The Canadian dollar continues to move upwards, gaining 130 points last week. USD/CAD closed the week just above the 1.31 line. There are seven events on the schedule this week. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

The US dollar posted broad losses last week, as Donald Trump disappointed markets with a press conference that was heavy on theatrics and light on substance. Trump didn’t lay out any economic vision or discuss fiscal stimulus, the catalyst for the greenback’s impressive run since the election. In Canada, Building Permits disappointed with a decline of 0.1%, well short of expectations.

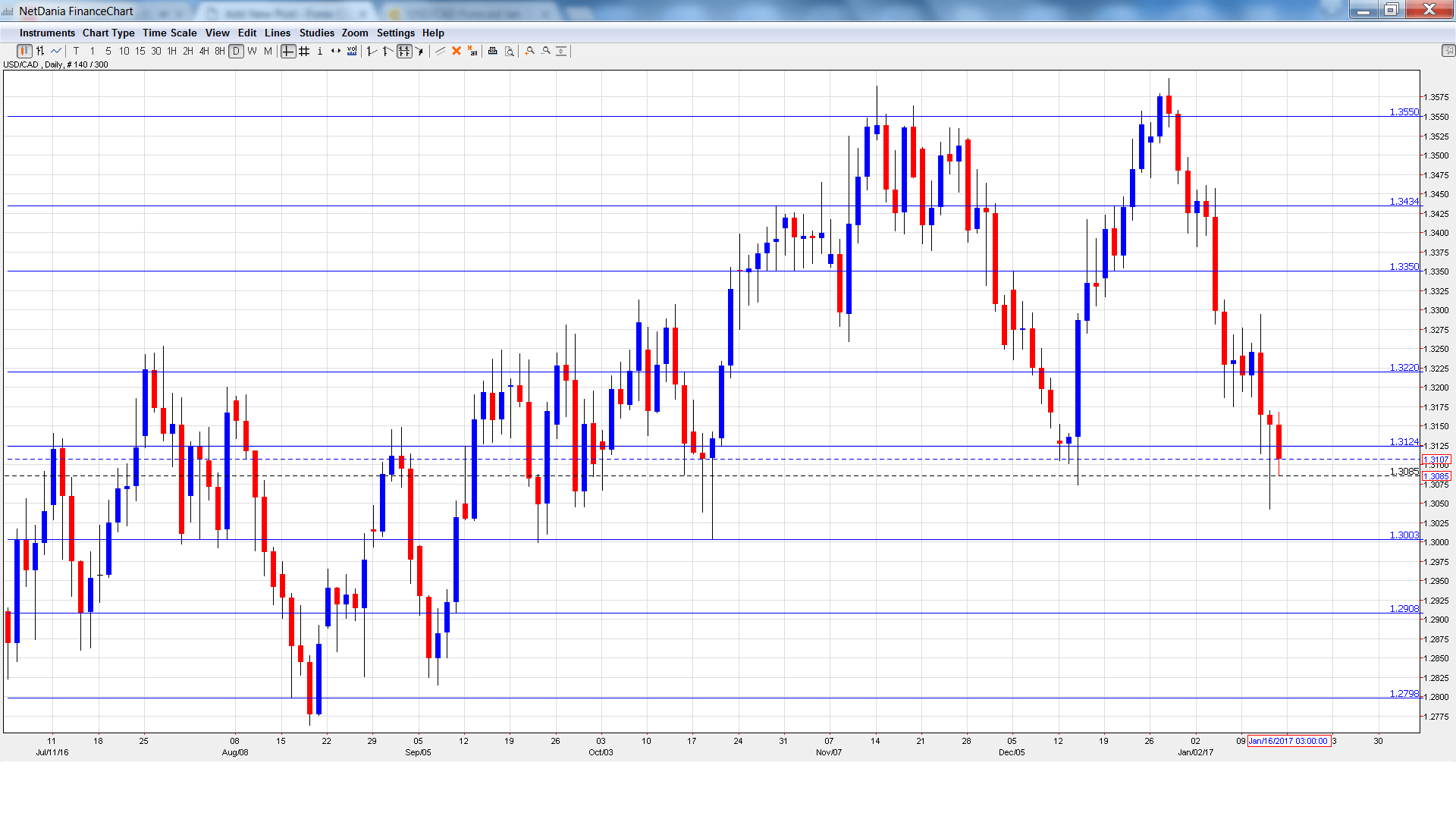

[do action=”autoupdate” tag=”USDCADUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- BoC Monetary Policy Report: Wednesday, 15:00. This report is released each quarter. It provides the bank’s view of economic conditions and inflation, so analysts will be looking for clues as to future monetary policy. It will be followed by a press conference.

- BoC Overnight Rate: Wednesday, 15:00. The benchmark rate has been pegged at 0.50% since July 2015 and no changes are expected. The BoC will make its announcement via a rate statement.

- Manufacturing Sales: Thursday, 13:30. The indicator declined 0.8% in October, well off the forecast of a 0.7% gain. The markets are expecting a turnaround in November, with an estimate of 0.2%.

- Foreign Securities Purchases: Thursday, 13:30. The indicator jumped to C$15.75 billion in October, easily beating the forecast of C$12.35 billion. This marked the highest level since March 2016.

- CPI: Friday, 13:30. CPI is the primary gauge of consumer inflation and should be treated as a market-mover. The index declined 0.4% in November, weaker than the forecast of -0.1%. Will we see an improvement in the December report?

- Core Retail Sales: Friday, 13:30. The indicator posted a sharp gain of 1.4% in October, easily beating the estimate of 0.7%. An unexpected reading in November could have a strong impact on the movement of USD/CAD.

- Retail Sales: Friday, 13:30. Retail Sales jumped 1.1% in October, crushing the forecast of 0.2%. This marked a second straight gain after three consecutive declines.

* All times are GMT

USD/CAD Technical Analysis

USD/CAD opened the week at 1.3240 and climbed to a high of 1.3294. The pair then dropped sharply and dropped to a low of 1.3094, testing support at 1.3124 (discussed last week). USD/CAD closed the week at 1.3107.

Live chart of USD/CAD:

Technical lines, from top to bottom

We start with resistance at 1.3551.

1.3433 was the high point in October.

1.3351 is the next resistance line.

1.3219 has switched to a resistance role after sharp losses by USD/CAD.

1.3124 is a weak resistance line.

1.3003 is protecting the symbolic 1.30 level.

1.2908 has held in support since September 2016.

1.2798 is the final support level for now.

I am bullish on USD/CAD

All eyes will be on Donald Trump’s inauguration on Friday and with the markets expecting fiscal stimulus from the new administration, sentiment towards the US dollar is positive.

Our latest podcast is titled Trump Train or Donald Derailed?

Follow us on Sticher or iTunes

Further reading:

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.