Euro/dollar finally broke down, lost uptrend support and the critical 1.30 line, as the debt crisis worsened once again. Yet it didn’t collapse. Does this point to a correction, or more gradual moves downwards? The upcoming week is packed with events, with GDP figures expected to show that Europe is in a recession. News from Greece and Spain will also weigh. Here is an outlook for the upcoming events and an updated technical analysis for EUR/USD.

Elections in Greece resulted in a deadlock, and the debt struck country will likely head into a second round of elections in June, as anti-bailout parties gain momentum. Worries and the uncertainty certainly weigh on the euro, together with Spain’s banking issues. The Spanish government’s decisions for the banking system might provide some support, but it seems that Spain is “going Irish” – making the banks’ problems its problems. In Ireland’s case, it ended with a bailout. Will Spain have the same fate?

Updates: EUR/USD gaps below 1.29 when markets open. Greece gets closer to new elections and to leaving the euro-zone, Merkel’s candidate in general elections loses on proposed austerity measures, and Spain’s Plan C undermines confidence. EUR/USD is down, trading at 1.2875. The pair continues to be affected by the Eurozone’s worsening political and fiscal problems. German WPI rose 0.5%, beating the market forecast of 0.3%. Euro-zone Industrial Production was a disappointment, declining by 0.3%. The estimate stood at 0.5%. In Italy the 10-y Bond Auction posted figures of 5.66/2.3. There was a host of data for the markets to analyse on Tuesday. French Prelim GDP came in at 0.0%, matching the market forecast. Italian Prelim GDP dropped by 0.8%, below the market estimate of -0.6%. French CPI posted a modest increase of 0.1%. The markets had called for an increase of 0.3%. German Prelim GDP was strong, with an increase of 0.5%. This figure easily surpassed the market forecast of 0.1%. However, German ZEW Economic Sentiment was a major disappointment, plummeting to 10.8 points. This was far lower than the market estimate of 10.8. Italian Prelim GDP fell -0.8%, which was below the market forecast of a 0.6% decline. Euro-zone Flash GDP was a flat 0.0%, which was better than the estimate of -0.2%. Euro-zone Economic Sentiment also was weak, coming in at -2.4 points. The market prediction called for a reading of 11.7 points. Finally, Finance Ministers from the EU member states will be meeting on Tuesday. They will certainly have their hands full with the burning political and fiscal issues confronting the Euro-zone. The euro has stemmed its fall for now, as the pair was trading at 1.2859. However, the currency is unlikely to recover before the political situation is resolved in Greece. Meanwhile, the crisis in Greece continues, and new elections are a strong possibility. EUR/USD continues to drop, and was trading at 1.2719. The markets did a good job of predicting Wednesday’s releases. Euro-zone CPI came in at 2.6%, matching the market forecast. Euro-zone Core CPI posted a reading of 1.6%, a notch higher than the market estimate of 1.5%. Euro-zone Trade Balance came in at 4.3B, exactly as predicted by the markets. The Italian Trade Balance was higher than expected, recording a surplus of 2.06B. This was the best monthly performance in almost three years. In Germany a government auction of 10-y bonds came in at 1.47/1.5. ECB President Draghi will be delivering a speech later on Wednesday. The markets will be all ears as talk of a Grexit get louder. EUR/USD briefly dropped below the 1.27 level, but recovered and was trading at 1.2726. French and German banks are closed on Thursday, and the markets will be quieter, with not Euro-zone releases. There is no pause in the Greek political crisis, however, as elections have been called for June 17. With anti-austerity running high, the new government could reject the bailout package, and there is louder talk of Greece exiting the euro-zone and dumping the euro (cynics might argue it is more a case of the euro dumping Greece). Meanwhile, the ECB has stopped providing liquidity to several Greek banks as they are severely undercapitalized, and has shifted them to an emergency liquidity assistance program. EUR/USD appeared to have steadied somewhat, but then dropped below the 1.27 level. The pair was trading at 1.2691. Will the downward trend continue?

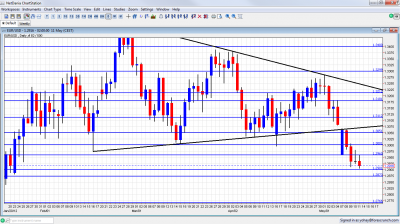

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- German Regional Elections: Sunday. The largest German state, North Rhine-Westphalia (one fifth of the population) will probably serve as another signal for Chancellor Merkel against her austerity policy, as the tables are turning in Europe. Her rival socialist SPD party is expected to win, especially after getting back wind from the Hollande’s win in France. Politics in this state impact national politics.

- German WPI: Monday, 6:00. One of main things that stops the ECB from cutting rates is inflation, especially in Germany, the continent’s powerhouse. Wholesale prices are expected to rise by 0.3%, less than last month’s 0.9% rise.

- Industrial Production: Monday, 9:00. After Germany surprised with a stronger than expected rise in output, the figure for the whole euro-area is expected to show growth for a second month in a row, accelerating from 0.5% to 0.8%.

- Italian 10-y Bond Auction: Monday, morning GMT. The 3 year loans by the ECB (LTRO) ease funding conditions for short term loans, but the euro-area’s third largest economy still struggles with the benchmark 10 year loans, which result in high yields. A yield of more than 6% will be very worrying. It will probably be lower. Italy is hiding behind Spain for now.

