USD/JPY dropped 150 points last week, as the pair closed just above the 103 level. There are 14 events this week. Here is an outlook for the highlights of this week and an updated technical analysis for USD/JPY.

The Fed refrained from raising rates last week, but the policy statement was slightly hawkish, as the Fed gave the economy a solid report card. US Non-Farm Payrolls were upbeat and wage growth improving to 0.3%, above the estimate of 0.2%. The BoJ stood pat and kept rates at -0.10%.

do action=”autoupdate” tag=”USDJPYUpdate”/]

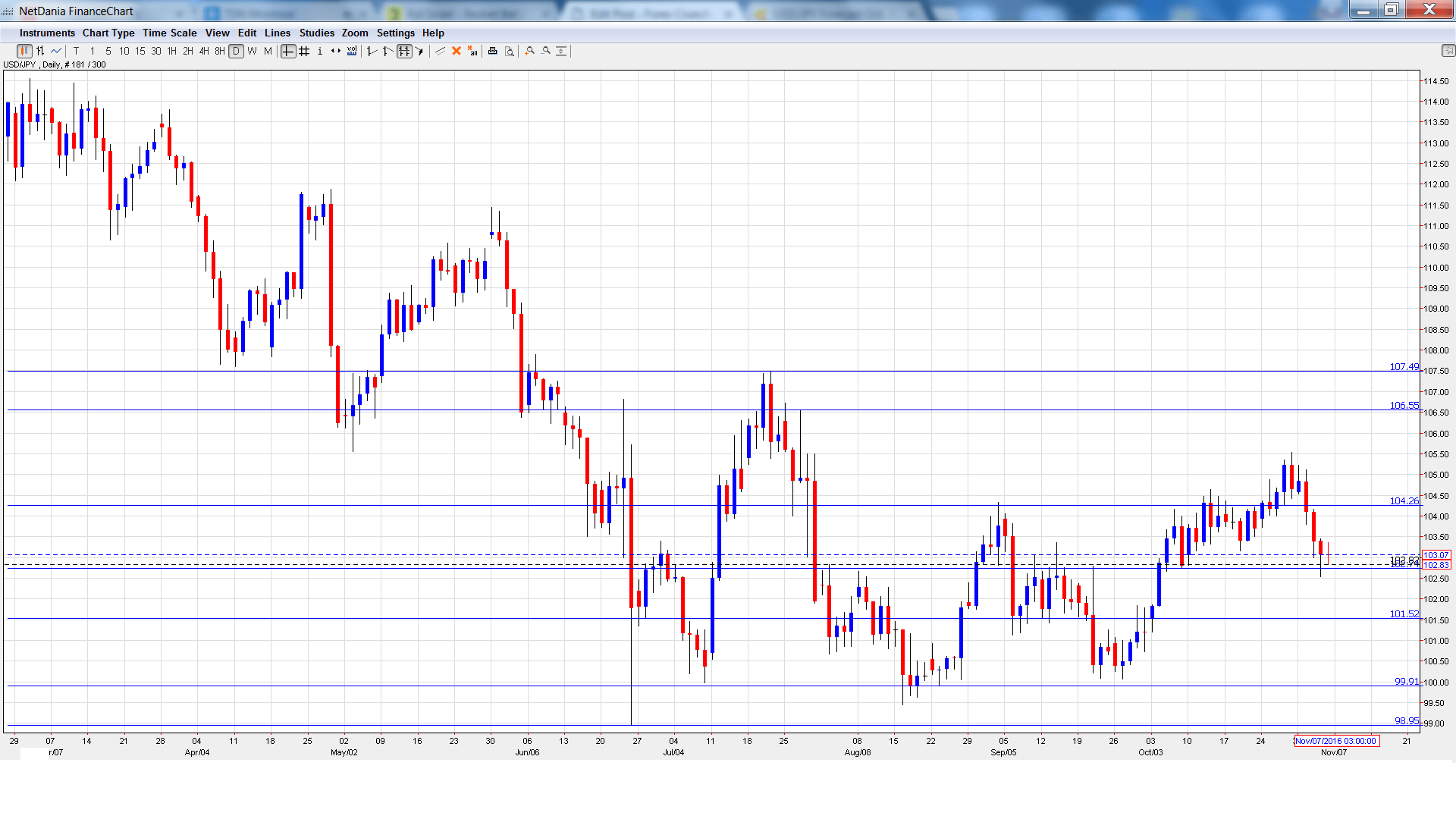

USD/JPY graph with support and resistance lines on it. Click to enlarge:

- BoJ Monetary Policy Meeting Minutes: Sunday, 23:50. The minutes provide details of the September BoJ policy meeting. The markets will be looking for clues as to the BoJ’s future monetary policy.

