- Somehow, the fall in oil prices is likely to balance the Dollar decline.

- Rising Covid concerns are keeping Greenback positive.

- The Moving Average Divergence Convergence indicator holds positive with the neutral stance. It signifies that there is a lot of space for the higher price action.

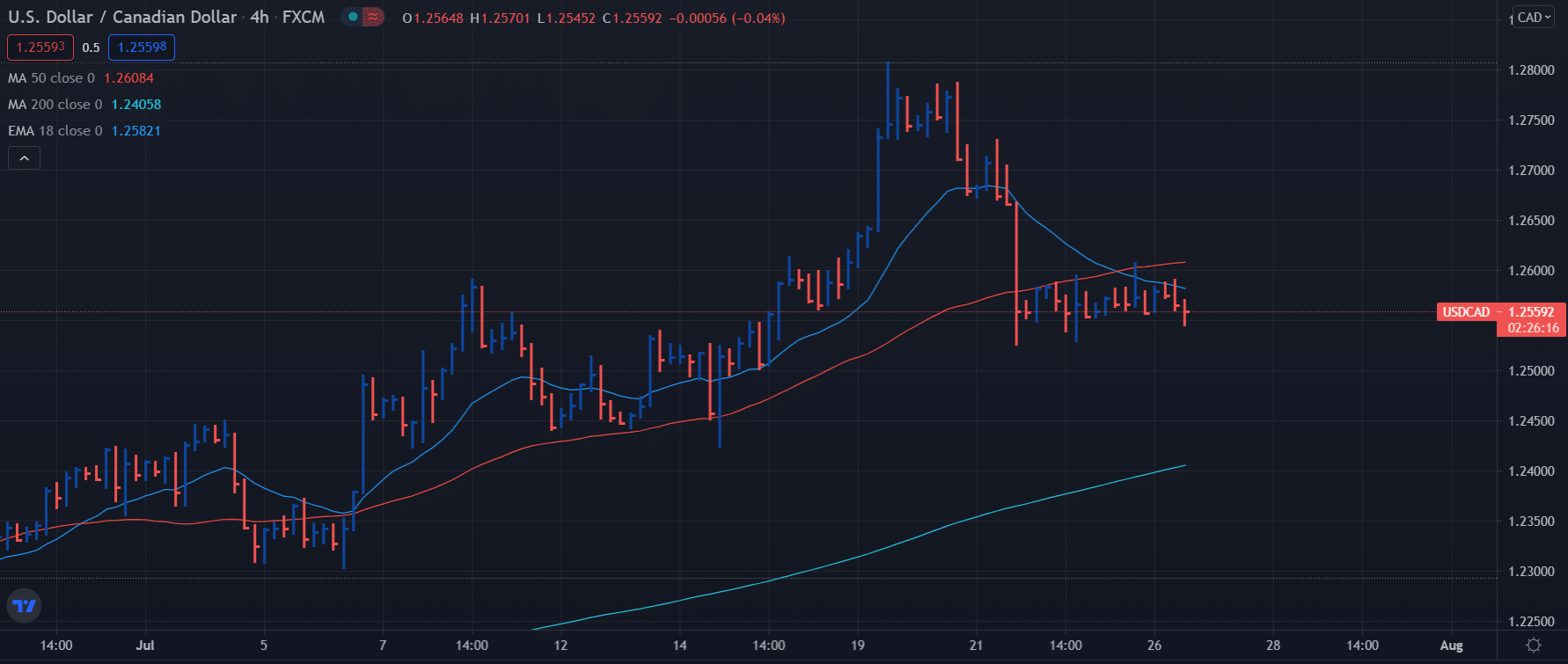

- On the downside, the 5-DMA at 1.2565 could offer quick support.

The USD/CAD price is struggling on the day but some variables help to keep the stance bullish to neutral at the moment. Rising Covid concerns keep risk sentiment undermined. Fresh US-Sino trade tension and tumbling Chinese stocks are further adding fuel to fire. The risk-off flows have raised the demand for US bonds.

–Are you interested to learn about forex bonuses? Check our detailed guide-

Somehow, the fall in oil prices is likely to balance the dollar decline. By Keeping the USD/CAD drifting near the higher level of the day. WTI price rose 1% so far on Monday, as increasing covid cases in Asia combined with the flood situation in China decrease the demand for oil. Firm demand inhibits shale supply, and the cautious monthly rise in supply from OPEC+ should not be enough to avoid a deficit in the upcoming month, which should continue to strengthen the fuel prices and tighten Spreads.

On Friday, WTI edged higher to close up the modest 0.46 percent extending deeper into daily resistance in corrective recovery from Monday’s steep slide and Tuesday’s low of 65.11.

Looking forward, the pair will continue to take the cues from the broader market sentiment like the data docket with Fed in the spotlight.

If the price remains above the lower upside trendline of the channel, it could move further higher towards the 1.2650 horizontal level.

Alternatively, if the price stops the bullish sloping line, it could fall back to 1.2530 horizontal support level.

–Are you interested to learn more about forex options trading? Check our detailed guide-

USD/CAD price technical outlook: Key levels to lookout

The bulls look to recover the critical 200-Daily Moving Average, now at 1.2606. Above that, the 1.2650 psychological resistance can be tested. On the downside, the 5-DMA at 1.2565 could offer quick support. Then bulls will need to defend the multi-day low of 1.2525 reached last week.

The Moving Average Divergence Convergence indicator holds positive with the neutral stance. It signifies that there is a lot of space for the higher price action pair.

Next, the USD/CAD bull aims to recover the July 21 high at 1.2730 followed by the high July 19 at 1.2807.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.