- USD/CAD pair is mildly bearish amid some correction in the US Dollar.

- Crude oil prices are rising but weak to provide a cause for a bullish reversal.

- Risk sentiment is bad that can keep the losses limited in the USD/CAD pair.

The USD/CAD price analysis suggests that bears are active at the moment after the pair peaked at 1.2652, the highest level since July 21.

The USD/CAD is trading at 1.2615 at the time of writing, 0.08% down so far on Wednesday.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

The USD/CAD pared off its overnight gains as we see a minute correction in the US Dollar across the board. The correction could be technical in nature. However, there are some other contributing factors as well.

The DXY Dollar index is trading near the multi-month highs above 93.00 and remains well bid. The index is trading at almost the same levels where it had closed yesterday. It has been able to reverse some of the losses seen in the earlier Asian session.

The crude oil prices are attempting to rise from the 66.30 area and is now just below the 67.00 mark. However, the price is still under bearish pressure. Moreover, the broader risk-off sentiment and fear of economic slowdown amid Delta variant spread to keep the oil prices capped. Hence, the Canadian Dollar will likely suffer, and as a result, the USD/CAD pair may find some support.

The risk sentiment remains deteriorated as the Covid is still on the rise in many countries. Moreover, mixed data concerns are offering no breather to the Canadian Dollar.

The Canadian CPI data is expected in the earlier New York session today, followed by the FOMC meeting minutes lately. Both the events can provide fresh impetus to the market.

–Are you interested to learn more about forex signals? Check our detailed guide-

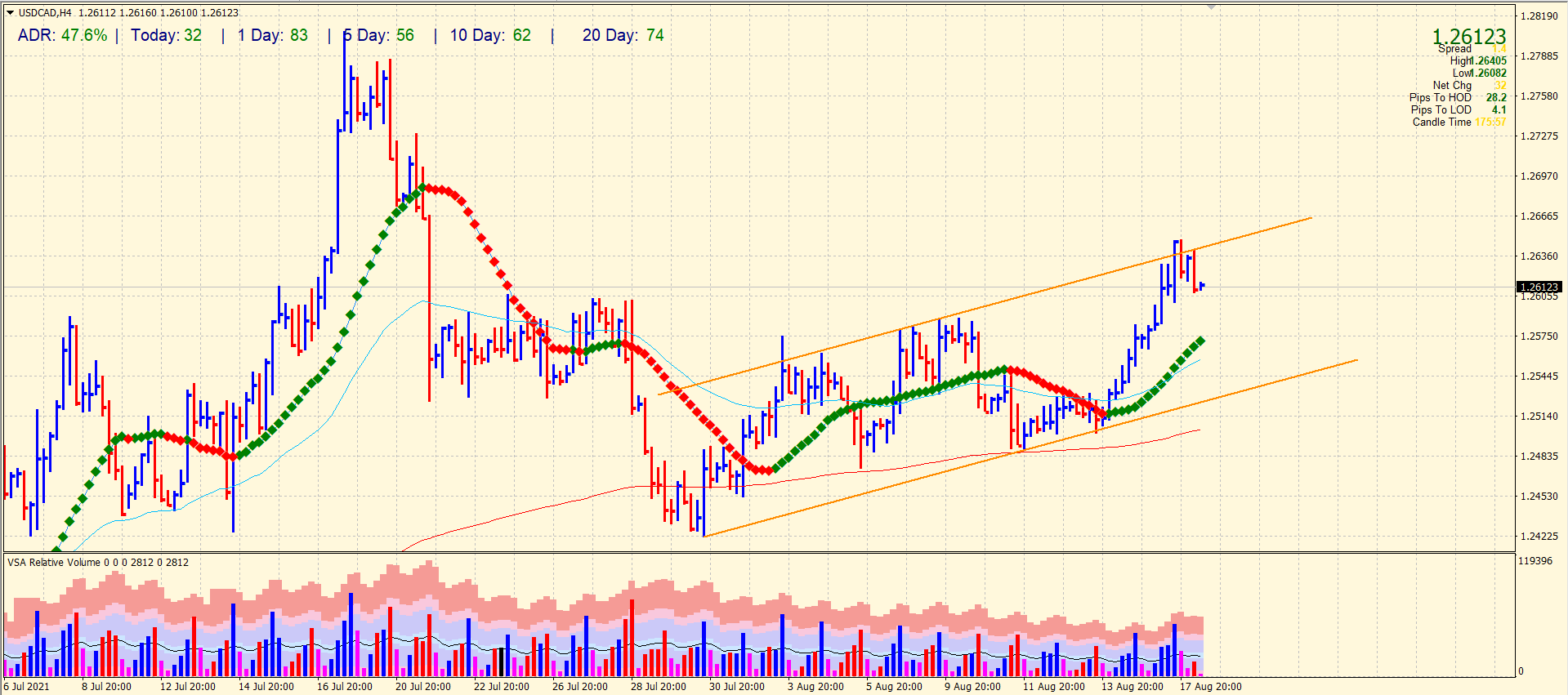

USD/CAD price technical analysis: Price to stay in a bullish channel

The USD/CAD pair hit the channel resistance and fell back near the 1.2600 area. The pair has posted a relatively widespread down bar with a high volume, indicating that the pair may lose further and target 20-period SMA on the 4-hour chart. The pair can further aim for 1.2550 ahead of channel support around 1.2530-40. On the upside, channel resistance and the key level of 1.2650 continues to act as a hurdle.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.