Key news updates for USD/JPY

Updates:

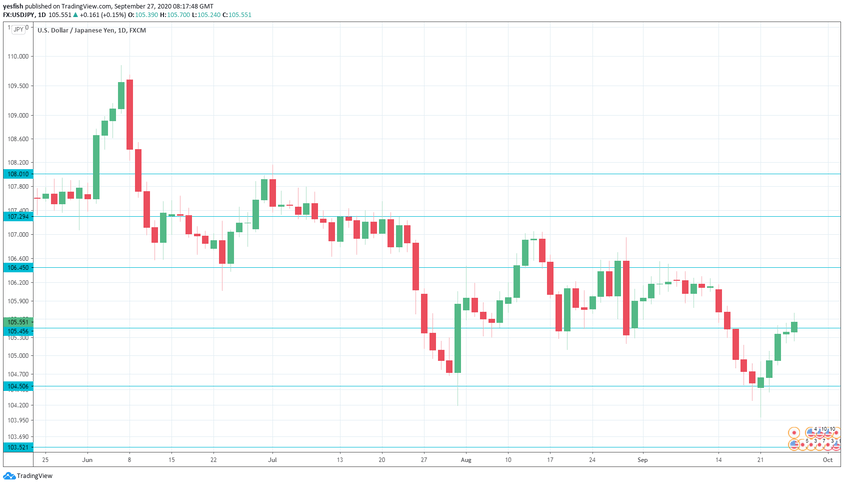

USD/JPY Technical Analysis

We start at the round number of 108, an important monthly resistance line.

107.29 (mentioned last week) is protecting the 107 level.

106.44 is next.

105.45 is an immediate support level.

104.50 has some breathing room in support.

103.52 has held in support since March.

102.13 is the final support line for now.

WAI

WAI