Euro/dollar had a positive week, riding on the determination of the ECB in using its firepower to counter the Spanish crisis. The upcoming week is even more important, with the German constitutional court’s ruling needed to enable the bailouts. There are quite a few additional regular indicators and special events. Will the rally continue?. Here is an outlook for the upcoming events and an updated technical analysis for EUR/USD.

Mario Draghi provided the goods with the OMT: a plan to buy an unlimited amount of bonds with a maturity of up to 3 years – a wider scope than expected. While full QE was not approved, Draghi did provide a political carrot to Spain – bond buying could happen also with a “precautionary program”– not necessarily a troika led program. Assuming an approval in Karlsruhe, the ball will pass to Spain, which is on the edge on many fronts. In the US, weak Non-Farm Payrolls convinced markets that QE3 is coming (even if it isn’t 100% certain), and this significantly hurt the dollar.

Updates: French Final Non-Farm Payrolls dropped 0.1%, matching the market forecast. German WPI had its highest jump since February, as the inflation index rose 1.1%. We could see some volatility in EUR/USD on Wednesday, as the German Constitutional Court rules on the constitutionality of the ESM. As well, voters in the Netherlands go to the polls to choose a new government. EUR/USD was testing the 1.28 line, but has retracted, as the pair was trading at 1.2875. The Euro pushed higher following the German Constitutional Court decision on the ESM. The Court held that Germany could participate in the program, but set a cap of 190 billion euros. French CPI rose 0.7%, beating the forecast of 0.5%. German Final CPI was up 0.4%, just above the estimate of 0.3%. Italian Industrial Production declined 0.2%, while the markets had predicted a 0.5% decline. Euro-zone Industrial Production rose 0.6%, easily beating the forecast of 0.0%. Voters go to the polls in the Netherlands, with the results too close to call. The euro rally continues, as the continental currency continues to test the 1.29 line. EUR/USD was trading at 1.2895. The ECB Monthly Bulletin was released on Thursday. The Bank stated that inflation rates are expected to remain above 2% throughout 2012, and the underlying pace of monetary expansion remains “subdued”. The report found that there is a need for structural and fiscal adjustment in many European countries, although progress is being made in this regard. Meanwhile, the markets are eagerly waiting for the FOMC statement, as speculation is high that the Fed will announce QE3 to help the US economy. In the Netherlands election, the conservative Liberal party won the most seats, but caretaker PM Mark Rutte will now be tasked with forming a new coalition government. EUR/USD has edged downwards, as it dropped closer to the 1.29 line. The pair was trading at 1.2910. It finally happened: the Fed announced QE3 – open ended, $40 billion per month, in addition to more twist and a longer pledge for low rates through 2015. EUR/USD topped 1.30.

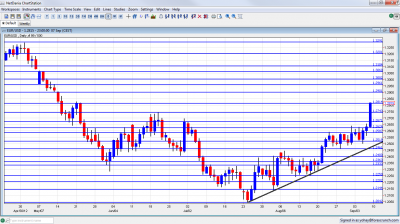

EUR/USD daily graph with support and resistance lines on it. Click to enlarge:

- French Industrial Production: Monday, 6:45. Europe’s second largest economy has seen no change in its industrial output in June, falling short of expectations. A drop of 0.5% is expected now.

- Sentix Investor Confidence: Monday, 8:30. This wide survey of 2800 investors has seen a steady deterioration since May, and is an excellent gauge for the current mood. From the abyss of -30.3 points, a small rise to -29.6 is predicted. Note that the negative number represents pessimism.

- Catalan Demonstrations: Tuesday. Many in Spain’s industrious northeastern region of Catalonia have aspirations of having an independent state. The recent economic crisis, including the aid request from Madrid have angered many. September 11th is Catalonia’s national day (a public holiday) and massive protests are expected in Barcelona, with a clear call for independence. This could raise the chances of a referendum. Increased tensions in Spain weigh on the economy and could enhance the aid request.

- French Final Non-Farm Payrolls: Tuesday, 5:30. This quarterly report has been inspiring of late. In Q2, France lost 0.1% of its jobs, after a previous gain of the same scale. Another drop is expected now.

- German Constitutional Court Ruling: Wednesday morning. The judges in Karlsruhe will decide on the legality of the ESM bailout fund. Their approval is required launching this important tool that Spain is waiting for. The ESM was already approved in the German parliament and the court isn’t likely to reject it. A year ago, it already gave its nod to the EFSF. In addition, the decision was approved with a huge majority in parliament, and the court probably understands the implications of rejection: a serious risk of the euro’s demise, a move that will hurt Germany badly, economically and politically. An approval by the court is partially priced in, but the euro is still expected to rally. A surprising rejection would send the euro hundreds of pips lower, but this isn’t likely. More details about this are in the monthly outlook.

- French CPI: Wednesday, 5:30. After the ECB focused on the OMT, the next decision could consists of a rate cut. Inflation, the ECB’s “single needle in its compass” will be important, making also this figure relevant. After a drop of 0.4% last month, a rise of 0.5% is expected now.

- German Final CPI: Wednesday, 6:00. Prices have risen for a second month in a row according to the initial estimation: 0.3%. This will probably be confirmed now.

