- The US dollar stayed below the recent 2-1/2-month highs against major currencies.

- In May, the US services sector experienced minimal growth.

- Japan’s real wages experienced a 13th consecutive monthly decline in April.

Today’s USD/JPY price analysis is bearish. The US dollar stayed below the recent 2-1/2-month highs against major currencies following the release of unexpectedly weak US services data on Monday. This data further reinforced expectations that the Federal Reserve would pause its activities at the meeting.

–Are you interested in learning more about copy trading platforms? Check our detailed guide-

In May, the US services sector experienced minimal growth, with a slowdown in new orders contributing to a decline in the measure of prices paid by businesses for inputs. This decline reached a three-year low, potentially assisting the Federal Reserve in its efforts to combat inflation.

Elsewhere, government data released Tuesday revealed that Japan’s real wages experienced a 13th consecutive monthly decline in April. This decline indicates a slow wage recovery despite consistent consumer inflation growth.

Notably, during negotiations between major Japanese firms and unions in March, agreements were reached to provide the largest wage increases in thirty years. This move was prompted by the need to compensate workers for the rising cost of living.

However, the data released on Tuesday suggests that it will take time for the impact of these wage hikes to be felt.

Moreover, Kazuo Ueda, the Governor of the Bank of Japan, has emphasized the importance of maintaining an ultra-loose policy. He aims to achieve the central bank’s 2% inflation target sustainably and stably, accompanied by wage increases.

USD/JPY key events today

Investors are not awaiting any key releases from the US or Japan, so today’s session will likely be quiet.

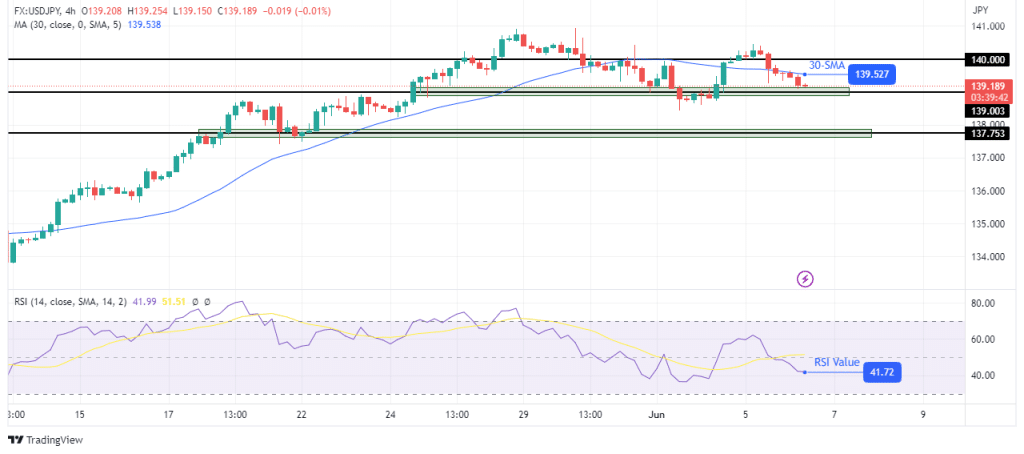

USD/JPY technical price analysis: 140.00 resistance prompts a bearish reversal.

The USD/JPY bears have taken over in the 4-hour chart by pushing the price below the 30-SMA and the RSI below 50. This indicates a shift in sentiment. Although bulls tried to trade above the key 140.00 level, they could not sustain the move. Consequently, the price fell back below the level.

–Are you interested in learning more about scalping forex brokers? Check our detailed guide-

A second attempt saw the price making a lower high before bears took over again. The price is now approaching the 139.00 support level. Given bears are in control. There’s a big chance the price will break below 139.00 to retest the 137.75 support.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money