Euro/dollar couldn’t really recover from the recent fall and eventually close a bit lower as Spanish worries intensified. Will it make a bigger break out of range? Two major German surveys are the highlights awaiting us. Here is an outlook for the upcoming events and an updated technical analysis for EUR/USD.

Spain is under growing pressure from all sides: EU inspectors landed in Madrid, Italian officials aren’t too kind and most importantly, the markets are sending Spanish yields higher. The ECB has already hinted about reigniting the bond buying scheme, but may forced to introduce LTRO 3. Also in the US, things were already better: jobless claims broke out of range and joined the weak NFP. QE3 still has low chances, but if the current employment figures turn into a trend, it will not bode well for the greenback.

Updates: EUR/USD dropped to a one-month low in the Asian session, as the markets responded to the news that Spanish banks borrowed a record amount from the ECB in March. There is concern that Spain may turn to the IMF for help, as Spanish 10-year yields climbed over 6.0%. The Italian Trade Balance posted a deficit of 1.11B, significantly better than the market forecast of -1.85B. The Euro-zone Trade Balance came in this morning at a surplus of 3.7B, well below the forecast of 4.7B. This represents a four-month low for the indicator. EUR/USD has recovered slightly in the European session, trading at 1.3032. The German Economic Sentiment posted a reading of 23.4, well above the market forecast of 19.7. This was the index’s best performance since June 2010. Eurozone Economic Sentiment also drew a cheer from the markets, coming in at 13.1, the best reading since May 2011. Euro-zone CPI came in at 2.7%, slightly above the market forecast of 2.6%. Eurozone Core CPI also was a touch higher than forecast, at 1.6%. EUR/USD is on the move upwards, as the pair is trading at 1.3146. Current Account disappointed, posting a 1.3B deficit, which was a three-month low for the indicator. The markets had predicted a surplus of 4.1B. The Euro continues to slide, as EUR/USD is trading at 1.3074. Spain successfully raised EUR 3 billion in a government auction. EUR/USD is managing to stay above the 1.31 level, trading at 1.3113. We could see some movement by the pair before the weekend, with the release of three key US indicators later on Thursday. Spain sold another EUR 2.5 billion in government bonds on Thursday, but the markets are concerned that increased borrowing costs could spell trouble for the Spanish economy. The markets are waiting for the key release of German Business Climate on Friday, to close the trading week.

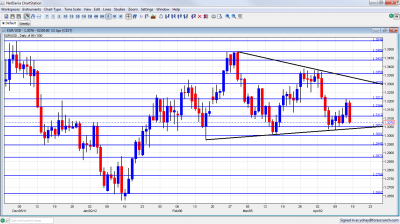

EUR/USD daily graph with support and resistance lines on it. Click to enlarge:

- Trade Balance: Monday, 9:00. Germany’s wide trade surplus is wider than the euro-area’s surplus, showing that the rest of the countries have a deficit together. The surplus of the whole zone is expected to shrink from 5.9 to 4.3 billion euros this time.

- German ZEW Economic Sentiment: Tuesday, 9:00. This usually pessimistic and disappointing survey changed its ways in the past 4 months, exceeding expectations and advancing strongly. The survey of 350 analysts and investors rose from the depths of -55.2 to +22.3 points last month. The optimism (a score above 0) will likely continue, even though the indicator is predicted to slide from 22.3 to 20.2 points. The all-European (though less important) figure is expected to slide from 11 to 10.7 points.

- CPI: Tuesday, 9:00. The headline consumer price index in the euro-area is likely to be confirmed at 2.6%, lower than last month but still above the 2% target. The ECB predicts it will remain above 2% throughout 2012. Core CPI is likely to stand at a more muted 1.5%.

- Mario Draghi talks: Tuesday, 13:30. The president of the ECB, who recently said that an exit strategy is premature, will speak at a conference in Frankfurt, and might answer growing pressures to launch another LTRO or to intervene in the markets via the SMP as pressure grows on Spain.

- Current Account: Wednesday, 8:00. The current account includes the trade balance as well as flows of money, services and more. Also here, the surplus is expected to squeeze: from 4.5 to 4.3 billion.

- Consumer Confidence: Thursday, 14:00. The official survey of 2300 consumers showed a minor improvement in February, rising from -20 to -19. This still reflects general pessimism with European consumers. No change is predicted now.

- German PPI: Friday, 6:00. Critics blame the ECB for being too minded to German inflation, which goes along with the Bundesbank’s traditional approach, rather than with the needs of the whole continent. After a rise of 0.4% last month, a similar rise of 0.5% is likely now.

- German Ifo Business Climate: Friday, 8:00. This think-tank tends to be positive. It showed a marginal rise to 109.8 points last month, and is now expected to slide back to 109.6 points. Note that the accompanying words of Hans-Werner Sinn, the president of Ifo, are no less important than the result of the 7,000 strong survey.

* All times are GMT

EUR/USD Technical Analysis

After a short-live move up, €/$ dropped and found support around 1.3050 (a new line that didn’t appear last week). It then bounced higher and after hitting resistance it turned back and eventually closed at 1.3076, a bit lower all in all.

Technical lines from top to bottom:

We start a bit lower this week. 1.3550 capped the pair in November and December and marked the beginning of the plunge. 1.3486 was a distinctive double top in February 2012 and is a strong cap.

It’s closely followed by minor resistance at 1.3437. The pair struggled there when it traded higher. 1.3360 provided some support in February 2012, when the pair was trading on high ground, and is now weak resistance.

Quite close by, 1.33 was tough resistance 4-5 times, with two attempts very recently. It remains key resistance. 1.3212 held the pair from falling and switched to resistance later on. It proved itself as resistance once again in April 2012. This was the bottom border of tight range trading in February.

1.3165 is a minor line that provided some support in December 2011 and worked as resistance in April 2012. It is a bit weaker now. 1.3110 is another minor line that capped the pair in January and later in April 2012.

1.3050 worked as support in April 2012 and also in March, and is the last frontier before 1.30. The round number of 1.30 is psychologically important and is now stronger than earlier. It managed to keep the pair from falling.

The 1.2945 line is stronger once again and still provides support. 1.2873 is the previous 2011 low set in January, and it returns to support once again. This is a very strong line separating ranges.

1.2760 is a pivotal line in the middle of a recent range. It provided support early in the year. 1.2660 was a double bottom during January and the move below this line is not confirmed yet. 1.2623 is the current 2012 low, but only has a minor role now.

Narrowing Channel

As you can see on the graph, the trading range of the pair is narrowing down. Both lines began in February, with uptrend support being more significant than downtrend resistance. The support line has also been challenged more recently. Additionally, here is a fresh Elliott Wave Analysis of the pair, which points to low ground.

I turn from neutral to bearish on EUR/USD

The situation in Spain is deteriorating fast and no respite is seen soon. The ECB will likely keep pressure up on the fourth largest economy of the zone. Things will likely get worse before they get better.

Also in the US, things aren’t good as they seemed. The difference now is that the US economic weakness doesn’t stand alone as a trigger for more QE and dollar weakness: it is combined with an official Chinese slowdown. The combined weakness of the world’s largest economies means risk averse trading, and this doesn’t favor the euro.

If you have interest in a different way of trading currencies, check out the weekly binary options setups, including EUR/USD, GBP/JPY and more.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand dollar (kiwi), read the NZD forecast.

- For the Swiss Franc, see the USD/CHF forecast.

- USD/CAD (loonie), check out the Canadian dollar forecast.