- Industrial Production: Wednesday, 9:00. Germany posted a strong rise in industrial output, and this will likely soften the fall in other countries. After a sharp drop of 1.4% in June, a small slide of 0.4% is expected in July.

- Dutch elections: Wednesday, results in the evening. The Netherlands went hand in hand with Germany in the austerity drive. However, the current government led by center-right Mark Rutte, fell over austerity measures. The anti-EU Socialist Party is expected to make gains, riding on the anti-austerity sentiment. However, poor debate performances by its leader Emile Roemer cast doubts. The outcome of the elections will determine if the next Dutch coalition government will be as supportive as it is now, or if it will be more like Finland.

- Italian 10-y Bond Auction: Thursday morning. The euro-zone’s third largest country is hoping for a quick resolution for Spain, so it will not need to ask for help as well. The auction of these benchmark bonds comes before

- ECB Monthly Bulletin: Thursday. One week after laying out the details of the OMT, the ECB will publish the data it saw before making its decisions. In the press conference, Mario Draghi presented updated staff forecasts for 2012 and 2013. Economic contraction in 2012 is already undoubted by the ECB, and also the forecast for 2013 was lowered. The details usually move the markets.

- CPI: Friday, 9:00. According to the initial estimates, the level of inflation in August was 2.6%, above target. This will probably be confirmed now. Core CPI is expected to stand at 1.7%.

- Employment Change: Friday, 9:00. While this is a late figure (for Q2), the quarterly scope makes it important. Total employment has squeezed by 0.2% in each of the preceding three quarters. Another drop of this magnitude is predicted now.

- Spanish government meeting: Friday. The Spanish government convenes every Friday. This specific meeting could be special, with a potential submission of a formal aid request. Spain may opt for a “precautionary program” or “soft bailout” that could be more easy to digest politically. The ECB already presented its bond buying program and at this stage, an approval from Germany’s court is expected. Even though his has been long awaited, the formal request will aid the common currency. New reports cast doubt about an aid request soon, as internal political considerations could push the request to late October.

- Finance minister meetings: Friday and Saturday. Finance ministers meet on Friday and on Saturday in Brussels to discuss the situation. If a Spanish aid request is made on Friday, it could be discussed and eventually approved, paving the way for bond buying in the next week. Statements made on Friday will rock the markets.

* All times are GMT

EUR/USD Technical Analysis

€/$ started the week capped under 1.2624, in what turned into a triple top. After falling to low ground and a new battle with this line, the pair finally conquered it and reached higher ground. It stopped only at the 1.2814 line (mentioned last week).

Technical lines from top to bottom:

We start from higher ground this time: 1.3290 capped the pair during April and is distant resistance. The round number of 1.32 also served as resistance at that time and is minor resistance.

1.3105 provided some support in April and is minor resistance as well. 1.3060, was a clear separator in May and also had an important role beforehand.

The very round 1.30 line is a very important line in case of huge rally. In addition to being a round number, it also served as strong support. It is closely followed by 1.2960 which provided some support at the beginning of the year.

1.29 is also notable after providing some support in May. 1.2814 was the peak of a recovery attempt in May and also capped the pair in September 2012.

1.2750 capped the pair after the Greek elections and also had a similar role in the past. It is weaker now. 1.2670 was a double bottom during January and was the high line of the recovery before the Greek elections in June. It also capped the pair at the beginning of July 2012.

1.2624 is the previous 2012 low and remains important as also seen at the end of August, when it served as resistance. Below, 1.2587 is a clear bottom on the weekly charts but after holding the pair down for a while, but it is weak now.

1.2520 had an important role in holding the pair during June, in more than one case, and it became stronger in August. 1.2460 is the next minor line of support after providing a cushion for the pair in August.

It is closely followed by 1.24 that provided some resistance in June 2010 and switched to resistance in July. It is now of higher importance after capping a recovery attempt at the end of July and also at the beginning of August. 1.2360 was temporary support in July 2012 but quickly switched to resistance. It is minor now.

Further below, 1.2330 is another historical line after being the trough following the global financial meltdown in 2008. It’s stronger after working as strong support. It should be closely watched if the pair falls. 1.2250 proved to be significant support for the pair in August 2012 and is key support now.

Uptrend Support Worked Again

An uptrend support line can be seen on the chart. After bouncing off the line last time, the line slowly got closer to the pair that remained stable in range. Another move closer saw another nice bounce and the line is far now.

I am neutral on EUR/USD

After the huge rally that sent the pair to the highest levels since May, there is room for some correction. The rise came on a better than expected ECB decision, and high hopes for QE3 in the US. These hopes could lead to a disappointment, countering the big steps that Europe is taking to counter the crisis.

The next phase is the German court approval (partially priced in) and the subsequent Spanish aid request, made easier thanks to Draghi. These should balance a potential compromise in the US, in a form of extended guidance instead of dollar printing.

If we get QE3, there’s more room for rises towards 1.30 and beyond. In an unlikely case of a German court rejection of the ESM, 1.20 could be challenged. The more likely scenario is none of these events, and a balanced outcome to a very important week. Volatility is back and is here to stay.

If you have interest in a different way of trading currencies, check out the weekly binary options setups, including EUR/USD, GBP/JPY and more. Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand dollar (kiwi), read the NZD forecast.

- For the Swiss Franc, see the USD/CHF forecast.

- USD/CAD (loonie), check out the Canadian dollar forecast