USD/JPY enjoyed an outstanding week, gaining almost 400 points. The pair closed at 104.63. It’s a very quiet week, with only two events on the schedule. Here is an outlook for the highlights of this week and an updated technical analysis for USD/JPY.

The yen nosedived early in the week, as a landslide victory for Prime Minister Abe’s coalition paved the way for further easing measures, which makes the yen less attractive. In the US, retail sales showed strength, but inflation levels remained low and consumer confidence slipped.

do action=”autoupdate” tag=”USDJPYUpdate”/]

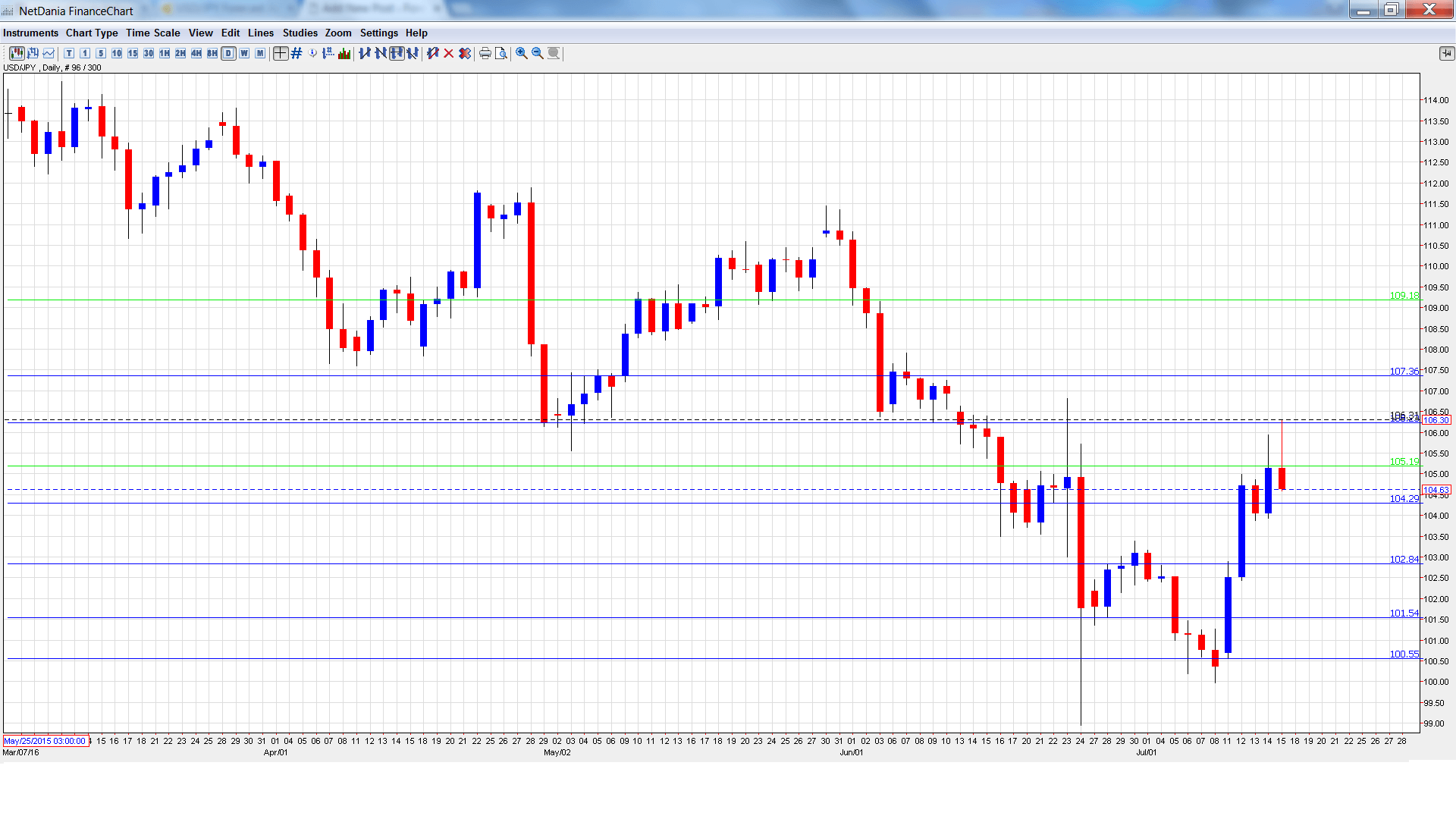

USD/JPY graph with support and resistance lines on it. Click to enlarge:

- All Industries Activity: Thursday, 4:30. This indicator measures the change in goods and services purchased by the business sector. In April, the indicator posted a strong gain of 1.3%, matching the forecast. This marked a 3-month high. The markets are braced for a downturn in May, with an estimate of -1.0%.

- Flash Manufacturing PMI: Friday, 2:00. The indicator has recorded four consecutive declines, pointing to ongoing contraction in the manufacturing sector. The June reading was almost unchanged at 47.8 points, shy of the forecast of 48.2 points. The estimate for the July report stands at 48.3 points.

* All times are GMT

USD/JPY Technical Analysis

USD/JPY opened the week at 100.69 and quickly touched a low of 100.55. The pair then posted huge gains and climbed to 106.31, testing support at 106.25 (discussed last week). The pair closed the week at 105.54.

Live chart of USD/JPY: [do action=”tradingviews” pair=”USDJPY” interval=”60″/]

Technical lines from top to bottom:

With USD/JPY posting huge gains, we start at higher levels:

109.18 was a cap in September 2008.

107.39 is the next line of resistance.

106.25 was tested as the pair briefly pushed above the 106 level.

105.19 was a cushion in October 2014.

104.25 is an immediate support line.

102.80 has switched to a support role following sharp gains by USD/JPY.

101.51 was a cushion in August 2014.

100.54 is the final support level for now.

I remain bullish on USD/JPY

The yen was hammered last week on expectations of further easing in Japan, and Prime Minister Abe is busy at work and will likely unveil another Abenomics economic package. The yen could regain some lost ground if Brexit concerns heat up and send investors to the safe-haven yen.

In our latest podcast we explain helicopter money and discuss how Carney Marked up the pound.

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast.