- The USD/CAD pair maintains a bullish bias despite temporary retreats.

- The US and Canadian data could be decided later today.

- A new higher high activates further growth.

The USD/CAD price increased as the US dollar recovered after a mild correction on Wednesday. The price registered a 1.65% drop yesterday.

However, now the US dollar looks determined to resume its uptrend. Yesterday, the USD took a hit from the Pending Home Sales and Prelim Wholesale Inventories indicators which came in worse than expected.

-Are you looking for automated trading? Check our detailed guide-

Today, the fundamentals could be decisive. The Canadian Gross Domestic Product is expected to report a 0.1% drop in July, while the US Final GDP could register a 0.6% drop in Q2.

Furthermore, the US Unemployment Claims could come in at 215K in the previous week compared to 213K in the previous reporting period. FOMC Member Bullard and FOMC Member Mester’s remarks could also move the markets.

Tomorrow, the fundamentals could be decisive as well. The US is to release the Core PCE Price Index, Revised UoM Consumer Sentiment, Personal Income, and Personal Spending data.

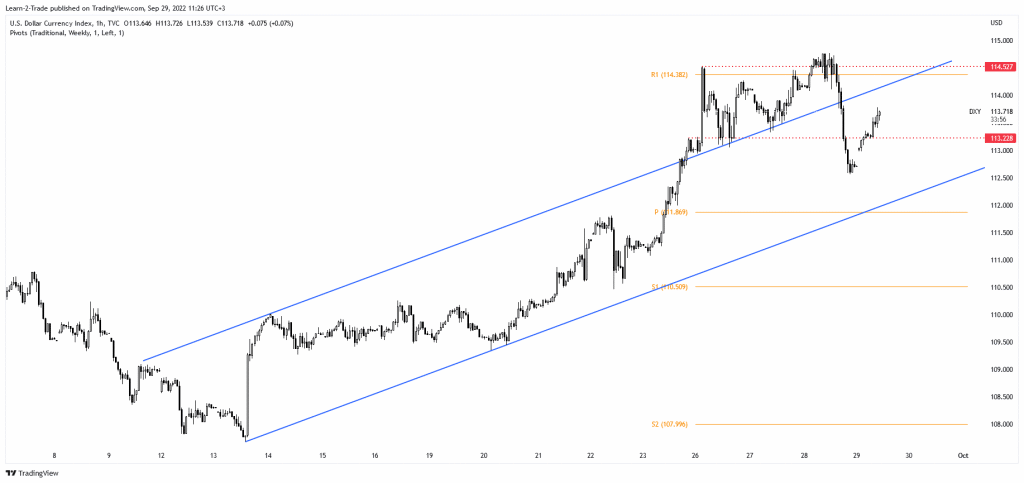

Dollar Index price technical analysis: Gap up

The Dollar Index crashed after failing to stabilize above the 114.52 former high and beyond the R1 (114.38). After its massive drop, the index opened with a gap up, signaling upside pressure.

Still, as long as it stays under the channel’s upside line and below the R1, the DXY could develop a new sell-off. Only a new higher high could activate further growth. The current rally forced the USD to appreciate versus its rivals.

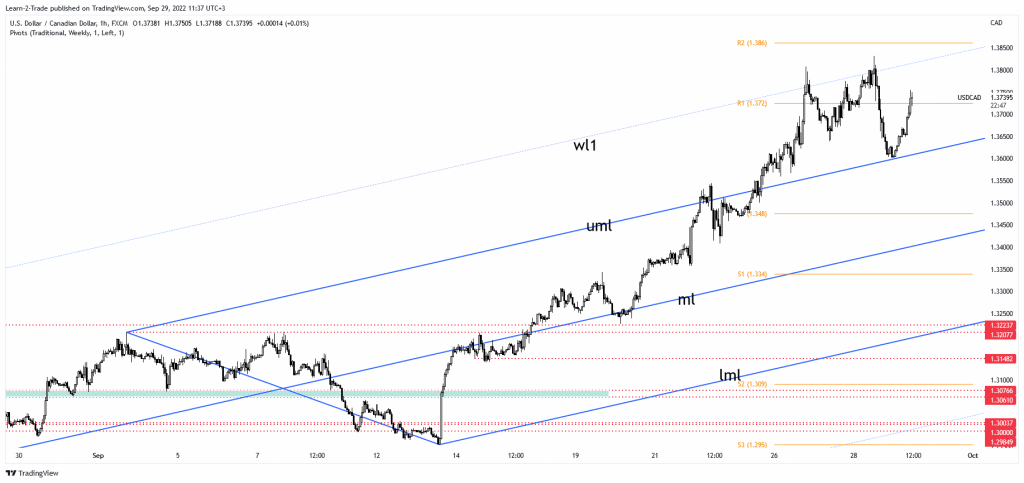

USD/CAD price technical analysis: Bullish bias

The USD/CAD pair dropped after registering only false breakouts above the warning line of the ascending pitchfork. Now, the pair has found support above the upper median line (UML) of the ascending pitchfork. It has jumped above the R1 (1.3720), representing an upside obstacle.

-If you are interested in forex day trading then read our guide to getting started-

Technically, the bias remains bullish as long as it stays above the upper median line (UML). Only breaking below this level could activate a larger downside movement. The 1.3800 psychological level stands as a potential upside target. The price failed to stabilize above this key obstacle in the previous attempts. A temporary consolidation in the short term could announce an upside continuation.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.