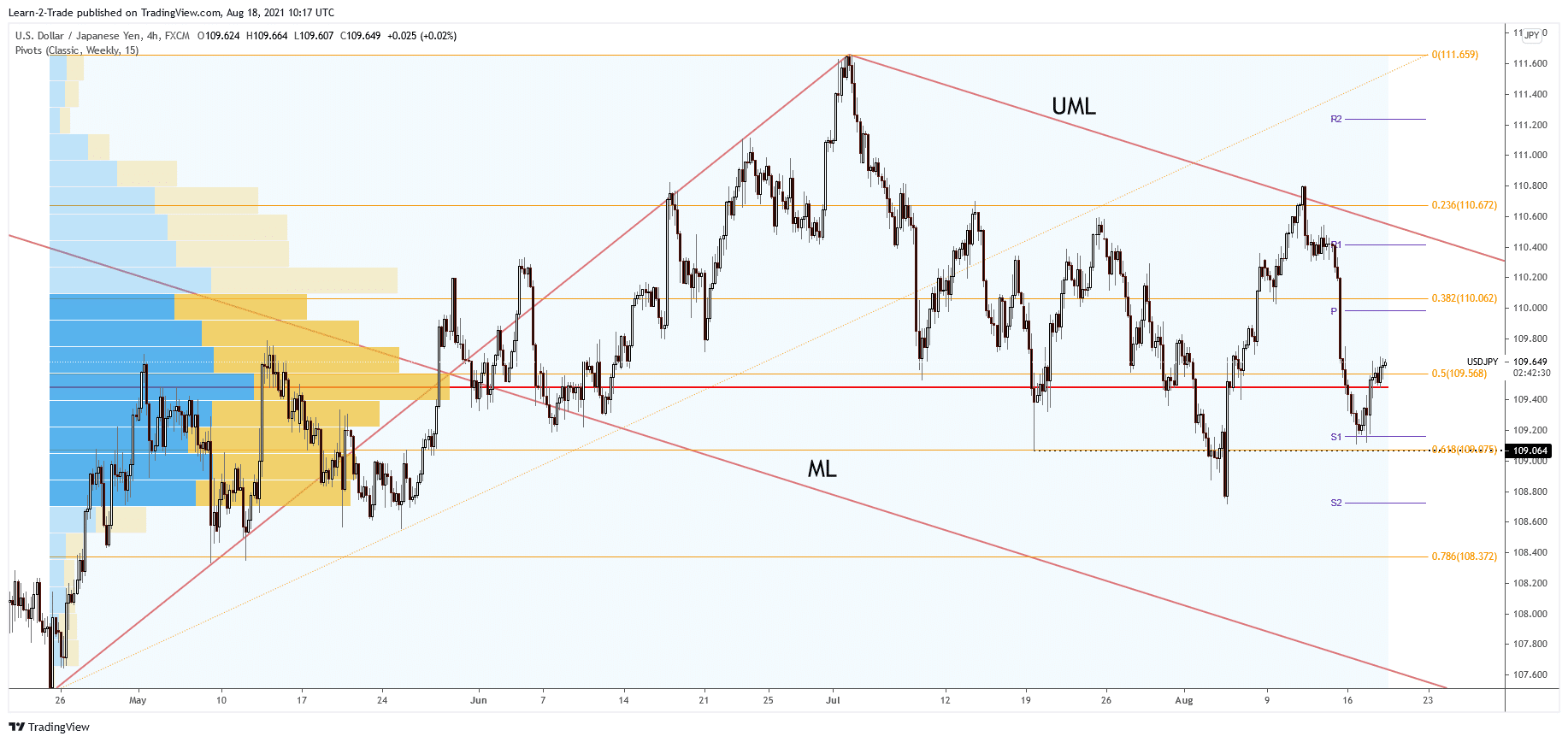

- USD/JPY could make a decent upside move if it consolidates above the 50% retracement level.

- The upper median line (UML) is seen as a critical upside obstacle.

- Failing to reach the median line (ML) signaled that USD/JPY could come back towards the UML.

The USD/JPY price increased in the short term after reaching a support zone. Also, DXY and JP225’s growth forced the pair to jump higher. Still, in the short term, USD/JPY seems undecided. It continues to move sideways, so we’ll have to wait for a fresh trading opportunity.

–Are you interested to learn more about forex signals? Check our detailed guide-

The Nikkei (JP225) slips lower at the time of writing. Therefore, USD/JPY is vulnerable if the Japanese stock index will drop deeper. Fundamentally, the Japanese data have come in mixed today, with the Trade Balance at 0.05T below 0.12T expected, while the Core Machinery Orders dropped only by 1.5% versus 2.7% expected.

The FOMC Meeting Minutes report could be decisive in the short term. This high-impact event could bring high action on USD/JPY as well. The greenback could extend its growth if the report is more hawkish. Moreover, the US Building Permits and the Housing Starts could help USD/JPY to increase

USD/JPY price technical analysis: Bulls to roar

The USD/JPY price has found support on the weekly S1 (109.16) level and now is located at 109.77. It continues to increase as the Dollar Index and the Nikkei are trading in the green. Technically, failing to approach and reach the descending pitchfork’s median line (ML) signaled a potential upwards movement. Also, USD/JPY is located above the point of control which is seen around 109.48 level.

The immediate upside target is seen at the weekly pivot point (109.98). After that, it moves somehow sideways between 23.6% and 61.8% retracement levels. After that, it could come back towards the descending pitchfork’s upper median line (UML).

–Are you interested to learn more about day trading brokers? Check our detailed guide-

The UML attracts the price after failing to move towards the median line. The 110.00 psychological level is seen as a near-term obstacle, target as well. Personally, I would like to see a temporary consolidation around the current levels before resuming its rise.

Moving sideways above the 50% retracement level could signal that USD/JPY could develop a broader upwards movement. Still, only a valid breakout through the upper median line (UML), escaping from the descending pitchfork’s body, could really signal a larger swing higher.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.