- The USD/CAD could extend its sell-off if the US data disappoints later.

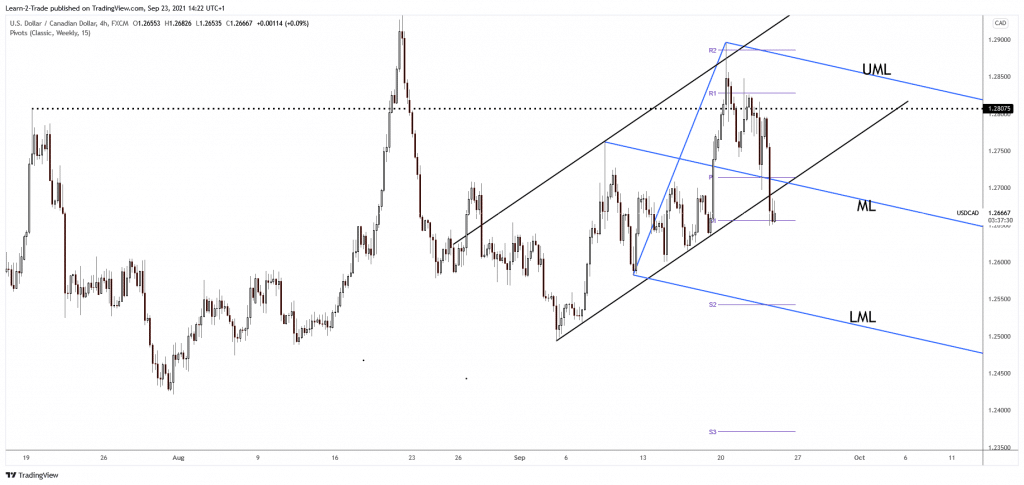

- It could drop towards the lower median line (LML) as long as it stays below the ML.

- The sentiment has changed after dropping below the uptrend line.

The USD/CAD price plunged in the short term after failing to stabilize above the 1.2807 static resistance. The pair is trading at 1.2668 level above the 1.2650 yesterday’s low. The price dropped in the seller’s territory, so the further drop is not quite strange. Again, though, it remains to see how it will react after the US data is released.

-Are you looking for the best AI Trading Brokers? Check our detailed guide-

As you already know, the Loonie remains strong as the Canadian retail sales have come in better than expected. The Retail Sales indicator dropped by 0.6% in July versus a 1.2% drop expected after the 4.2% growth in June. Furthermore, the Core Retail Sales registered only a 1.0% fall versus 1.5% expected. The economic indicator rose by 4.7% in the previous reporting period.

The USD/CAD pair maintains a bearish bias as the USD has hit the Unemployment Claims indicator. The Jobless Claims jumped unexpectedly from 332K to 351K last week, even if the economists expected a drop to 322K.

Fundamentally speaking, the US services and manufacturing data could be decisive today. The Flash Services PMI is expected to remain steady at 55.1 points, while the Flash Manufacturing PMI could drop from 61.1 points to 60.7 points.

USD/CAD price technical analysis: Uptrend line breakout

As you can see in the 4-hour chart, the USD/CAD pair dropped far below the uptrend line and under the descending pitchfork’s median line (ML). Failing to stabilize above the 1.2807 static resistance or to approach and reach 1.2949 signaled strong sellers.

-Are you looking for the best MT5 Brokers? Check our detailed guide-

Now the pair is pressuring the weekly S1 (1.2656) level, static support. The bias is bearish as long as the price is below the descending pitchfork’s median line (ML). The major downside target is seen at the descending pitchfork’s lower median line (LML).

Technically, the median line retest could bring new selling opportunities. However, it’s risky to sell it here only because the rate could turn to the upside after this massive sell-off. Only coming back and stabilizing above the median line (ML) could invalidate a deeper decline.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.