- On Thursday, the USD/JPY continued to rise after a strong performance following the Fed meeting.

- The overnight rally in US bond yields and steady US dollar buying continued to support the dollar.

- The bullish sentiment seemed unaffected by the risk-off sentiment, which benefits the safe-haven JPY.

At the start of the European session, the USD/JPY price jumped to a week and a half high and was last seen trading near the key psychological level of 115.00.

–Are you interested to learn more about ETF brokers? Check our detailed guide-

After the Fed meeting on Wednesday, the pair continued its bullish trend by increasing for a second straight day on Thursday, marking the third day of positive movement in the previous four days. Furthermore, the Fed reiterated market expectations of possible growth in March, causing the US dollar to fall to its highest level since mid-December. Thus, the USD/JPY pair’s strong growth is attributed to this factor.

The overnight rally in US Treasury yields indicates that markets anticipate four rises in 2022. As a result, the benchmark 10-year Treasury yield rose to 1.85% overnight. On the other hand, the yield on the 10-year JGB remained near zero due to the Bank of Japan’s policy of controlling the yield curve. In addition to this, the increase in yield differentials between the US and Japan has benefited USD/JPY.

Global risk sentiment was weighed down by the prospect of faster Fed policy tightening and political tensions between Russia and Ukraine. Stock markets fell in reaction to this development. However, the safe-haven Japanese Yen was not spurred by this, and the USD/JPY pair continued to rise sharply. As a result, bullish traders have a better chance of profit.

Participants in the market now await US economic reports – fourth-quarter GDP growth, durable goods orders, weekly jobless claims, and pending home sales. Combined with US bond yields, this will affect US dollar price momentum and give the USD/JPY pair a new impetus. Additionally, traders should pay attention to the overall market sentiment to find opportunities around the major currencies.

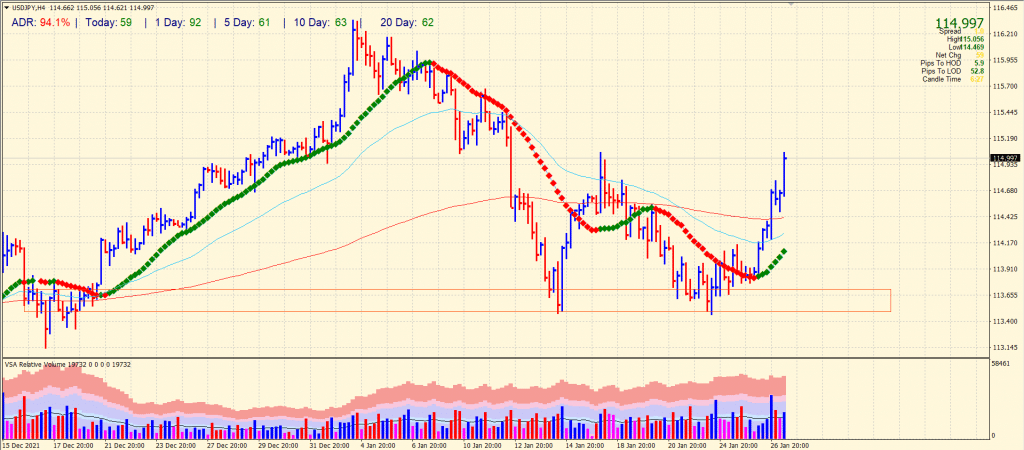

USD/JPY price technical analysis: Bulls hit 115.00

The USD/JPY price hits 115.00 strong resistance and may find some pullback. However, sustaining above the 115.00 mark may gather buying and aim to test 116.00 and higher. The volume is rising for the up bars in a row. The pair has marked 94% average daily range so far, which is quite high. It shows high volatility.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

On the flip side, the USD/JPY pair may pull back towards 114.50 ahead of 114.00. However, the strength in JPY may emerge at any time and trigger selling momentum.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.