- Positive trade balance data from the US saw USD/CHF rising.

- The World Bank’s warning on possible stagflation in the global economy has raised concerns.

- Janet Yellen expects inflation to remain high as investors await inflation data.

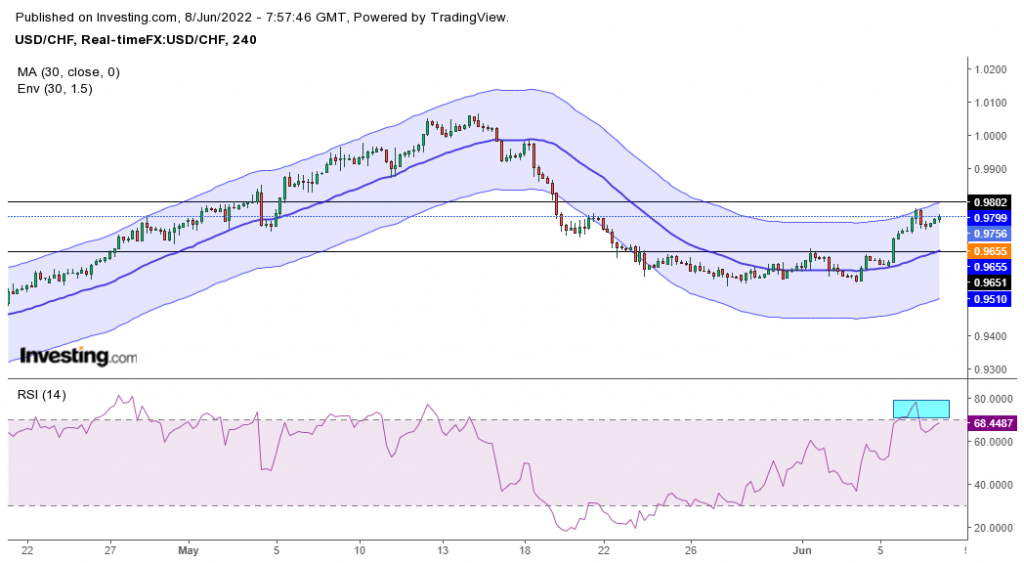

- The bulls are pushing towards 0.9800 in the charts.

The USD/CHF outlook remains strongly bullish as the poor risk sentiment amid inflation fears let the investors flow towards safe-haven.

-Are you interested in learning about the best AI trading forex brokers? Click here for details-

The USD/CHF pair closed Tuesday on a bullish candle, continuing its Monday rally. The US reported a higher trade balance than investors expected on Tuesday, boosting the USD/CHF pair. Wednesday morning saw the pair pushing higher as the dollar strengthened over recession concerns.

The World Bank released a report yesterday that renewed global recession concerns. The bank slashed its global growth forecast to 2.9% for 2022.

“The danger of stagflation is considerable today,” World Bank President David Malpass wrote in the foreword to the report. “Subdued growth will likely persist throughout the decade because of weak investment in most of the world. With inflation now running at multidecade highs in many countries and supply expected to grow slowly, there is a risk that inflation will remain higher for longer.”

The USD/CHF rally may return as investors look for safety in the US dollar. US Treasury Secretary Janet Yellen shared her inflation concerns yesterday during a Senate finance committee hearing. She expects the Biden administration to raise its 4.7% inflation forecast and say the US is dealing with “unacceptable inflation levels.”

USD/CHF key events today

After the jobs report from Switzerland, which did not surprise, investors will not be expecting any more critical news releases from the country. The United States is set to release crude oil inventory data later in the day, which might move the dollar. Investors expect an increase from -5.068M to -1.917M.

USD/CHF technical outlook: Retracement before the uptrend

Looking at the 4-hour chart, we see that bulls have returned and pushed the price to the overbought region. The price is trading above the 30-SMA and is currently touching its envelope. At this point, we might see a short-term return of bears who will push the price back to retest the 30-SMA.

-Are you interested in learning about the forex indicators? Click here for details-

However, if bulls are still as strong as they were yesterday, we might see a continuation of the trend to 0.9800. The bias will remain bullish as long as the price trades above the 30-SMA.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money