Key news updates for USD/JPY

Updates:

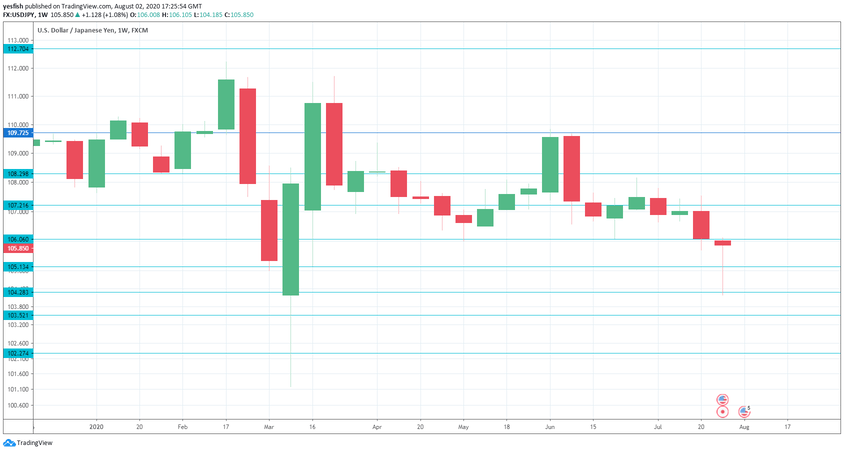

USD/JPY Technical Analysis

109.73 (mentioned last week) is protecting the 110 level, which has psychological significance.

108.30 has provided resistance since early June.

107.22 is next.

106.05 is an immediate resistance line.

105.13 is providing support.

104.29 is next.

103.52 was last tested in early March.

102.27 is the final support line for now.