- USD/CAD dropped, but the current decline could only be corrective in nature.

- When USD/CAD will confirm a larger downside movement?

- A new higher high could change the sentiment and could announce an upside continuation.

The USD/CAD price plunged after failing to close around 1.2589 today’s high. It has dropped as the DXY has shown some overbought signs. Technically, USD/CAD is still under pressure. It was expected to drop after the most recent rebound.

–Are you interested to learn more about forex signals? Check our detailed guide-

Still, it remains to see what will happen as the pair is located above some strong support levels. I believe that the US inflation data will be decisive tomorrow. The volatility will be high around this high-impact event. The Dollar Index is located at resistance, so a potential drop forces the dollar to lose ground versus the Loonie.

On the other hand, DXY’s growth could help the greenback to dominate the currency market. Of course, anything could happen in the coming hours, so you’ll have to be careful. The Core Price Index, CPI, is expected to increase by 0.5% in July, while the Core CPI may increase by 0.4% versus 0.9% in the previous reporting period.

The US economic data will drive the pair during the week. As a result, the USD/CAD pair is vulnerable to drop deeper, but we still need confirmation because DXY’s breakout above 93.19 high may signal USD’s appreciation.

USD/CAD price technical analysis: Key levels to watch

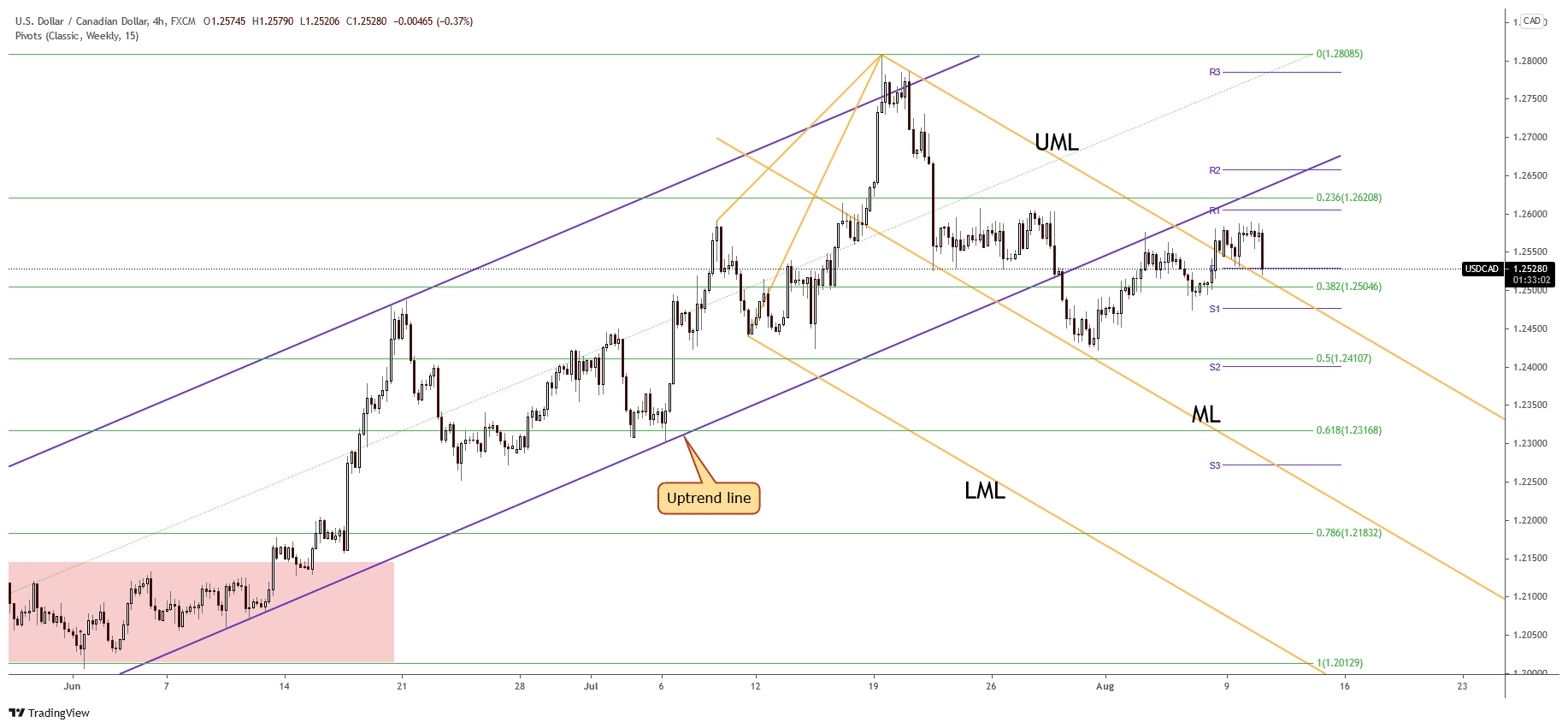

The USD/CAD price dropped after failing to reach and retest the uptrend line in the last attempt. Also, it has failed to reach the 1.2605 weekly R1, so its current decline towards the weekly pivot point (1.2529) is natural.

–Are you interested to learn more about automated forex trading? Check our detailed guide-

Staying above the pivot point and above the upper median line (UML) may signal that USD/CAD could still increase. However, technically, I believe that only dropping and stabilizing below the 1.2476 S1 could really announce a deeper decline and could invalidate an upside continuation.

The uptrend line retest, the false breakout, signaled that USD/CAD pair could come back down, but the breakout through the upper median line (UML) signaled strong buyers. After the current retest, a new higher high could signal more gains and bring new opportunities to go long.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.