AUD/USD posted modest losses last week, as the pair closed at 0.7520. There are 9 events on the calendar this week. Here is an outlook on the major market-movers and an updated technical analysis for AUD/USD.

US GDP dipped to 1.9% in Q4, weaker than the previous quarter but close to the estimate of 2.1%. Unemployment Claims and Existing Home Sales both missed expectations, but consumer confidence moved slightly higher, beating the forecast. Down Under, Australian CPI dipped to 0.5% in Q4, short of the estimate of 0.7%.

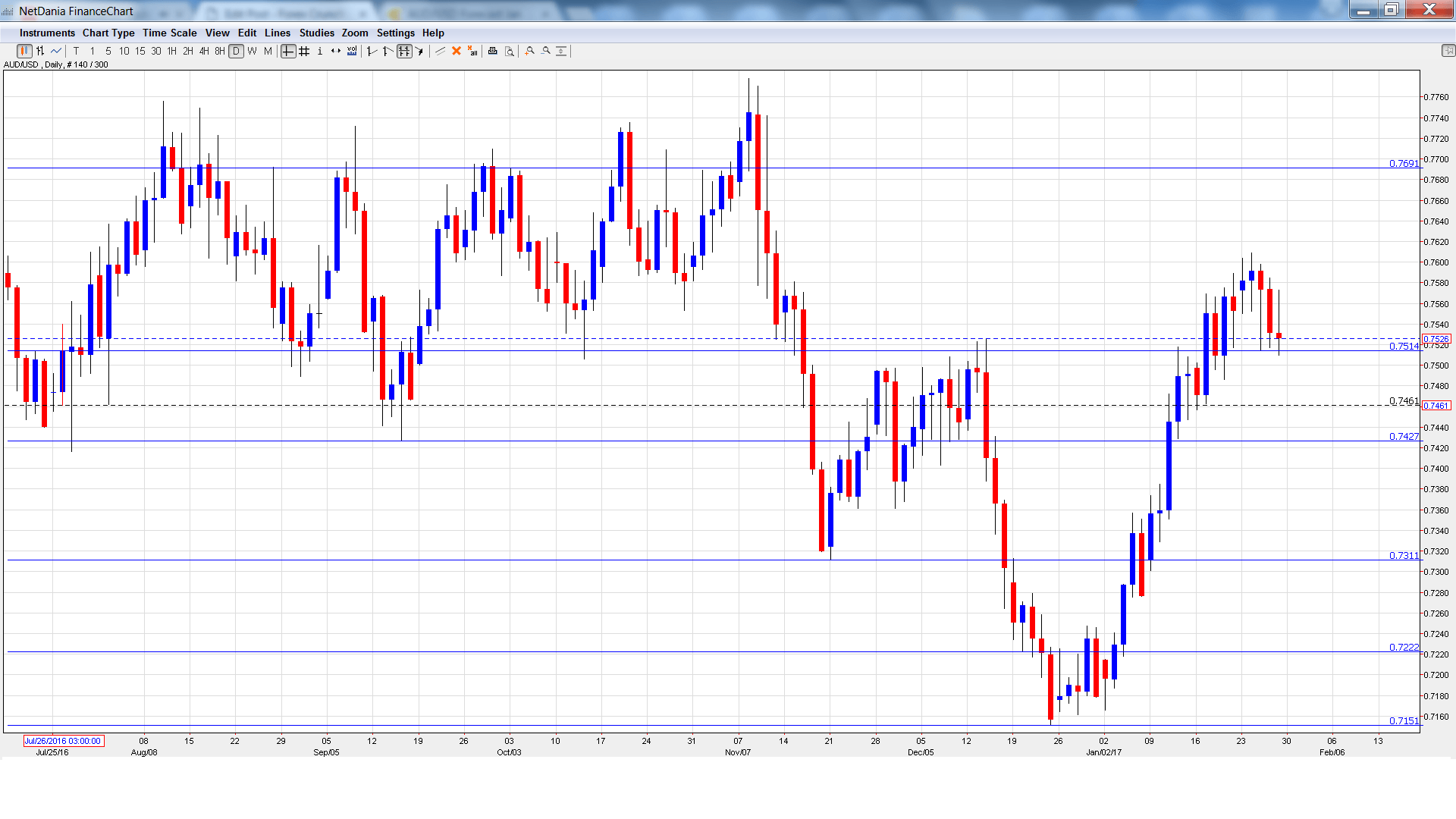

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- RBA Assistant Governor Guy Debelle Speech: Monday, 7:45. Debelle will deliver remarks at an event in Sydney. The markets will be looking for clues regarding the RBA’s future monetary policy.

- NAB Business Confidence: Tuesday, 00:30. The indicator edged up to 5 points in November, indicative of increased optimism in the business sector. Will the upswing continue in the December report?

- AIG Manufacturing Index: Tuesday, 22:30. The manufacturing indicator has been steady, posting two straight gains of 0.5%. An identical gain is expected in the upcoming release.

- Chinese Manufacturing PMI: Wednesday, 1:00. Key Chinese indicators can have a significant impact on AUD/USD, as China is Australia’s number one trading partner. In December, the index edged lower to 51.4, within expectations. The January estimate stands at 51.2.

- Commodity Prices: Wednesday, 5:30. The indicator continues to post strong gains. In December, the indicator jumped 45.5%, up from 32.1% a month earlier. Will the upward trend continue in January?

- Building Approvals: Thursday, 00:30. Building Approvals is often marked by sharp fluctuations, making accurate predictions a tricky task. In November, the indicator rebounded with a sharp gain of 7.0%, after three straight declines. The estimate for December is -1.7%.

- Trade Balance: Thursday, 00:30. Australia’s trade surplus improved in November, with a surplus of A$1.24 billion. This easily beat the forecast of a deficit of A$-0.55 billion. The surplus is expected to widen in December, with a forecast of A$2.00 billion.

- AIG Services Index: Thursday, 22:30. The index jumped to 5.7.7 in December, pointing to considerable expansion in the services sector. Will the upswing continue in January?

- Chinese Caixin Manufacturing PMI: Friday, 1:45. The index rose to 51.9 points in December, above the forecast of 50.9. Little change is expected in January, with an estimate of 51.8.

AUD/USD Technical Analysis

AUD/USD opened the week at 0.7572 and climbed to a high of 0.7609. The pair then reversed directions and dropped to 0.7510, testing support below 0.7513 (discussed last week). AUD/USD closed the week at 0.7526.

Live chart of AUD/USD:

Technical lines from top to bottom:

We begin with resistance at 0.7938.

0.7835 has held firm since April 2016.

0.7691 was a cap for much of October.

0.7513 was a cushion in April 2015.

0.7427 is next.

0.7311 marked a low point in November.

0.7223 is next.

0.7151 has held in support since mid-December. It is the final support level for now.

I am bearish on AUD/USD

Just a week into his new job, Donald Trump has not shied away from controversy. The new president withdrew the US from the Trans-Pacific Partnership and has escalated tensions with Mexico. However, the economy is strong and if inflation levels move higher, we could see the Fed step in with additional rate hikes which is bullish for the US dollar.

Our latest podcast is titled Trumping Trade and the Donald Dollar

Follow us on Sticher or iTunes

Safe trading!

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast.