- Canadian retail sales increased by 1.4% in October.

- Canada’s October retail sales increase was the highest in the previous five months.

- Oil prices increased over concerns that millions of Americans would cancel travel plans.

Today’s USD/CAD forecast is slightly bearish. According to data released Tuesday, Canadian retail sales increased by 1.4% in October from September. Still, the estimate for November shows a monthly fall of 0.5% as we approach the Christmas shopping period and after seven interest rate rises this year.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

Although it was somewhat below the 1.5% increase analysts had predicted, October’s retail sales increase was the highest in the previous five months.

According to Statistics Canada, price hikes at petrol stations and in food and drink were the main factors driving October’s sales.

The Bank of Canada raised interest rates at a rapid pace of 400 basis points in just nine months, to 4.25%, to control inflation, which was 6.9% in October. This level was previously reached in January 2008.

Bank Governor Tiff Macklem stated that future policy rate determination would depend more on facts. Wednesday is the deadline for November consumer prices, while Friday is the deadline for October gross domestic product data.

The rise in oil prices also supported the Canadian dollar. Oil prices increased as concerns that millions of Americans would cancel travel plans over the holiday season arose from the worsening forecast for a significant winter storm in the United States.

A weaker dollar and a US effort to replenish petroleum stocks helped to boost oil prices, although concerns about the impact of an increase in COVID-19 cases in China restrained gains.

USD/CAD key events today

From the US, investors will be watching the CB consumer confidence and existing home sales reports. Canada will release inflation figures for November. Investors expect the core CPI to drop from 0.4% to 0.2%.

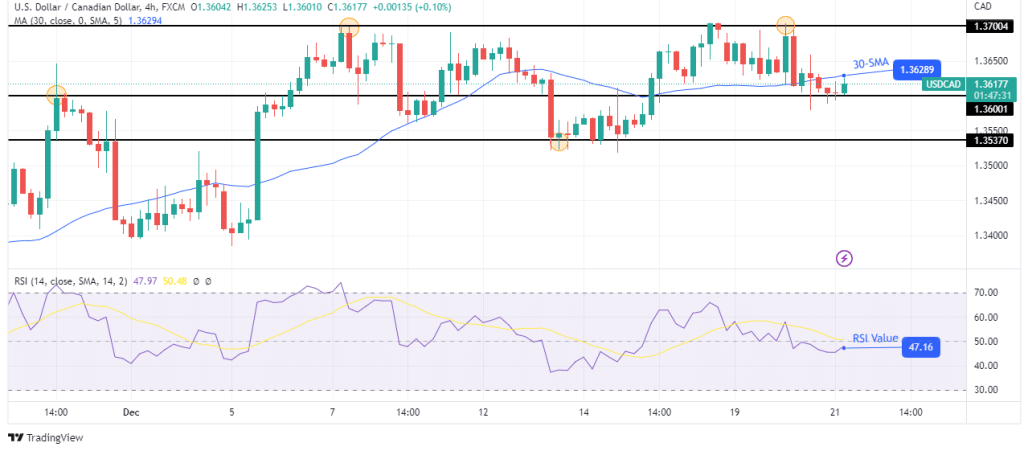

USD/CAD technical forecast: Consolidation between the 30-SMA and 1.3600 support

USD/CAD consolidates in a tight range with support at the 1.3600 level and resistance at the 30-SMA. The RSI is currently below 50, pointing to stronger bearish momentum. The bears need to gather enough strength to break below the 1.3600 support.

–Are you interested to learn more about forex options trading? Check our detailed guide-

If this happens, the price will head for the next support level at 1.3537. However, if the price breaks above the 30-SMA, we might see a return to the 1.3700 resistance level.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.