- A panel advised the BOJ to make its 2% inflation target a long-term objective.

- The group recommended that Japan’s bond market function be normalized.

- Kuroda reaffirmed the significance of continuing an ultra-loose monetary policy.

Today’s USD/JPY price analysis is slightly bearish as pressure mounts on the BoJ to change its monetary policy. In light of the mounting costs of extended monetary easing, a panel of academics and business executives advised the Bank of Japan (BOJ) to make its 2% inflation target a long-term objective rather than one that must be achieved as soon as possible.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

According to the panel, the revised price target must be included in a new policy agreement between the government and the central bank, which would take the place of the one created in 2013.

The group also recommended that Japan’s bond market function be normalized and that interest rates be raised in a manner more consistent with economic fundamentals.

The BOJ’s ultra-loose policy has come under fire from investors who predict it will raise interest rates when Governor Haruhiko Kuroda’s term ends in April. This is due to rising raw material costs pushing inflation well above its 2% target.

Nobuyuki Hirano, a former president of MUFG Bank and member of the panel, claimed that the yield control strategy of the BOJ has become unsustainable since it is leading to significant yield curve distortions.

However, Kuroda reaffirmed the significance of continuing an ultra-loose monetary policy before parliament on Monday.

Prime Minister Fumio Kishida, who will select the next BOJ governor, has hinted that the policy agreement may be changed under Kuroda’s successor in light of recent public complaints over rising inflation.

USD/JPY key events today

Investors anticipate the January CB Consumer Confidence Report, which will reveal the degree of consumer confidence in US economic activity.

USD/JPY technical price analysis: No clear direction in the market

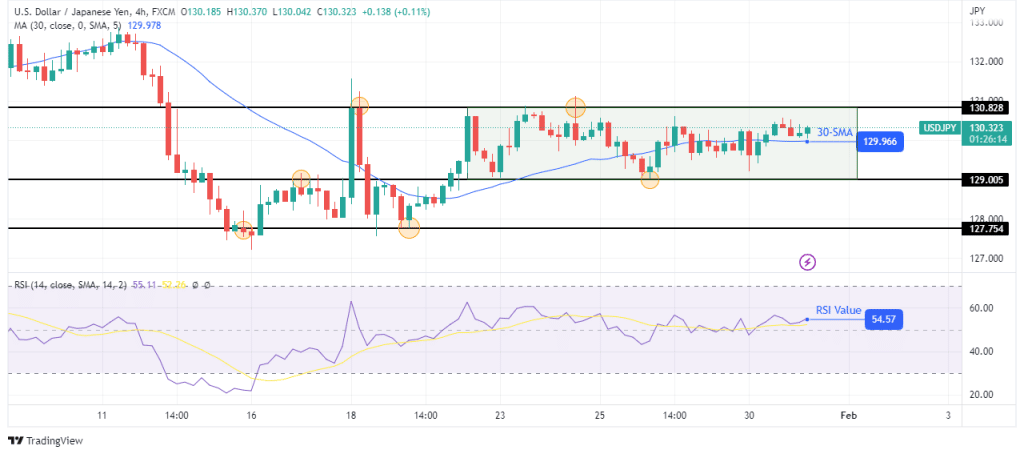

The 4-hour chart shows USD/JPY trading slightly above the 30-SMA with the RSI slightly above 50. Although bulls are currently stronger, there is no clear direction in the market as the price keeps chopping through the 30-SMA.

–Are you interested to learn more about forex signals? Check our detailed guide-

The price ranges between the nearest resistance at 130.82 and the nearest support at 129.00. The market can only pick a side when it breaks out of this range. A break above the resistance would mean a bullish trend while a break below the support, a bearish trend. Until then, it might continue consolidating.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.