- USD/CAD price found some support at 1.2600.

- The rally may remain capped by high WTI prices that keep the CAD bullish.

- Poor risk sentiment stemming from Evergrande’s crisis keeps the US dollar strong.

The USD/CAD price forecast is neutral as the price is wobbling. The dollar-led bulls remain capped by the high WTI prices.

-Are you looking for automated trading? Check our detailed guide-

The USD/CAD price rebounded 50 pips in the last hour after dropping to more than two weekly lows in the European session. In the last trading session, the pair traded near the 1.2600 mid-point and gained nearly 0.15%.

A broad rally in the US dollar and rising Treasury yields boosted the US dollar and helped exit short positions below 1.2600. Standard US Treasury 10-year yields peaked on June 17 amid speculation that the Federal Reserve will soon tighten.

As was announced last week, the Fed would soon be withdrawing its massive pandemic-era incentives. Furthermore, the dot plot showed the likelihood of inflation in 2022, according to policymakers. Additionally, several FOMC members praised the first round of tightening and supported the dollar.

The shifting risk sentiment, coinciding with unresolved debt issues facing China’s Evergrande Group, has further strengthened the dollar’s status as a relatively safe haven. However, with the following bullish surge in oil prices, the commodities loonie continues to rise, likely limiting the USD/CAD’s upside potential.

Participants in the market are eagerly anticipating Jerome Powell’s testimony to the Senate Banking Committee on Monday. Additionally, the US bond yields and the Consumer Confidence Index released by the Conference Board will impact the dollar. In addition, the strength of the USD/CAD pair could be helped by a surge in oil prices.

-Are you looking for the best AI Trading Brokers? Check our detailed guide-

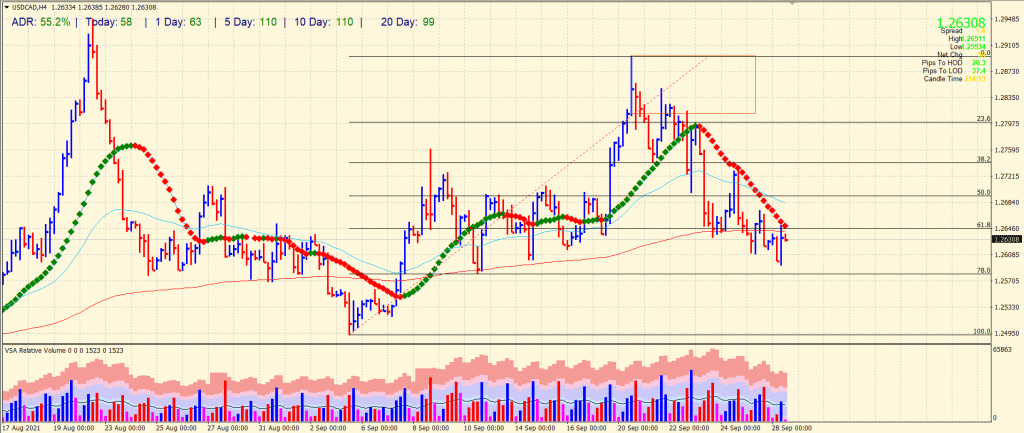

USD/CAD price technical forecast: Confluence zone at 1.2650

The USD/CAD price found some respite near the 1.2600 level and managed to gain to 1.2650 where it could not find acceptance and pared off 10-15 pips. However, the round number coincides with the 200-period SMA (4-hour) is keeping the rallies limited. Moreover, the 20-period SMA resides in the same zone. So, it really needs a strong bullish momentum to break the confluence of resistance. The pair can then rally to the 1.2700 area. On the flip side, the price may find support at 1.2600 ahead of 79% Fibo retracement at 1.2580.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.