The Canadian dollar retreated against the soaring US dollar. Retail sales figures are the highlight of this week. Here’s an outlook for the Canadian events and an updated technical analysis for the Canadian dollar.

Last week, manufacturing sales jumped by 2.6%, well above the 1.1% rise expected and inflation grew more than predicted with CPI rising 0.2% and Core CPI increasing by 0.3%. However foreign securities purchases dropped more than anticipated to 7.35 billion after an encouraging figure of 8.22 billion in the previous month. Let’s see what awaits us this week.

Updates: USD/CAD continues rising as the European debt crisis continues to catch the headlines. The pair couldn’t conquer the 1.0360 line, at least not now. The weak Chinese Manufacturing PMI weighed heavily on global markets and sent USD/CAD to 1.0425, despite the relatively high oil prices – that remain stable despite the global sell-off. The Canadian dollar is strongly affected by the shocking German bond auction. With no safe havens left in the euro-zone, global worries are growing, and this strengthens the US dollar. USD/CAD moved higher and got close to the 1.05 line, which wasn’t broken so far. The loonie continues to suffer from the euro crisis, as oil also weakens, in addition to the flow to the US dollar. The really big key line for USD/CAD is 1.0677.

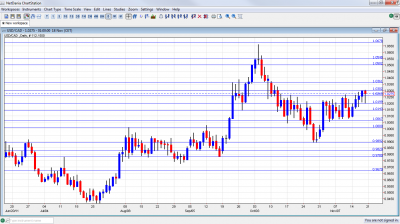

USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- Wholesale Sales: Monday, 13:30. Canadian wholesale sales rose less than predicted in August with a 0.2% increase after 0.8% rise in July. Nevertheless this was the fourth consecutive month of increase. The moderate reading came amid worsening in Europe’s debt crisis and US credit rating downgrade by Standard & Poor. An increase of 0.6% is predicted now.

- Retail sales: Tuesday, 13:30. Consumers gave a boost to Canada’s economy in, August with a 0.5% increase in sales following 0.4% decrease in the previous month. This reading was above predictions of a 0.4% increase. The main cause for this increase is a jump in auto sales. Meanwhile Core sales excluding the auto retail sales gained 0.4% better than the 0.3% forecasted and following 0.1% rise in the previous month. Retail sales is expected to rise again by 0.5% and Core prices are expected to rise by 0.4%.

- Mark Carney speaks: Wednesday, 17:40. Bank of Canada Governor Mark Carney is scheduled to speak inMontreal and will focus on economic developments and the conduct of monetary policy. Mr. Carney is a highly influential figure in Canada and abroad as the Chairman of the Financial Stability Board (FSB). His speech may rock the market.

- Corporate Profits: Thursday, 13:30. Canadian corporate profits dropped 4.9% in the second quarter of 2011 compared to 4.2% gain in the first quarter. Manufacturing profits declined 8.3%. Nevertheless, Canadian corporate earnings were still 10.2% higher than the same period in 2010.

* All times are GMT.

USD/CAD Technical Analysis

Dollar/CAD climbed early in the week, and met resistance at 1.0263 (mentioned last week). A second attempt to break higher eventually succeeded and the pair peaked at 1.03. It eventually closed the week at 1.0275, after very choppy trading.

Technical lines, from top to bottom:

We begin higher this week: 1.0750 was the top border of a long running range. 1.0677 is a veteran and distinct resistance line, which worked well in October and also in the past.

1.0550 is a minor line on the way up. 1.0500 is another minor line of resistance. It was a pivotal around the same time and was a point of resistance before the pair fell.

1.0360 capped the pair in September and October and also provided support. The round number of 1.03 was the peak of a move upwards seen in November.

1.0263 is the peak of recent surges during October and also November but has a weaker role now. The round figure of 1.02 was a cushion when the pair dropped in November, and also the 2009 trough.

1.0143 was a swing low in September and worked as resistance in the past. It capped a small recovery attempt in November. 1.0060 worked as support in November and had the opposite role back in 2010. It worked as a great cushion for the pair in November.

The very round number of USD/CAD parity is a clear line of course, and it will be closely watched on a potential downfall. Under parity, the round number of 0.99 provided support on a fall during October and also served as resistance back in June.

0.9830 provided support for the pair during September. 0.9780, where the current run began is the next and important support line.

Below, 0.9667 is of importance after working as strong support back in March.

I am neutral on USD/CAD.

On one hand, the positive US figures and the rise in domestic inflation support a stronger loonie, but on the other hand, the might of the European debt crisis sends money towards the greenback. These forces are likely to continue the choppy trend.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand dollar (kiwi), read the NZD forecast.

- For USD/CAD (loonie), check out the Canadian dollar

- For the Swiss Franc, see the USD/CHF forecast.