- The USD/CAD pair hit a fresh weekly low on Wednesday due to a combination of factors.

- Rising oil prices supported the dollar and put it under downward pressure.

- Risk appetite pushed down the safe-haven dollar and increased selling sentiment.

- Market participants are watching Canada’s CPI and US Retail Sales, as well as the minutes from the FOMC.

The USD/CAD outlook remains bearish as the crude oil prices soar and US dollar remains on the backfoot ahead of Fed meeting. In the last hour, the USD/USD price fell to fresh weekly lows near 1.2685.

–Are you interested in learning more about day trading brokers? Check our detailed guide-

As the USD/USD pair faced fresh supply and came under pressure from a combination of factors during Wednesday’s trading, it briefly consolidated. The commodity-pegged Canadian dollar was supported by higher crude oil prices. Risk-on sentiment, however, continued to exert pressure on the safe-haven US dollar, resulting in a third straight decline for the pair.

After exercises near Ukraine’s border, some Russian troops will return to their bases, allaying fears of a full-blown conflict. Global risk trading was triggered as a result, as evidenced by bullish moves in equity markets and capital outflows from traditional safe-haven assets. US Treasury prices, however, should limit further US dollar losses.

Due to persistently high inflation, markets believe the Fed will tighten more quickly than expected and are considering a 50 basis point rate hike in March. Therefore, benchmark 10-year Treasury yields have moved back above 2.0% and neared last week’s swing high, set in response to the highest inflation in four decades.

Accordingly, the market’s attention will remain focused on the FOMC meeting minutes, released later in the US session. In the near term, investors will be paying attention to the pace of the Fed’s tightening cycle, which will impact the US dollar and the dollar/Canadian dollar pair. Moreover, the CPI report for Canada and monthly retail sales data for the United States may provide some potential trading opportunities within the next few weeks.

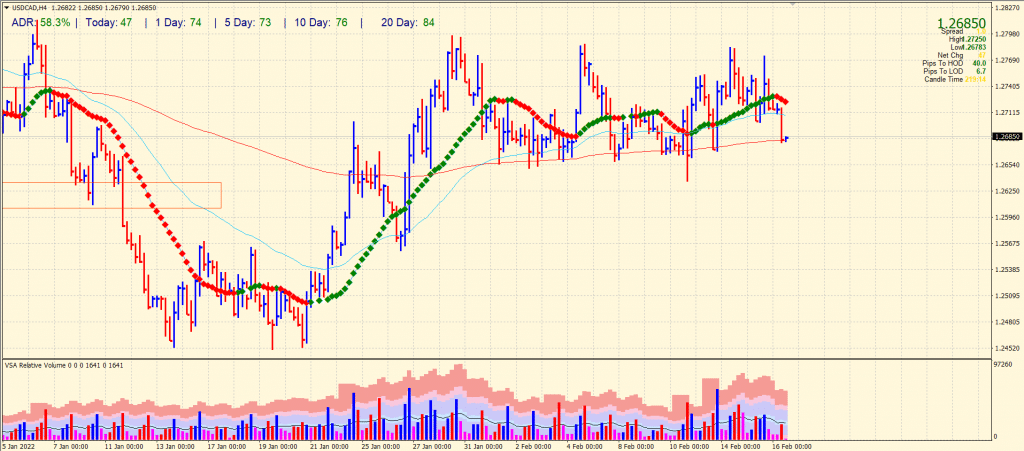

USD/CAD price technical outlook: Bears dominating the market

The USD/CAD price is turning south after breaking the 1.2700 mark. Although the 200-period SMA provides interim support around 1.2680, the pair may break the level and aim for swing lows around 12650 ahead of 1.2600.

–Are you interested in learning more about day trading brokers? Check our detailed guide-

The average daily range is 58% which shows a trendy day for the USD/CAD pair. However, the volume data is supportive of the bearish trend. As a result, we can see a buying climax setup on the chart. The up bar closed in the middle with a very high volume.

Alternatively, the upside targets lie around 1.2750 ahead of 1.2800 and then 1.2900. However, the bulls find no respite at the moment.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money