Dollar/yen wobbled around as stock markets were under pressure and the US Dollar also suffered from reports that the Fed may take a pause and weak data. What’s next? The upcoming meeting between Trump and XI as well as the Fed meeting minutes stand out.

USD/JPY fundamental movers

Some USD weakness on stocks, the Fed, and data

Equity markets fell early in the week and the yen attracted safe-haven flows. The following recovery supported a recovery. However, the greenback suffered from weak data: durable goods orders missed on both the headline and the core, and this was exacerbated by downward revisions. And while existing home sales recovered, it was a recovery from the lows that resulted.

After Richard Clarida, Patrick Harker, and other Fed officials expressed growing concern about the global economy, a report came out suggesting that the central bank will pause rate hikes in the spring.

Elsewhere, Brexit and Italy caused jitters in the old continent but did not have a substantial effect on USD/JPY. One of the reasons was the holiday in the US: Thanksgiving slowed down the activity in the latter part of the week.

FOMC Minutes, GDP, and the G-20 Summit

US traders will return to markets with fresh energy and will have quite a few events to digest. The second release of GDP for Q3 may show a downgrade in comparison to the first release. The FOMC Meeting Minutes will be of high interest given the recent dovish comments. While a rate hike is expected in December, it is unclear if Jerome Powell and his colleagues will continue on the same path next year.

And at the of the week, Presidents Xi Jinping and Donald Trump will meet in Buenos Aires and will try to thrash out a trade deal. The stakes are high as the countries are the world’s largest economies. A failure will likely result in a strengthening of the Japanese Yen.

See all the main events in the Forex Weekly Outlook

Key news updates for USD/JPY

[do action=”autoupdate” tag=”USDJPYUpdate”/]USD/JPY Technical Analysis

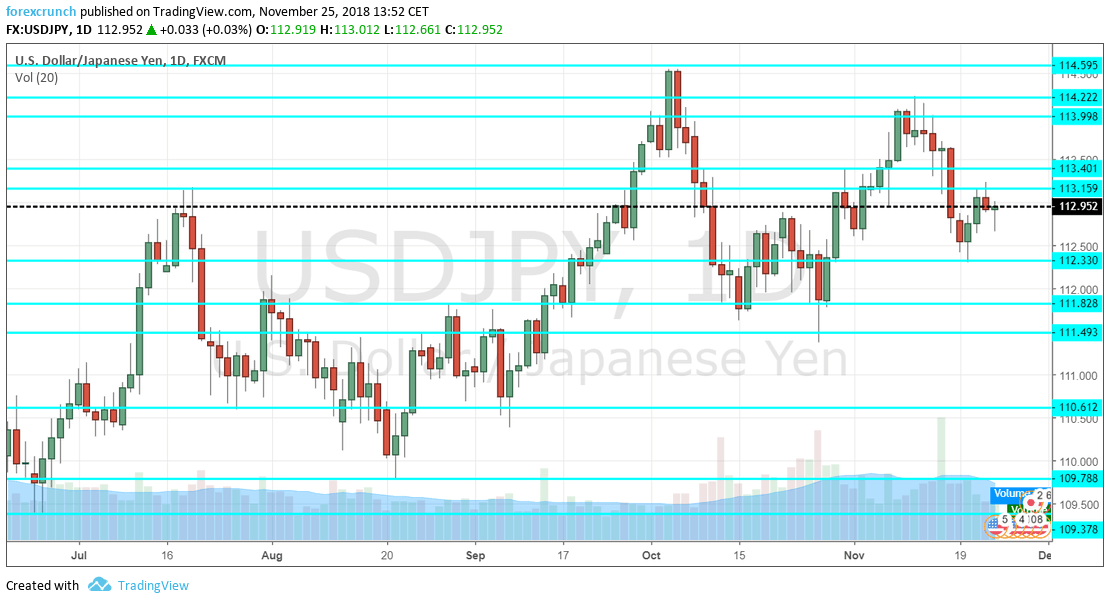

115.55 was a high point in the first half of 2017 and is an upside target. 114.60 was the high point in early October and serves as resistance. 114.25 was the high point in November.

114 is a round number and was a stepping stone on the way down. 113.40 capped the pair in late October and is immediate resistance.

113.15 was a swing high back in July. 112.55 served as support in September and resistance in October, making it a significant level.

111.80 was the low point after the fall in mid-October. 111.50 capped the pair in August.

110.60 was a swing low in late July and then again in late August. 109.70 was a swing low in late August and provides extra support below the round 110 level.

Close by, 109.35 was a cushion in mid-July. 108.70 was a cushion early in the summer and 108.10 a swing low in late May.

Lower, we find 107.50 capped the pair in early April and is a strong line.

USD/JPY Daily Chart

USD/JPY Sentiment

I am bearish on USD/JPY

The stock market rout is not over and the safe-haven yen has more room to gain.

Our latest podcast is titled Are stocks free falling or is it a buying opportunity?

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

Safe trading!