- The yen hit a 32-year low after a positive US inflation report.

- Japan is keeping a close eye on the yen and is ready to intervene if necessary.

- Japan is suffering imported inflation due to the weaker yen.

Today’s USD/JPY price analysis is bullish. News that consumer inflation in the United States was at 8.2% propelled the yen’s overnight decline to a 32-year low. It reinforced expectations that the Federal Reserve would continue hiking interest rates for longer, further devaluing Japan’s currency.

-If you are interested in forex day trading then have a read of our guide to getting started-

A senior politician in Japan’s ruling coalition party said on Friday that the country would carefully consider whether to intervene to stop any excessive yen depreciation after the Japanese currency fell to a 32-year low versus the dollar. Japan will urgently watch the yen, which is historically low.

On Thursday, a senior International Monetary Fund official said that Japan’s currency intervention last month to arrest a rapid decline in the yen was likely a “signalling action” to moderate volatility. However, the effects of such interventions often last just a short time.

The weak yen, once hailed as boosting exports, has caused policymakers in Japan problems because it raises the price of importing already-expensive fuel and food. Therefore, markets are keeping an eye on Japan to see whether they will intervene again. But intervention can only do so much. The yen looks set for further weakness.

USD/JPY key events today

Investors are expecting retail sales data from the US. This data will measure the total retail sales, indicating the state of consumer spending in the country and the economy’s health.

USD/JPY technical price analysis: Bulls heading for 148.00

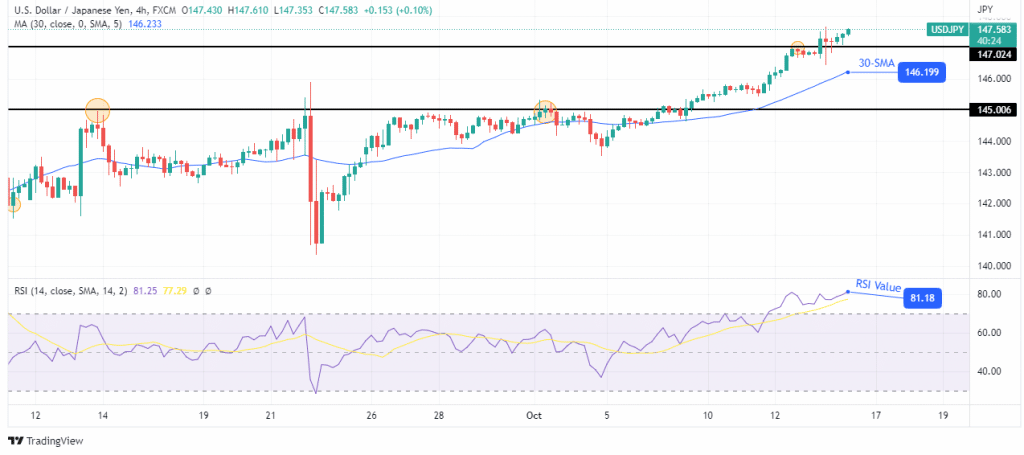

Looking at the 4-hour chart, we see the price trading well above the 30-SMA and the RSI in the overbought region. These are all signs of a strong bullish trend. Bears have not played a big role in the market since the price broke above the 145.00 key resistance level.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

With this much strength, bulls broke above the 147.02 psychological level and can only go higher. However, there is a chance that it will come in as the price is oversold. If they do return, it would be to retest the 30-SMA as resistance before the price makes new highs.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.