- On Friday, USD/JPY hit a weekly high, its fifth day of gains.

- Fed-Bank of Japan’s divergence in monetary policy remained a tailwind for the economy.

- The fundamental backdrop supports prospects for a return to the 125.00 round figure.

The USD/JPY forecast is bullish for much of the European session as the pair traded with a moderately positive bias, last hovering around 124.10, just a few pips off their weekly high.

–Are you interested in learning more about AI trading brokers? Check our detailed guide-

On Friday, USD/JPY reversed its intraday slide into the 123.65 area and climbed higher for the fifth straight day. With the widening interest rate differential between Japan and the United States, and a good recovery in global stock markets, the Japanese yen has lost its appeal as a safe-haven currency. Furthermore, the US dollar’s bullish sentiment helped spot prices.

Fed’s minutes boost the greenback

With expectations that the Fed will tighten monetary policy more rapidly, the US dollar gained its highest level since May 2020. The FOMC minutes for March 15-16 released on Wednesday showed policymakers were poised to hike rates by 50 basis points. In addition, inflation concerns and high US Treasury yields continued to support US dollar strength.

Eased BoJ

The recent spike in fuel prices following Russia’s invasion of Ukraine remains a concern for investors because it could increase already high consumer inflation. However, Asahi Noguchi, an executive board member at the Bank of Japan, said the central bank should maintain its ultra-loose monetary policy despite market fears.

The Bank of Japan has stated repeatedly that it will utilize effective tools to prevent excessive interest rate increases in the long run. To protect the 0.25% yield cap, the Bank of Japan offered unlimited 10-year Japanese government bonds purchases last week. The spread between the US and Japanese bond yields was thus further widening.

The USD/JPY should continue to support bullish traders while fundamentals favor bulls. Moreover, in the short-term charts, the formation of an upward channel also supports the prospect of further gains. So, it seems likely that we will return to the psychological level of 125.00 or a multi-year high soon.

What’s next to watch?

As long as there are no major economic news announcements from the US, US bond yields will affect the US dollar price and boost the USD/JPY pair. There will be a continued focus on developments associated with the Russia-Ukraine saga, stimulating a broader market risk appetite and demand for safe-haven assets.

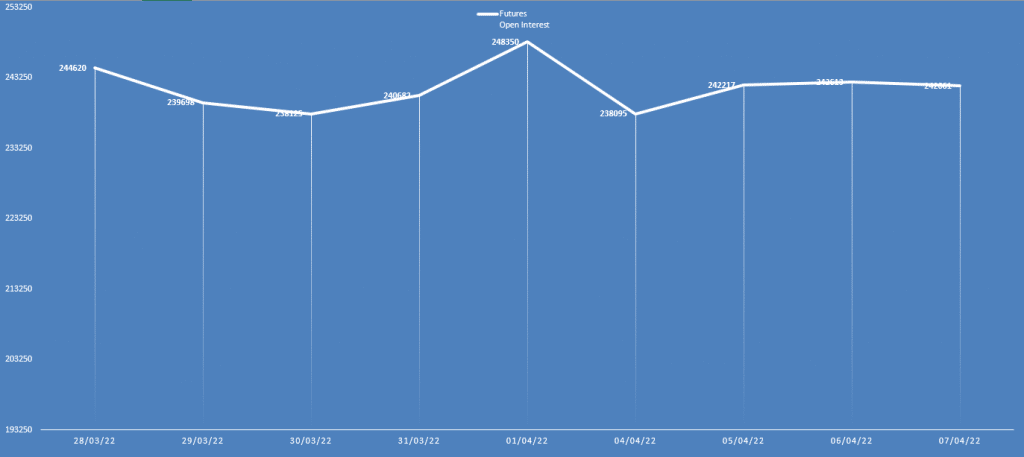

USD/JPY daily open interest forecast

The USD/JPY price rose significantly on Thursday. However, the daily open interest dropped slightly. It shows that the pair may lag conviction to go further higher. The bias is not bullish at the moment.

–Are you interested in learning more about spread betting brokers? Check our detailed guide-

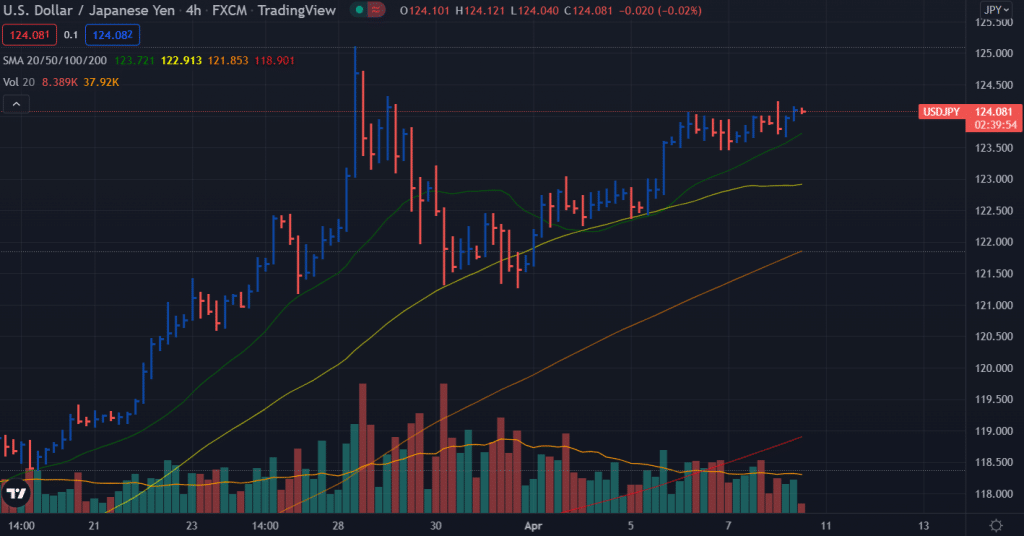

USD/JPY price technical forecast: Bulls remain intact

The USD/JPY is comfortable above the 124.00 area. The pair is slowly heading towards the multi-month top at 125.11. The pair is constantly above the 20-period SMA on the 4-hour chart, a bullish sign. The bias will be changed if the price bar closes below the 20-SMA with a very high volume.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money