- USD/CHF could resume its growth after ignoring the immediate resistance levels.

- The greenback is strongly bullish after the US data came in better than expected earlier.

- DXY’s further growth should help USD/CHF to resume its growth and to approach new highs.

USD/CHF price rallied and now is traded at 0.9108 below 0.9110 today’s high. The Dollar Index has resumed its growth. That’s why the dollar has appreciated. We have a strong positive correlation between DXY and USD/CHF. So, if the index increases, the currency pair is expected to increase as well.

–Are you interested to learn more about automated forex trading? Check our detailed guide-

If you look at the economic calendar, you’ll notice that the US data has come in better than expected earlier, boosting the USD. The Non-Farm Employment Change was reported at 943K in July versus 850K in June, exceeding the 850K estimate.

The Unemployment Rate dropped unexpectedly lower as well, from 5.9% to 5.4%, far below the 5.7% forecast, while the Average Hourly Earnings increased by 0.4%, beating the 0.3% estimate.

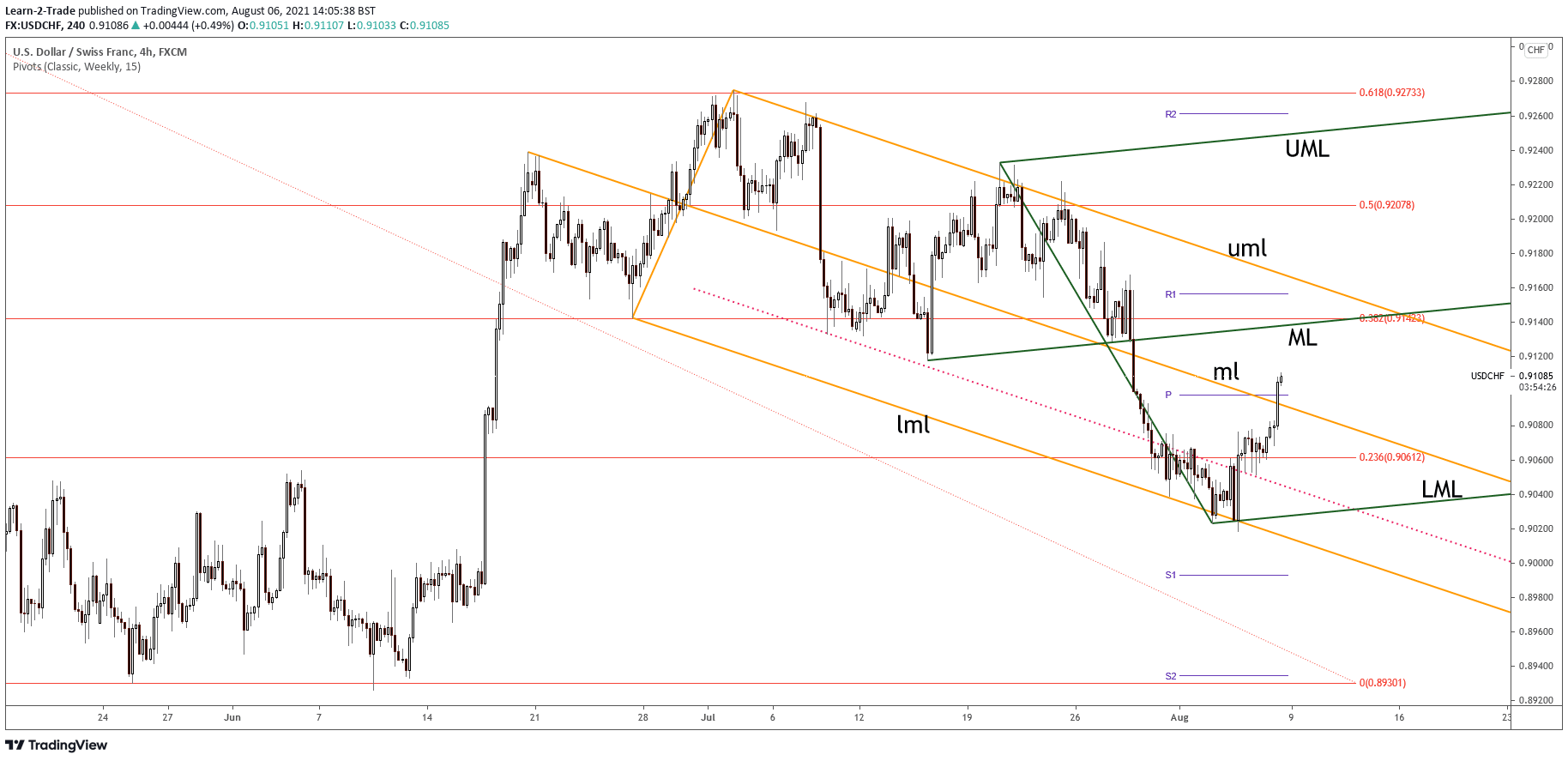

USD/CHF price technical analysis: Bulls to roar

The USD/CHF pair has found support on the descending pitchfork’s lower median line (LML) and now is traded above the median line (ML) and beyond the weekly pivot point (0.9097). Personally, I’ve drawn an ascending pitchfork, hoping that I’ll catch an upside movement.

