- USD/JPY is still bullish despite the most recent downside movement.

- The United States economic data helped the dollar to appreciate again versus its rivals.

- A larger upwards movement will be signaled only by a valid breakout above the immediate high.

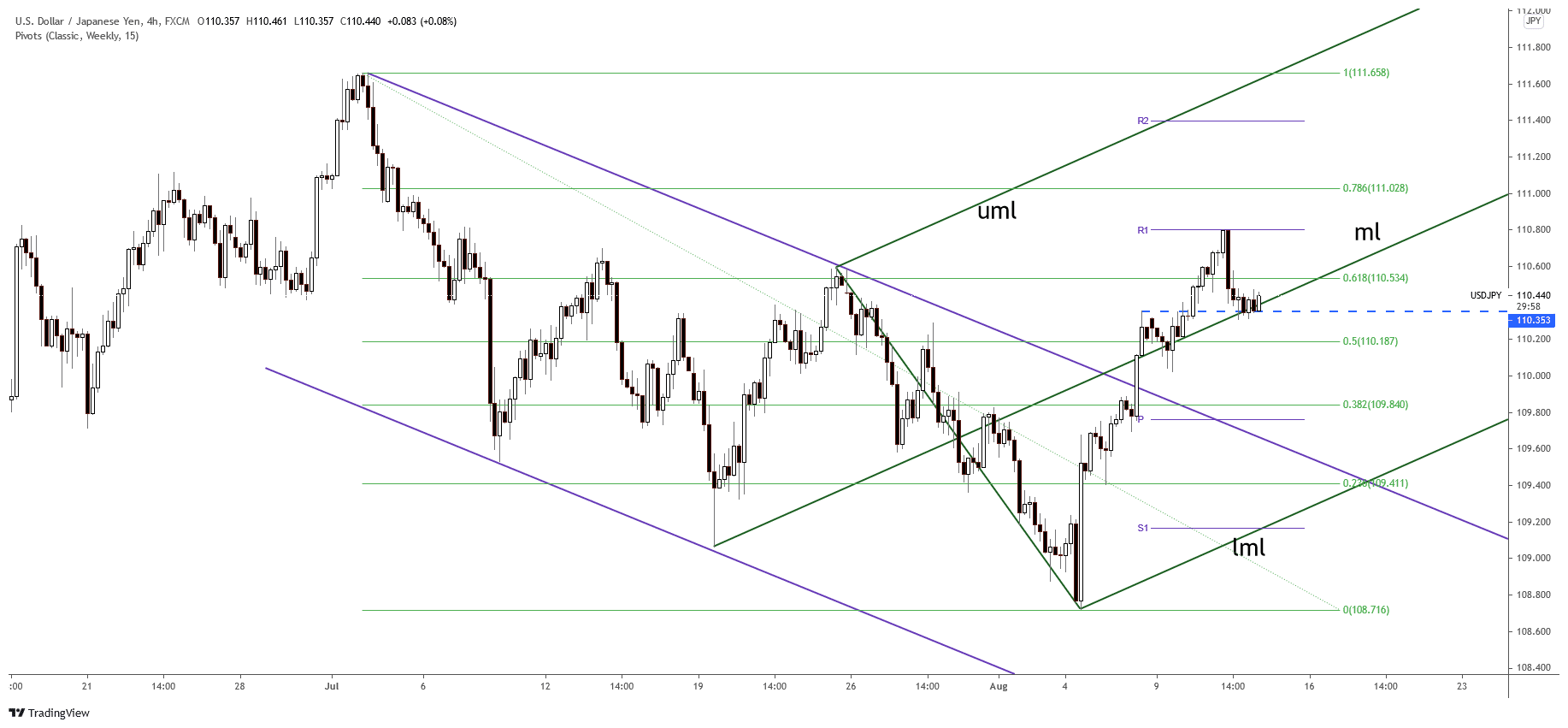

The USD/JPY price is trading in the green on the 4-hour chart at the 110.44 level. The price has found temporary support. Now it attempts to go higher. However, the USD/JPY pair is fighting hard to stay in the buyers’ territory in the short term.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

The USD/JPY pair has dropped because the DXY and the JP225 have slipped lower. Fundamentally, the pair could increase a little after the US data. The United States PPI increased by 1.0% in July, beating the 0.6% estimate. It has come in line with 1.0% growth in June.

Moreover, the Core PPI registered a 1.0% growth, exceeding the 0.5% forecast, while the Unemployment Claims dropped from 385K to 375K as expected. So, the USD could increase in the short term versus its rivals after these positive economic figures.

In the early morning, the Japanese Yen had received a helping hand from the Japanese PPI, which increased by 5.6%, beating the 5.1% estimate and the 5.0% increase registered in the former reporting period.

USD/JPY price technical analysis: Bearish invalidation or a correction?

The USD/JPY pair has found resistance at the weekly R1 (110.80). Now it has found demand right on the 110.35 and on the ascending pitchfork’s median line (ml). So, the pair could still rise as long as it stays above the median line (ml).

–Are you interested to learn more about day trading brokers? Check our detailed guide-

Technically, the USD/JPY price was expected to increase after escaping from the down channel’s body. The most recent decline was somehow expected. The Dollar Index and the Japanese stock index are still bullish. Further growth on both indexes could help the USD/JPY pair to rise further.

The upside scenario could be invalidated by a potential drop and stabilization below the ascending pitchfork’s median line (ml). The immediate upside obstacle is seen at the 61.8% retracement level, at 110.53.

Jumping and stabilizing above it may signal a potential upside continuation. However, an important growth could be signaled only by a new higher high if the USD/JPY price jumps and stabilizes above the R1 (110.80).

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.