- French GDP: Tuesday, 5:30. France starts the series of preliminary GDP figures. The final figures usually minor or no changes. As Hollande enters the Elysee palace, he will receive the preliminary figures, which aren’t expected to be positive: Europe’s second largest economy is expected to remain stagnant. France managed to grow by 0.2% in Q4 2011, by 0.2%.

- German GDP: Tuesday, 6:00. The zone’s locomotive is expected to show a very modest growth rate of 0.1% after contracting by 0.2% in Q4 2011. If Germany disappoints and contracts, it will be an official recession, with significant implications for the euro.

- French Non-Farm Payrolls: Tuesday, 6:45. In between the GDP reports, France is expected to show a second quarter of contraction in jobs. This quarterly indicator dropped by 0.1% in Q4 and is now predicted to drop by 0.2%.

- Italian GDP: Tuesday, 8:00. The zone’s third largest economy, which has a significant amount of public debt, is expected to contract for a third consecutive quarter, falling 0.6% this time, following a drop of 0.7% in Q4 2011. This will be bad news in the debt crisis front. A lower output makes the debt ratio higher.

- Flash GDP: Tuesday, 9:00. The 17 nation euro-area will likely contract by 0.2%, following a 0.3% contraction and will officially enter a recession. Spain already reported a contraction of 0.4% (preliminary). Note that the expectations might be updated after the German and French releases.

- German ZEW Economic Sentiment: Tuesday, 9:00. This publication usually stands out, but it is slightly overshadowed by the GDP releases. After 5 months of positive surprises that shifted the outcome from negative ground to positive ground, the optimism is likely to ease this time, with a drop from 23.4 to 19.2 points. The German economy is still doing better than the rest, but the 350 analysts and investors will probably lower their expectations. The less important euro-wide figure is expected to soften to 11.7 points.

- CPI: Wednesday, 9:00. The initial read of a 2.6% annual rise in prices will likely be confirmed now. This is above the ECB’s target of 2%. The central bank points to energy prices as the source of this rise. Indeed, Core CPI will likely stand at 1.5%.

- Trade Balance: Wednesday, 9:00. Germany’s high trade surplus sets the tone for the whole area. The surplus is expected to widen from 3.7 to 4.3 billion euros for the month of March.

- Mario Draghi talks: Wednesday, 14:00. The president of the ECB will speak about monetary policy in Frankfurt and might provide hints about future moves, such as cutting the interest rates. In the recent press conference, Draghi sounded surprisingly optimistic about the second half of the year. At this point, GDP figures and CPI data will already be public.

- Spanish 10-y Bond Auction: Thursday morning. Spain’s funding issues are now at the epicenter of the debt crisis. Spanish financial institutions are having serious trouble operating in the markets, and they had to lend over €300 billion from the ECB. With Spain injecting money into banks, this long term auction for benchmark bonds will be a test for the sovereign, to see if it still can operate.

- German PPI: Friday, 6:00. Germany opens and closes the week with inflation data. After a rise of 0.6% last time, a more modest rise of 0.4% is predicted.

* All times are GMT

EUR/USD Technical Analysis

€/$ kicked off the week with a big weekend gap that sent it below uptrend support (discussed last week) and below 1.30. While it did recover above 1.30 for a short while, the gap was never closed.

The open gap was certainly a bearish sign. The pair continued lower and eventually traded between 1.29 and 1.2960, before closing at 1.2916.

Technical lines from top to bottom:

We start from a lower point this time. The round number of 1.34 was the top border of the wide 1.30 – 1.34 range. It capped the pair in the most recent surges. The next line below is round as well:, 1.33 was tough resistance 4-5 times, with two attempts before the downfall.

1.3212 held the pair from falling and switched to resistance later on. It proved itself as resistance once again in April 2012. This was the bottom border of tight range trading in February. 1.3180 capped attempts to rise in May 2012 and is a minor line on the way up.

1.3110 is another minor line that capped the pair in January and later in April 2012 as a stepping stone for a move higher. 1.3050 worked as support in April 2012 and also in March, and is next frontier above 1.30.

The round number of 1.30 is psychologically important and proved to be a place of struggle. After the downfall, the pair made another attempt to fight over this line, but this failed.

1.2960 is minor resistance after capping the pair following the downfall in May 2012. It is followed by 1.29 which provided support more than once after the fall.

Very close, 1.2873 is the previous 2011 low set in January, and it returns to support once again. This is a very strong line separating ranges. 1.2760 is a pivotal line in the middle of a range. It provided support early in the year.

1.2660 was a double bottom during January and the move below this line was not confirmed. 1.2623 is the current 2012 low, but only has a minor role now.

Below, 1.2587 and 1.25 await, but these lines weren’t seen since 2010.

Uptrend Support – Broken

The narrowing channel that characterized the pair for so long was very convincingly broken to the downside.

I remain bearish on EUR/USD

The results in Greece were worse than expected: no new government and a growing chance that a new government will take Greece out of the euro-zone. This might be good for Greece in the long run, but a serious pain for Europe, especially from the feared “domino effect”, including bank runs. A big domino, Spain, is having serious troubles of its own and took an unintended step towards receiving a bailout package. The downside potential is significant, especially as the US remains stable for now.

If you have interest in a different way of trading currencies, check out the weekly binary options setups, including EUR/USD, GBP/JPY and more.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand dollar (kiwi), read the NZD forecast.

- For the Swiss Franc, see the USD/CHF forecast.

- USD/CAD (loonie), check out the Canadian dollar forecast.