–Are you interested to learn more about forex signals? Check our detailed guide-

You can see that the price has retested the lower median line (LML) of the ascending pitchfork, confirming it as dynamic support as well. Actually, USD/CHF has printed a major bullish engulfing on the confluence area formed at the intersection of the lower median lines (LML).

Confirming the ascending pitchfork, the USD/CHF pair signaled a potential upside towards the median line (ML).

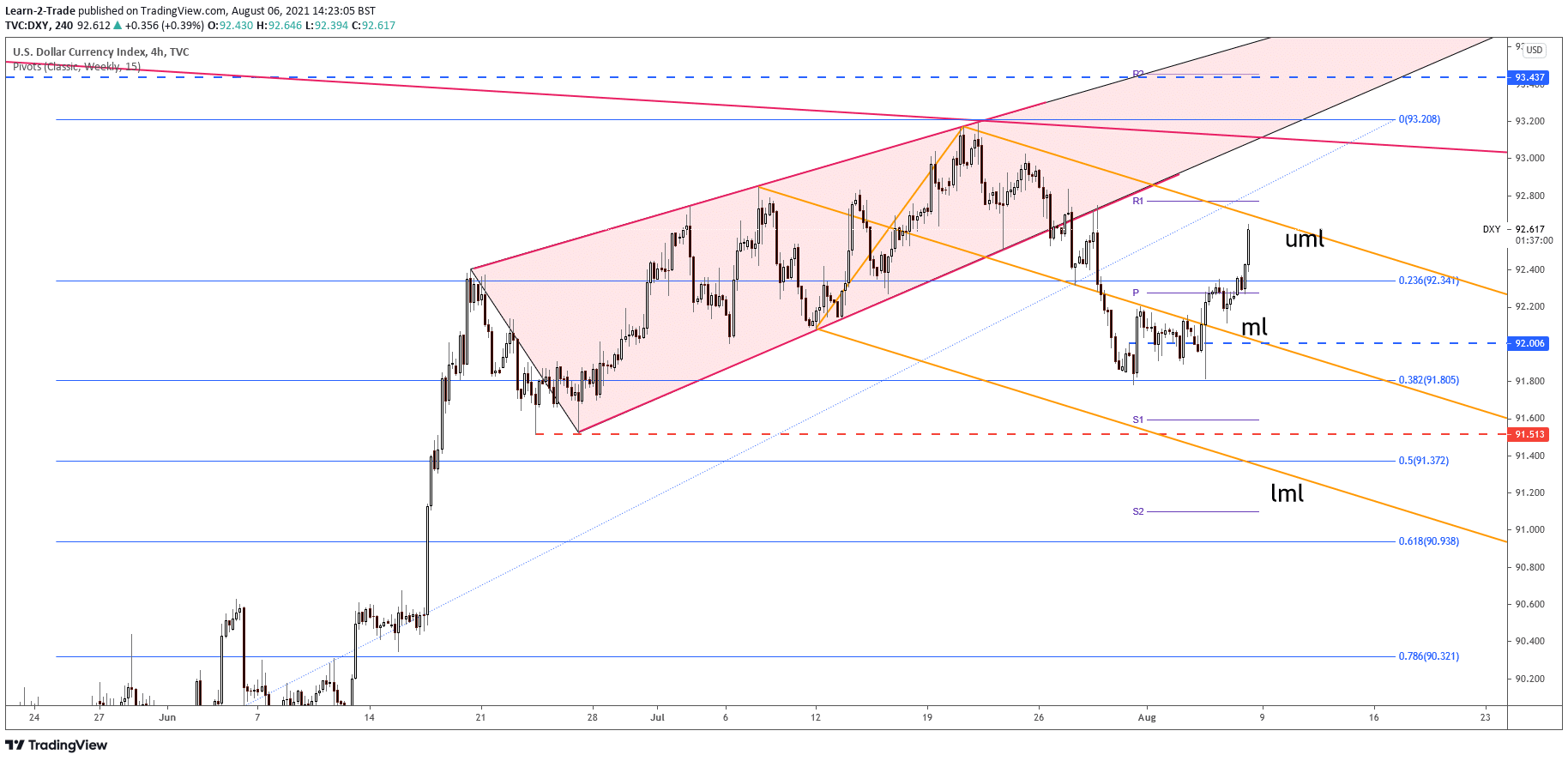

DXY technical analysis

DXY almost reaches the descending pitchfork’s upper median line (UML), which is seen as an upside target. It was somehow expected to increase after failing to close below 38.2% and after jumping above the median line (ml).

Making a valid breakout above the upper median line (UML) and resuming its growth could help the USD/CHF resume its growth. On the other hand, DXY’s potential drop from the upper median line (UML) may signal a USD/CHF drop.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.