- The dollar was not strengthened with the earlier news that Challenger’s contraction dropped to 15,723 in June, the lowest level since 1997.

- Since the start of the week, the pair has struggled to achieve significant gains.

- The drop in crude oil prices since the start of the week, despite widespread selling pressure around the US dollar, has made it difficult for the Canadian dollar to find demand.

The USD/CAD price outlook seems bearish as the Greenback persistently remains weak despite the positive US data.

The USD/CAD pair is trading at 1.2566, down 0.38%, at the time of writing on Thursday.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

In contrast, the US dollar index lags behind the average data release, which allows the USD/CAD pair to remain in the weekly range. The dollar was not strengthened with the earlier news that Challenger’s contraction dropped to 15,723 in June, the lowest level since 1997.

We will utilize data on US unit labor costs, nonfarm productivity, as well as weekly initial jobless claims to re-energize the session.

At least for now, a softer tone in crude oil prices could undermine demand for Canadian dollars and limit further losses for the USD/CAD pair. As OPEC + reaffirmed its commitment to increasing supply, and despite concerns over the recent increase in infected cases, the USD/CAD pair failed to take the plunge in both directions during the first half of the week. Thursday.

Since the start of the week, the pair has struggled to achieve significant gains. In light of uncertainty over the timing of the Fed’s policy cutbacks and doubts about the recovery of US unemployment, the US dollar lost about a month’s lows. The USD/CAD pair was, in turn, hindered due to this factor.

The drop in crude oil prices since the start of the week, despite widespread selling pressure around the US dollar, has made it difficult for the Canadian dollar to find demand. Investors don’t believe the delta variant could reduce global petroleum demand despite WTI prices trading in positive territory on Thursday.

–Are you interested to learn more about forex signals? Check our detailed guide-

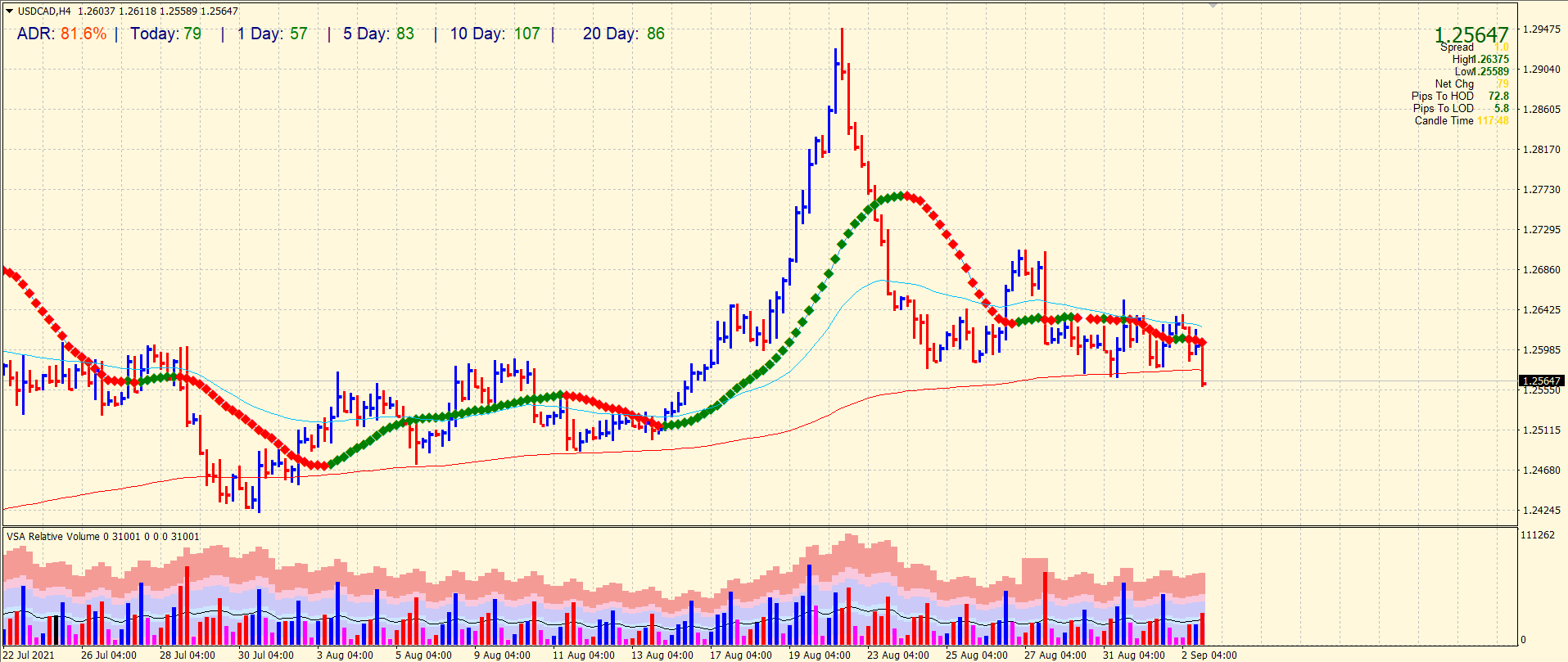

USD/CAD price technical outlook: 200-SMA broken

The USD/CAD price outlook is slightly bearish as the price remains below the 1.2600 mark. The pair has finally broken the 200-period SMA on the 4-hour chart. However, the price is still within the range (lower end). If the range breaks, the bears may head to 1.2550 leading to 1.2500. On the upside, the pair may test the 1.2600 area but stay below the 1.2600 will call for more losses.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.