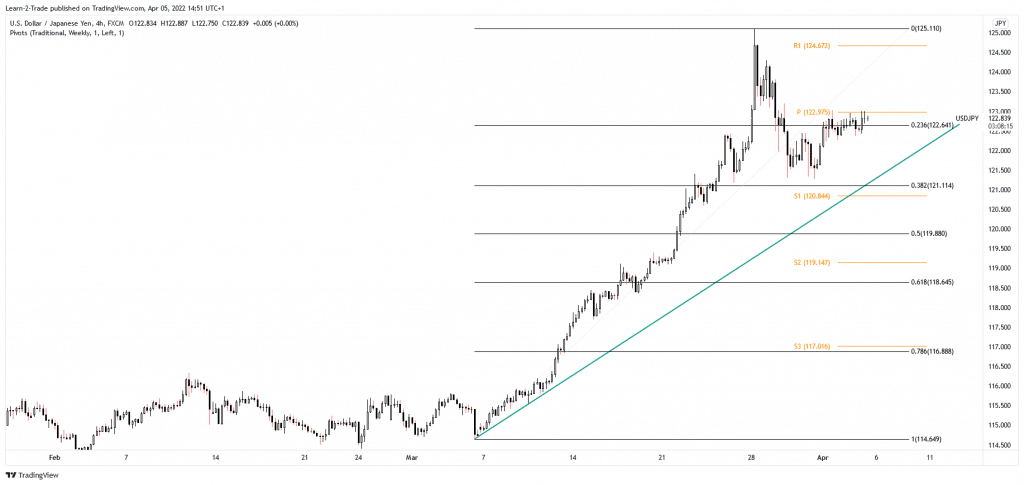

- The USD/JPY pair maintains a bullish bias as long as it stays above the uptrend line.

- Consolidating above the 23.6% level could bring new long opportunities.

- Breaking above the weekly pivot point could confirm an upside continuation.

The USD/JPY price is trading at 122.84 at the time of writing. However, the price seems undecided as the Dollar Index retreated after its amazing rally, while the Japanese Yen Futures found temporary support.

–Are you interested in learning more about AI trading brokers? Check our detailed guide-

Technically, the bias is bullish, and the pair could extend its rally anytime if the DXY jumps higher and if the Yen Futures extend the sell-off. As you already know, the USD/JPY pair was in a corrective phase, and now it is trying to resume its upwards movement.

Fundamentally, Japanese Household Spending rose by 1.1% in February versus 2.8% expected and 6.9% growth in January, while the Average Cash Earnings registered a 1.2% growth exceeding the 0.6% growth expected and the 1.1% growth registered in the previous reporting period.

Unfortunately for the USD, the US economic data came in worse than expected earlier. The ISM Services PMI surged from 56.5 to 58.3 points, but it has failed to reach 58.6 estimates. In addition, the final Services PMI was reported at 58.0 points below 58.9 expected, while the Trade Balance came in at -89.2B versus -88.5B forecasts.

USD/JPY price technical analysis: Uptrend continuation

The USD/JPY pair retreated, but bears failed to reach the 38.2% (121.11) retracement level signaling strong buyers. However, it has managed to rise above the 23.6% (122.64) level, and it seems determined to come back higher towards 125.10 high. It challenges the weekly pivot point (122.97), representing a static resistance. Breaking above this level may confirm an upside continuation.

–Are you interested in learning more about spread betting brokers? Check our detailed guide-

Technically, strong buyers were announced after failing to reach and retest the uptrend line. In the short term, strong consolidation above the 23.6% level could help buyers catch more gains. The bullish bias remains intact as long as the rate stands above the uptrend line. Only a valid breakdown below this dynamic support could announce that the upwards movement is over and that the USD/JPY pair could develop a larger downwards movement.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money