- Markets have priced in a 75-bps rate hike at the next FOMC meeting.

- The possibility of a 100bps rate hike has gone down to 10%.

- Investors expect a drop in US consumer confidence which could indicate poor spending.

Today’s USD/CHF price analysis is bearish as the US dollar edges lower ahead of the FOMC meeting. Investors are expecting a 75 basis point rate hike from the Federal Reserve tomorrow. The possibility of a more significant rate hike has dropped to 10%.

–Are you interested to learn more about forex options trading? Check our detailed guide-

The markets have already priced in the 75-bps rate hike, and the Federal Reserve would have to surprise investors to get a rally in the US dollar. As these rate hikes continue, the risk of recession in the US continues to dampen risk sentiment.

“We are leaning to the view that 75-bps is most likely, but won’t be the end unless they see some demand destruction and some tempering of inflation. We are fearful they have to slow the U.S. economy further materially,” said John Milroy, an investment adviser at Ord Minnett.

USD/CHF key events today

USD/CHF investors will pay attention to news releases from the United States today. The conference board consumer confidence, which measures the level of consumer confidence in economic activity, is expected to drop from 98.7 to 97.2. This report is a good indicator of consumer spending, which drives the overall economy.

Investors will also be keen to see the new home sales report from the US, which is expected to drop from 696K to 660K. This report will show the annualized number of new homes sold in the previous month.

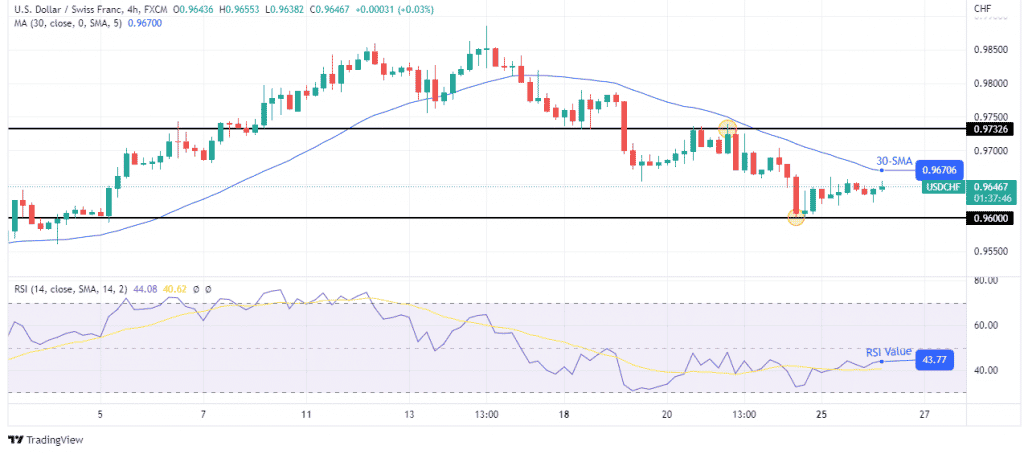

USD/CHF technical price analysis: Retracement to the 30-SMA before bears return

Looking at the 4-hour chart, we see the price pulling back to 30-SMA after a strong move down. The bears were unable to go beyond 0.96000, which acted as support. At this point, short-term bulls came in to try and push the price higher, but the move has been choppy at best.

–Are you interested to learn about forex robots? Check our detailed guide-

The price is getting closer to the SMA, which will likely act as resistance and resume the downtrend, retesting and possibly breaking below 0.96000. However, if the SMA fails to stop the bullish move, we might see the price break above the 30SMA and retest the July 21 resistance at 0.97326.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.