- Average Cash Earnings: Monday, 00:00. Wage growth is an important employment indicator. In August, the indicator declined 0.1%, well short of the forecast of 0.5%. The estimate for September stands at 0.2%.

- 10-year Bond Auction: Tuesday, 3:45. 10-year bonds continue to post negative yields. The yield came in at -0.06% at the October auction.

- Leading Indicators: Tuesday, 5:00. The indicator came in at 101.2% in August, slightly short of 101.7%. The forecast for the September report is 100.5%.

- Current Account: Tuesday, 23:50. Japan’s surplus improved to JPY 1.98 trillion in August, well above the forecast of JPY 1.58 trillion. This was the highest surplus since March 2016. An identical surplus is expected in the September release.

- Bank Lending: Tuesday, 23:50. Credit levels are closely connected to consumer spending, a key driver of economic growth. The indicator gained 2.2% in September, marking a 4-month high. The indicator is expected to post another gain of 2.2% in October.

- Economy Watchers Sentiment: Wednesday, 5:00. The indicator continues to point to pessimism, with readings well under the 50-point level. In September, the indicator dipped to 44.8 points, short of the forecast of 45.9 points. The estimate for October stands at 44.4 points.

- BoJ Summary of Opinions: Wednesday, 23:50. This report is released about 10 days after the BoJ’s policy statement. It provides details of the BOJ’s economic and inflation forecasts.

- Core Machinery Orders: Wednesday, 23:50. The indicator declined 2.2% in August, better than the forecast of a decline of 4.4%. Another decline is expected in September, with a forecast of -1.8%.

- M2 Money Stock: Wednesday, 5:00. The indicator improved to 3.6% in September, above the forecast of 3.4%. The forecast for October remains at 3.6%.

- 30-year Bond Auction: Thursday, 3:45. The yield at the October auction was almost unchanged, coming in at 0.51%. No significant change is expected in the November auction.

- Preliminary Machine Tool Orders: Thursday, Tentative. This manufacturing indicator continues to post declines, although the declines have moderated for five straight readings. In September, the indicator came in at -6.3%.

- PPI: Thursday, 23:50. Japan continues to grapple with deflation. PPI has not posted a gain since March 2015. The index is expected to improve to -2.6 in the October report.

- Tertiary Industry Activity: Friday, 4:30. The indicator dipped to a flat 0.0% in August, short of the estimate of -0.2%. The forecast for September remains unchanged at -0.2%.

* All times are GMT

USD/JPY Technical Analysis

USD/JPY opened the week at 104.57 and touched a high of 105.23. USD/JPY then reversed directions and touched a low of 102.54, testing support at 102.74 (discussed last week). The pair closed the week at 103.07.

Live chart of USD/JPY:

Technical lines from top to bottom:

107.49 was the high point in July.

106.55 is next.

105.55 was a cushion in May and June.

104.25 has strengthened in resistance following strong gains by USD/JPY last week.

102.74 is providing weak support. It could see further action early in the week.

101.52 is next.

99.91 has held in support since late August.

98.95 is the final support line for now.

I am bullish on USD/JPY

The US economy continues to look solid, while the Japanese economy continues to struggle with deflation and weak consumer growth. With the Fed expected to raise rates in December, monetary divergence continues to favor the US dollar.

More:

- How to trade the US elections with currencies

- US elections: updates on 21 brokers

- US elections and forex – all the updates in one place

And the video:

Our latest podcast is titled Bold in oil and talking up the currency

Follow us on Sticher or iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast.