The USD/CAD price moves sideways quickly after finding strong support above the 1.2525 level. The pair needs a bullish spark to start bullish momentum again after its short-term correction. It awaits to see how it will react after the US data dump.

–Are you interested to learn more about automated trading? Check our detailed guide-

The US is to release the Durable Goods Orders, which is expected to increase by 2.1%, and the Core Durable Goods Orders, the indicator could register a 0.8% growth in June versus 0.3% in May.

Still, I believe that only the CB Consumer Confidence could have a big impact on USD/CAD today. The economic indicator could drop from 127.3 to 123.9 points which could be worse for the USD. Actually, a deeper decline could force Greenback to lose ground versus its rivals.

Only better than expected economic figures could help the dollar to stay higher ahead of the FOMC meeting.

USD/CAD price technical analysis: Bulls finding strength for a breakout

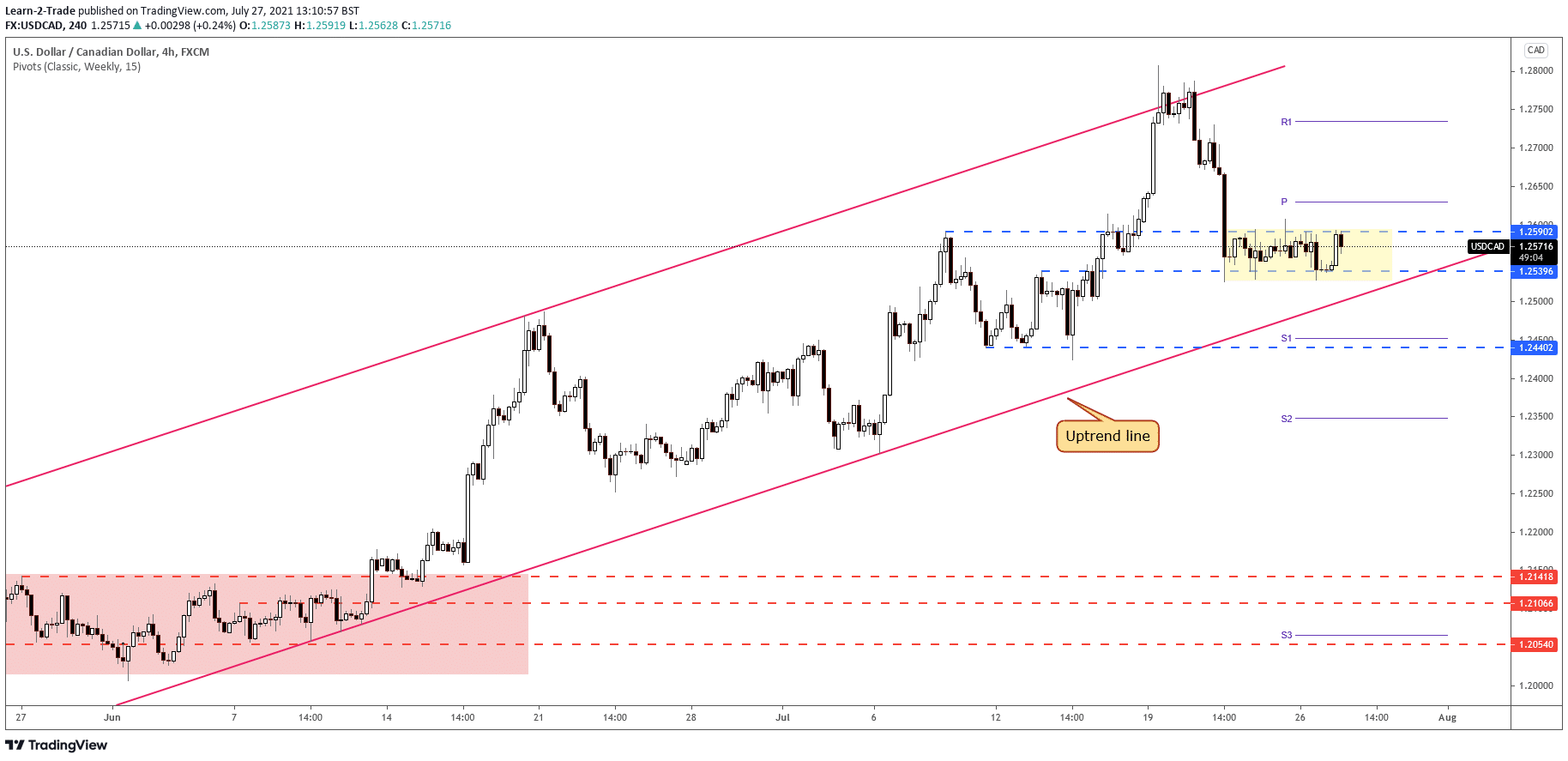

The USD/CAD price is still located within an up channel, so the bias remains bullish. However, it has found buying near the 1.2539 static support and now is pressuring the 1.2590 static resistance.

The pair has moved sideways between these two levels. A valid upside breakout could signal that the pair may develop a new swing higher. On the other hand, staying under this level could lead the price towards the up trendline.

–Are you interested to learn more about forex signals? Check our detailed guide-

Personally, I would like to see the down trendline retest. A false breakdown with great separation or a major bullish engulfing printed on the uptrend line really announces an upwards movement. Technically, only a valid breakdown through the uptrend line could change the sentiment and invalidate the bullish scenario.

The outlook is still bullish. That’s why we could still look for buying opportunities around the immediate support levels.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.