- USD/CAD is moving in a tight range amid the Easter holiday.

- The greenback remains firm against its major peers.

- A quiet day, but traders will focus on Wednesday’s Core Inflation.

The USD/CAD forecast at the start of the London session is making little moves amid the Easter holiday in Australia and New Zealand.

Greenback flexing its muscles

The greenback strengthened at the close of the holiday-shortened week as more hawkish remarks from Federal Reserve members bolstered prospects for quicker policy tightening in the US.

–Are you interested in learning more about forex bonuses? Check our detailed guide-

The good ol’ oil

WTI continues to fall from three-week highs of $107.96 set earlier in the Asian session on Easter Monday.

The escalation of the Ukrainian conflict raises the likelihood of tougher Western sanctions against Russia, the world’s largest exporter. Last week, EU states said that the bloc’s executive was working on ideas to ban Russian oil.

The drop in the WTI price might be attributed to the US dollar’s unwavering strength.

BoC update

The Bank of Canada expedited its tightening cycle last week, following up on March’s 25 basis point rate rise with a bigger, 50 basis point increase that brings the overnight rate to 1%. In addition, the bank stated that it will begin decreasing its balance sheet by discontinuing reinvestment of maturing GoC holdings.

USD/CAD data events ahead

We don’t have anything significant to report about the USD and CAD today amid the Ester Monday. We are going to see NAHB Housing Market later during the New York session. However, it’ll have little to no effect on the pair.

What’s next to watch for USD/CAD forecast?

Moving forward, Canadian Core Inflation data will be the primary driver for CAD.

On the other hand, purchasing interest in the dollar index remains unabated with the uncertainties surrounding the Ukraine crisis and China’s COVID lockdowns, which are affecting supply chains and driving up inflation through increasing commodity prices.

USD/CAD technical forecast: Keeping a flat line

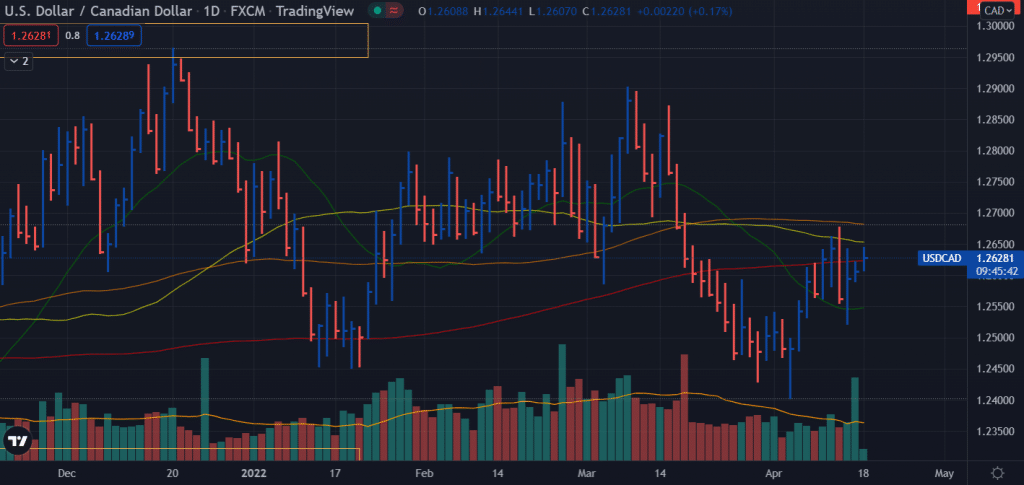

The USD/CAD price is hovering around the 1.2635 level. So far, the pair has lost a moderate 0.02%. The price is above 20, 50, 100, and 200 SMAs. It signifies a bullish trend.

–Are you interested in learning more about ETF brokers? Check our detailed guide-

The next key resistance level for the loonie is 1.2654. If the price goes above this level, it can further climb towards 1.2708.

On the other hand, the next support for USD/CAD is at 1.2612. If the price dips below this level, we can see it further drifting towards the 1.2583 level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money