- Even though investors lack confidence in the Fed’s monetary policy, USD/CHF is close to 0.9400.

- The US CPI remained unchanged at 7.9% due to higher prices for commodities such as oil, food, and metals.

- The DXY is fluctuating around 99.00 due to a lull in market momentum.

The USD/CHF outlook is positive as the market sees cautious optimism over the Russia-Ukraine conflict. Meanwhile, the Fed’s rate hike bets are pricing in as well.

–Are you interested in learning more about making money with forex? Check our detailed guide-

Investors are beginning to weigh the impact of the US Federal Reserve’s (Fed) tightening at Wednesday’s monetary policy meeting as USD/CHF opened above Friday’s session high and climbed above Friday’s high of 0.9350.

Fed’s rate hike

It has been so long since Fed Chair Jerome Powell announced monetary policy. A rate hike of 25 basis points (bp) is expected in their upcoming policy announcement. Although the latest release of the US consumer price index (CPI) with 7.9% has not yet been taken into account in calculating the interest rates. Additionally, the US CPI of 7.9% is not affected by the runaway prices of commodities like oil, food, metals, etc. Thus, we should steer clear of the slogan dictated by Powell’s statement of raising interest rates, betting 25 basis points.

As investors anticipate an impulsive change in market sentiment, the US Dollar Index (DXY) fluctuates around 99.00. Last weekend’s headlines about the Russo-Ukrainian War did not significantly impact the US Dollar Index (DXY). The Fed’s policy conundrum is, therefore, the focus of investors.

What’s next for the USD/CHF outlook?

The US retail sales on Wednesday will also keep investors busy despite the stimulus from the Russo-Ukrainian war and statements from the Fed.

USD/CHF price technical outlook: Bulls heading north

The USD/CHF price broke the 0.9300 hurdle after consolidation, and now the pair is consistently posting gains above 0.9360 area. The 4-hour chart reveals a strongly bullish scenario, lying above the major SMAs. The upside may face a mild resistance at 0.9375 ahead of the 0.9400 handle.

On the flip side, the pair may likely pullback towards the 20-period SMA around 0.9300 as the volume is slowly declining for the bullish price action.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

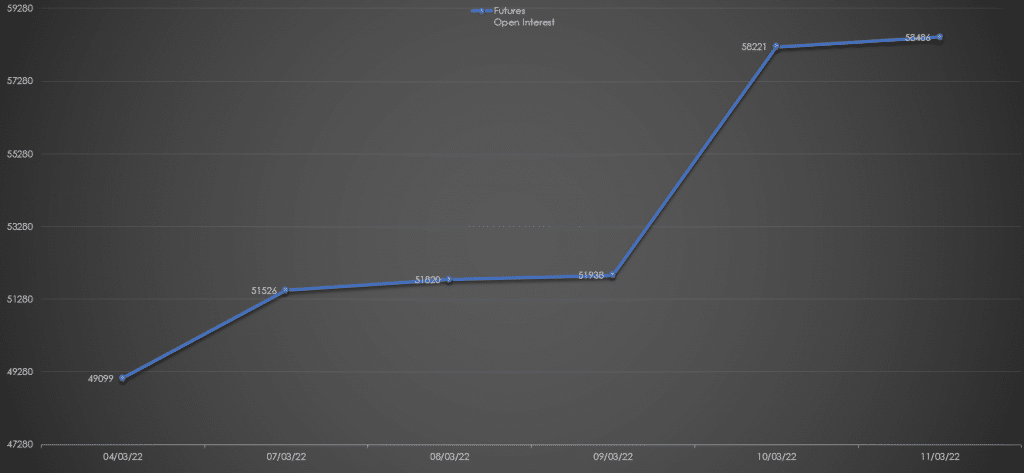

USD/CHF outlook via daily open interest

The daily open interest for Friday slightly rose along with the prices. It indicates that more buyers entered the market. Therefore, we consider it a bullish sign. However, the rise in open interest numbers is not significant.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money