CAD key events today

The economic calendar is filled with important news releases from the United States and Canada. The US will release inflation data later today, bound to cause volatility in the pair. This inflation report will inform the Fed’s monetary policy.

From Canada, investors expect to receive a rate hike decision from the Bank of Canada. The bank is expected to raise rates by 75bps, the highest since 1998.

USD/CAD technical forecast: Indecision in the market

The 4-hour chart shows the price moving sideways while staying slightly above the 30-SMA. Although bulls are in charge, as seen in the RSI, which trades above 50, there seems to be a bit of hesitation in the move up.

–Are you interested to learn about forex robots? Check our detailed guide-

At this point, the SMA should act as support and push the price to retest 1.30732. This level is a strong resistance level that stopped the price on July 5. However, there is a possibility that the price might break below the 30-SMA if bearish momentum comes in at this point. A break below would mean prices are falling to the next support level at 1.29362 and maybe further to 1.28512.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money