- The USD/CHF rises to a fresh multi-day high amid sluggish market conditions.

- The threat of war between Ukraine and Russia is easing amid signs of peace ahead of May.

- Risk appetite is being tested by China’s Coronavirus crisis and expectations of further monetary tightening.

- The US PPI, a second-tier Swiss data, may delight traders, but fresh impetus must come from risk catalysts.

The USD/CHF outlook continues its four-day uptrend at the beginning of Tuesday’s European session. As of press time, the quote for the currency has risen beyond 0.9400 after gaining 0.15% on the day.

–Are you interested in learning more about making money with forex? Check our detailed guide-

Some risk barometers initially welcomed the idea that the conflict between Moscow and Kyiv would end in May. However, due to the resumption of peace talks after Monday’s abrupt halt and comments from US Senator Marco Rubio, who said, “Russia currently has no morale, and no manpower to take Kyiv,” an end to the geopolitical crisis seems likely.

Additionally, the refusal of the European Union (EU) to ban bank payments related to Ukraine also supports a moderately bullish market sentiment, which in turn is stimulating USD/CHF rates.

Moreover, the multi-month high US Treasury yield favors USD/CHF bulls.

Nevertheless, the worsening situation with the virus in China and Russia’s willingness to fully meet its targets in Ukraine suggest darker days are ahead.

As part of this game, the 10-year US Treasury yield rose to a new high since June 2019 before falling to 2.14%, while the 5-year coupon hit a 34-month high before falling back to 2.098 %. Stock futures in the US and Europe are also up slightly.

The Swiss producer price index and import prices for February are expected to fall by 5.1% versus 5.4% the previous month, outpacing the US producer price index (PPI) for this month, which is expected to rise to multi-day highs with a year-over-year reading of 10.0% compared to 9.7% previously to provide an immediate indication of the future. It will be more important for the new momentum to focus on Russian, Chinese, and US Federal Reserve (Fed) headlines.

USD/CHF price technical outlook: Bulls shy of 0.9400

The USD/CHF price took a brief jump above 0.9400 handle but could not hold on to gains. However, the technical outlook is still bullish as the 4-hour chart suggests further gains. In addition, the key SMAs are pointing higher.

However, the volume declined for the recent upside move. It means that the probability of downside correction remains on the cards.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

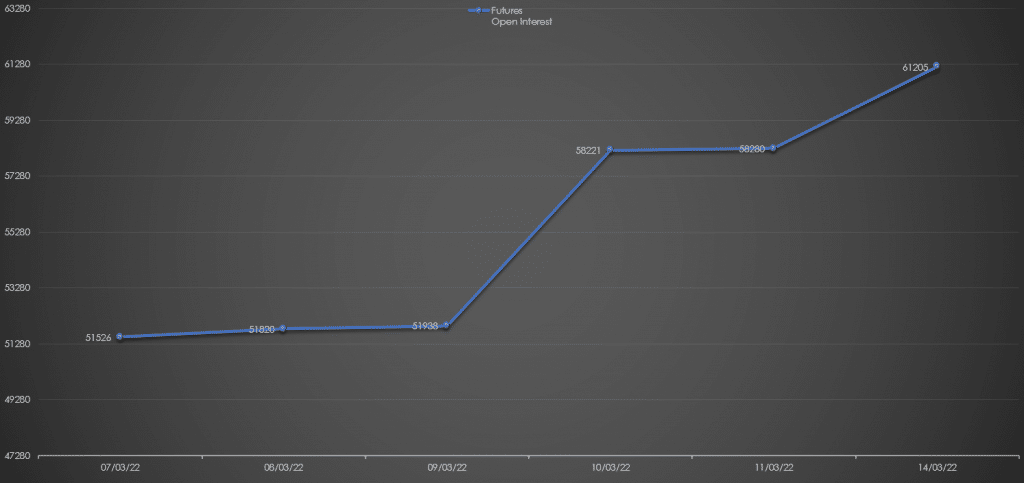

USD/CHF outlook via daily open interest

The USD/CHF price increased yesterday, while the open interest for the pair also increased. It shows a bullish bias.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money