- The dollar weakened against the yen for a third straight day on Tuesday.

- There is the potential for buying on the downside given differing views on Fed and Bank of Japan policies.

- In the near term, traders are waiting for the release of the ISM US Manufacturing PMI.

During the Asian session, the USD/JPY price fell to a three-day low, and now bears are attempting to extend the downside below the key psychological level of 115.00.

–Are you interested to learn more about Islamic forex brokers? Check our detailed guide-

USD/JPY declined for a third straight day Tuesday, after an early rise to the 115.20 area. Last Friday, spot prices fell off a nearly three-week high, mainly because the dollar was weaker.

The Fed’s expectation of tightening monetary policy faster than expected now appears to have dampened prospects for future growth. In money markets, the spread between 2-year and 10-year Treasury bonds fell below 60 basis points for the first time since early November, undermining the dollar.

As part of the speculation, Atlanta Fed President Rafael Bostic said the Federal Reserve could raise interest rates by 50 basis points if a more aggressive approach is needed to address stubbornly high levels. Additionally, markets are examining the possibility of five quarter-point rate hikes by the end of 2022.

Meanwhile, the Bank of Japan has repeatedly stated that it will maintain sustained and strong monetary easing for the time being. Therefore, the Fed’s policy divergence from the BOJ supports bullish traders and some buying on the downside around USD/JPY.

It is prudent to wait for further selling before confirming that the recent strong rebound has started from the 113.45 area. Participants in the USD/JPY market are eagerly awaiting the US ISM Manufacturing PMI release for some short-term opportunities.

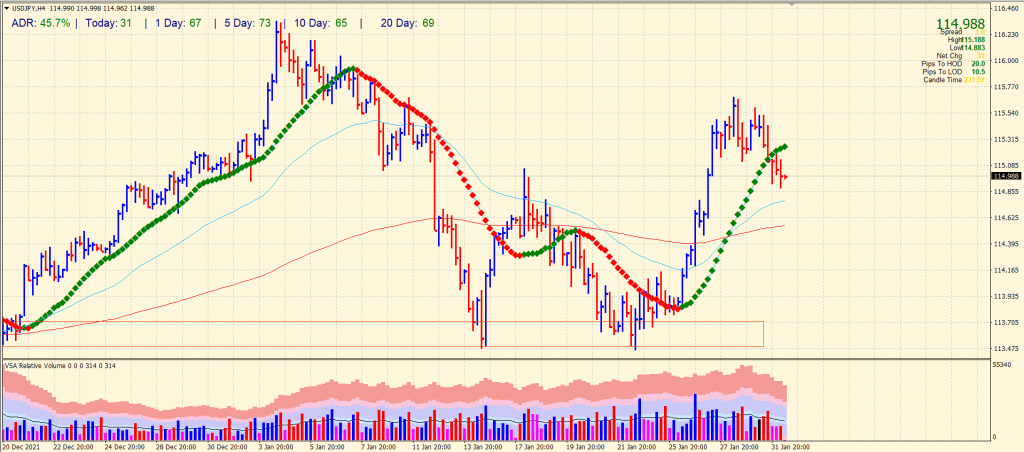

USD/JPY price technical analysis: Bears breaking 115.00

The USD/JPY price has slipped below the 20-period SMA on the 4-hour chart. The downside may find support between the 114.55 – 75 zone as the 200-period and 50-period SMAs are creating a confluence in the area. The price may also find support around the current levels of 115.00.

–Are you interested to learn more about Thailand forex brokers? Check our detailed guide-

The volume data is not clear at the moment, indicating a neutral bias. Moreover, the bars are closing in the middle, which shows a sidelined behavior. Finally, the average daily range is 45% higher than the normal. The entire scenario indicates that the market is awaiting a catalyst event.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.