- The USD/CAD pair is down to its lowest level in two months.

- Although oil prices are recovering amid strained Russia-Ukraine relations, the market decision limits their movement.

- Speakers from the BOC/Fed remain key catalysts for renewed momentum.

The USD/CAD price traded around 1.2530 during Friday’s Asian session. Considering the inactivity of the market, the loonie seems unconcerned with the rise in prices of Canada’s main exports and the fall in the US dollar.

–Are you interested in learning more about STP brokers? Check our detailed guide-

Russian saga

The day before, listings were at their lowest level in two months due to the invasion of Ukraine. Moreover, Moscow’s recent military operations have added more to the risk aversion due to Western sanctions.

WTI prices soar

However, it is possible that the recent surge in oil prices can be accounted for by concerns about supply cuts due to Europe’s dependence on Russian oil, which prevents the United States from taking more aggressive steps against Russia. Recent challenges to the global supply chain include the resurgence of Coronavirus and North Korea’s missile tests.

Futures for the S&P 500 and Treasury yields are still uncertain ahead of the Eurogroup meetings and oil prices. WTI crude oil prices are up 0.76% intraday to $111.75 as of press time.

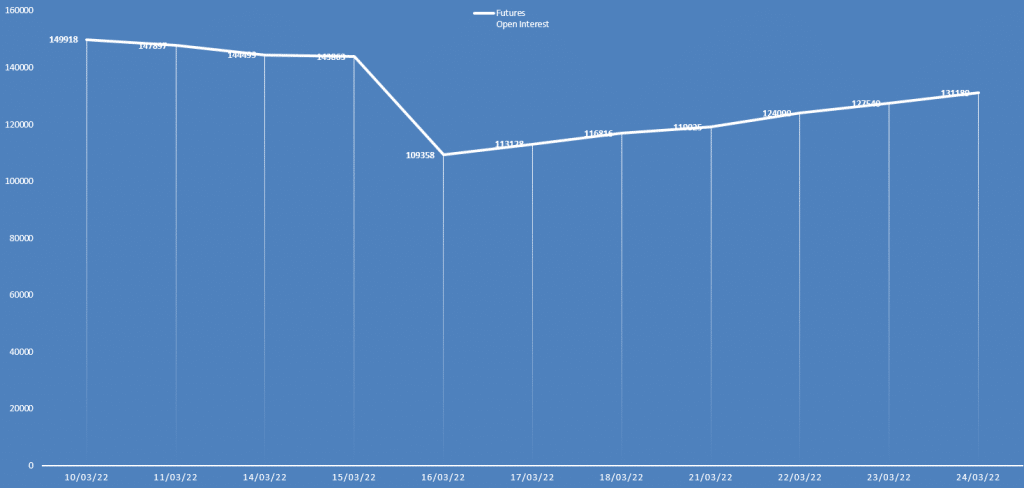

USD/CAD price analysis via daily open interest

The USD/CAD price has been constantly tumbling. At the same time, the open interest is rising too. It indicates that the pair has been in a strong bearish trend.

What’s next to watch for the USD/CAD price analysis?

Deputy Governor Tony Gravel of the Bank of Canada (BOC) and at least one Fed official are likely to influence USD/CAD’s intraday movement.

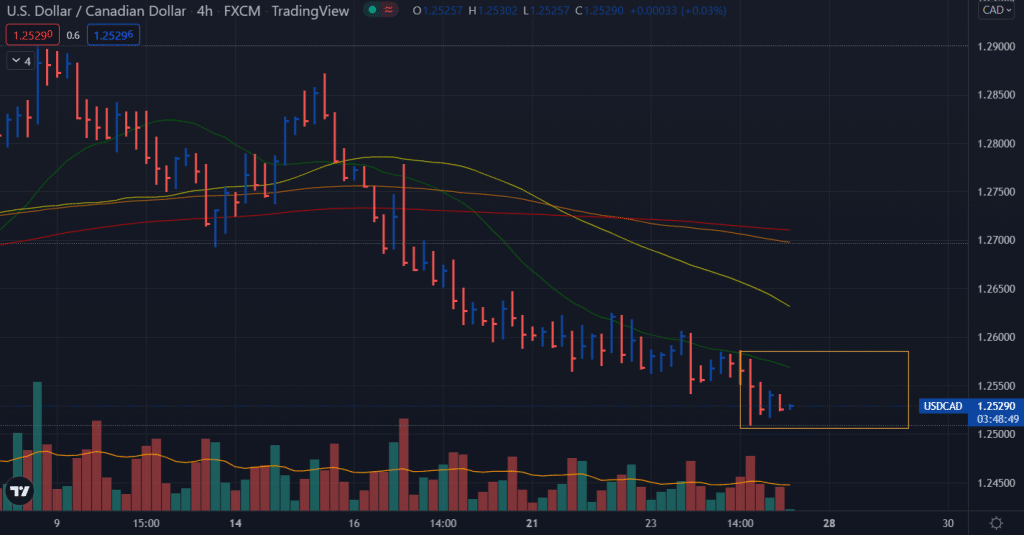

USD/CAD price technical analysis: 1.2500 remains the key

The USD/CAD price has hit bottom at 1.2500 area, and the price is now consolidating the losses in a tight range. The down bar closed near the middle, with a very high volume. It shows a potential selling climax. Hence, we must wait for further price action to confirm the bullish reversal.

–Are you interested in learning more about forex bonuses? Check our detailed guide-

If the price breaks the upside of the high-volume bar, which is at 1.2578, we will be looking for long opportunities. Alternatively, if the price breaks the 1.2500 area, we will be more interested in finding the selling opportunities. Finally, if the selling persists, we may see the prices dipping to 1.2400.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money