Key news updates for USD/JPY

Updates:

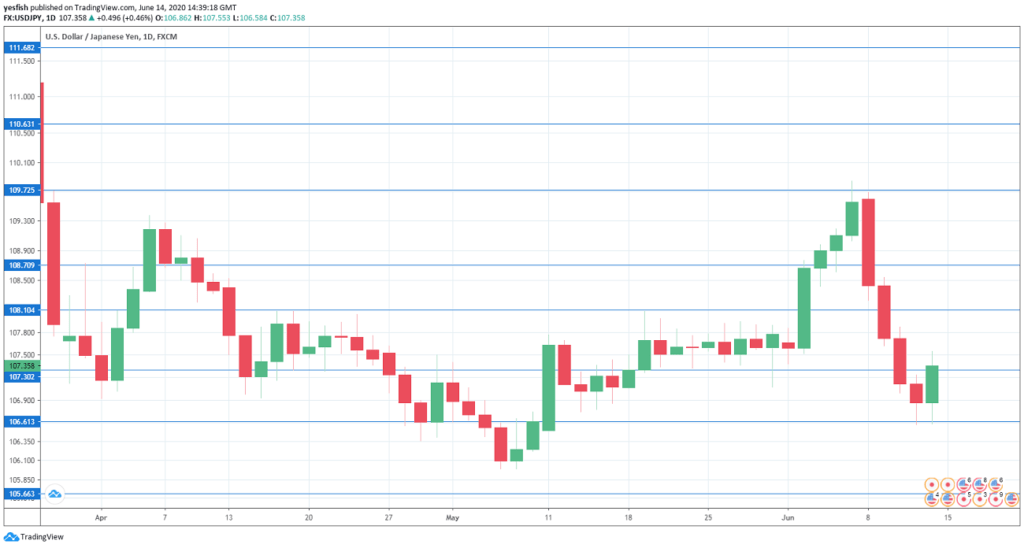

USD/JPY Technical Analysis

With USD/JPY posting strong losses last week, we start with support at higher levels:

110.62 switched to resistance in late March, when USD/JPY dropped sharply.

109.73 is protecting the 110 level, which has psychological significance.

108.70 (mentioned last week) has switched to a resistance line after sharp gains by USD/JPY last week.

108.10 last saw action in the first week in January.

107.30 is an immediate support line.

106.61 is next.

105.55 has held in support since mid-March.

104.65 follows.

The round number of 104 was a key line in May 2008.