Key news updates for USD/JPY

Updates:

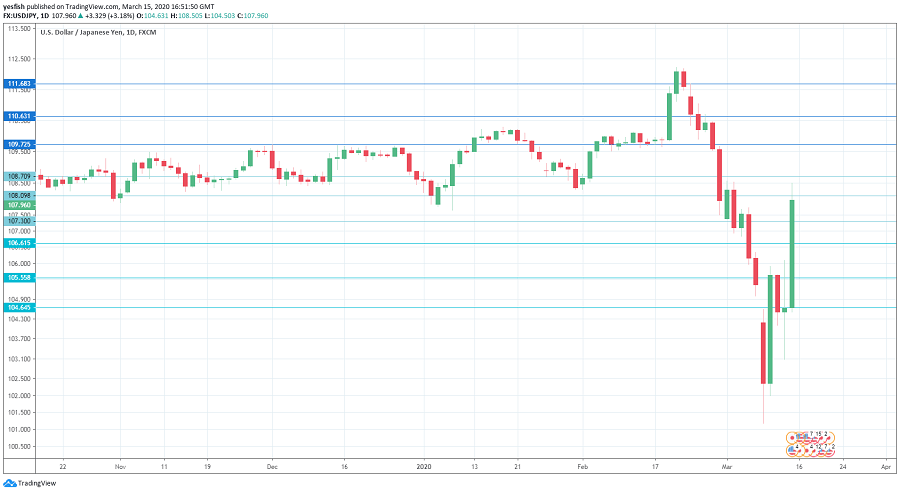

USD/JPY Technical Analysis

We start with resistance at 111.69. 110.62 is next.

109.73 has switched to a resistance role after sharp gains by USD/JPY last week.

108.70 (mentioned last week) was breached at the end of the week.

108.10 is an immediate resistance line.