- The USD/JPY pair could extend its growth after making a new higher high.

- Only a new lower low could activate a corrective phase.

- The NFP publication could bring sharp movements.

The USD/JPY price continues to move sideways in the short term. The price action signaled exhausted buyers, but the price stayed higher as the Dollar Index rallied while the Japanese Yen Futures dropped.

-Are you interested to find high leverage brokers? Check our detailed guide-

Technically, the bias remains bullish, so we cannot talk about a new sell-off as long as it stays above the 135.00 psychological level, above the previous lows. It has changed little, but the US data could bring high volatility today. The US is to release high-impact data.

The Non-Farm Employment Change is expected at 260K in June versus 390K in May. The unemployment rate could remain at 3.6%, while the Average Hourly Earnings indicator may report a 0.3% growth in the last month. In addition, the Final Wholesale Inventories and the Consumer Credit will be released as well.

The Japanese Yen could take the lead only if the Yen Futures developed a new leg higher. The JPY remains sluggish as the Japanese data mixed in the early morning.

Household Spending dropped by 0.5% versus a 2.2% growth expected, Bank Lending surged by 1.3% versus 0.9% forecasted, and Current Account came in at 0.01T below 0.16T estimates. In contrast, the Economy Watchers Sentiment dropped unexpectedly from 54.0 to 52.9 points even if the traders expected a potential growth to 55.0 points.

USD/JPY price technical analysis: Ranging

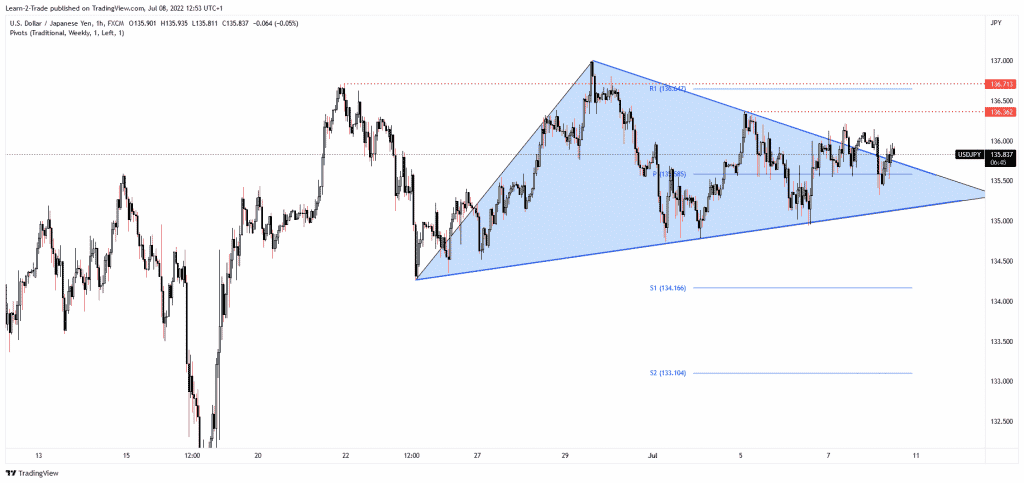

Later, the fundamentals could drive the price. From the technical point of view, the USD/JPY pair escaped from the triangle pattern, and now it is trying to stabilize above the broken dynamic resistance. The 136.00 psychological level stands as a static resistance. As you can see on the 1-hour chart, the rate failed to stabilize above this level in the last attempts.

-Looking for high probability free forex signals? Let’s check out-

The 136.36 and 136.71 are seen as upside obstacles as well. Most likely, the rate will register sharp movements after the US NFP. As long as it stays above the triangle’s support, the USD/JPY pair could try to resume its major uptrend. Only a valid breakdown below the triangle’s support and a new lower low could activate a larger correction.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money