Key news updates for USD/JPY

Updates:

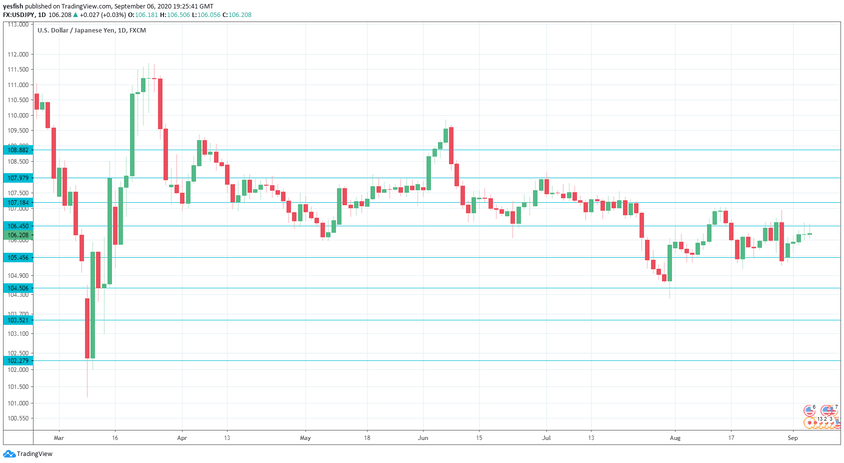

USD/JPY Technical Analysis

108.88 has provided resistance since early June.

107.97 is protecting the 108 line.

107.18 (mentioned last week) is next.

106.44 is an immediate resistance line.

105.45 has switched to a support role after strong gains by USD/JPY last week.

104.50 has some breathing room in support.

103.52 is the final support line for now.