- USD/JPY is trying to rally in response to higher US Treasury yields.

- As the US dollar weakened, the pair failed to sustain above 124.00.

- It will be interesting to see how the Fed’s minutes compare with those of the BOJ.

The USD/JPY price recovers towards 124.00 as the rally in US Treasury yields helps find a floor near 123.60.

–Are you interested in learning more about AI trading brokers? Check our detailed guide-

DXY’s correction

The US dollar has weakened sharply over the last few hours from its multi-month high of 99.75 against its major counterparts. Taking profits ahead of the minutes of the key FOMC meeting in March could explain this.

US yields weighing on the yen

While US Treasury yields are still rising, Fed officials recently stepped up their hawkish rhetoric, calling for further hikes in rates and a reduction in the Fed’s balance sheet.

Russian crisis keeping USD strong

Furthermore, the new sanctions against Russia over its alleged war crimes in Ukraine and hawkish Fed expectations have weighed on market sentiment, making the dollar’s drop short-lived.

Dovish BoJ

The Bank of Japan (BoJ) retains an ultra-loose monetary policy and defends its 0.25% yield curve target. Such action by the Japanese central bank resulted in widening its divergence with the Fed, which will raise the probability of further weakening of the yen.

What’s next to watch for the USD/JPY price?

The FOMC meeting minutes are due on the day. The market expects a hawkish tone, which will boost the US dollar against other currencies. Hence, it is key to watch the Fed’s tone.

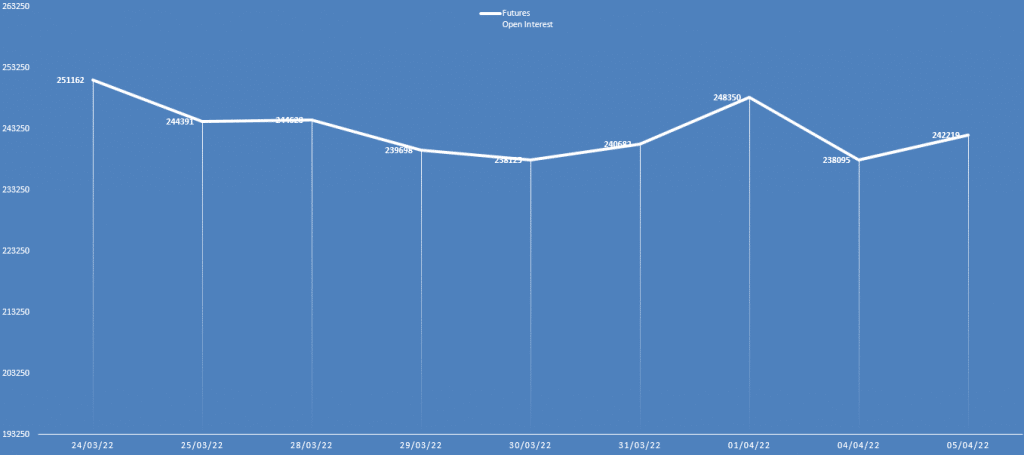

USD/JPY price analysis via daily open interest

The USD/JPY price was gained yesterday, while the open interest increased greatly. It shows that new buyers have entered the market. Hence, the bias is strongly bullish.

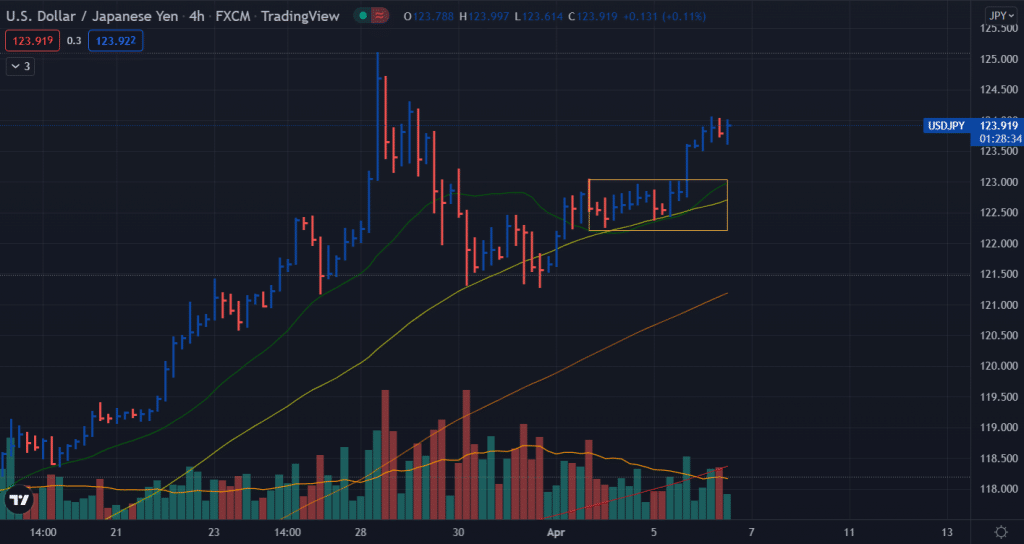

USD/JPY price technical analysis: Bulls on fire

The USD/JPY price remains well bid above the key moving averages on the 4-hour chart. The recent bullish crossover between 20 and 50 SMAs may fuel the upside momentum. The volume data also supports the buying side as the volume rises with the price rise.

–Are you interested in learning more about spread betting brokers? Check our detailed guide-

After breaking the range, the pair constantly attempts to find acceptance above the 124.00 area. However, the price may test the broken zone with a low volume before continuing the upside. The 125.00 level will remain a tough nut to crack.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money