EUR/USD was on the back foot after Draghi managed to drag the euro down and as the greenback recovered. The week ahead consists of French parliamentary elections, an important German survey, the Eurogroup meetings and more. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

The ECB now sees “balanced risks” rather than downside ones. It also removed its guidance regarding interest rates. The Bank now expects rates to remain at present levels for a long time, but not fall to lower ones. These hawkish changes were priced in. However, inflation forecasts were significantly downgraded, more than the rumors had suggested. In addition, Draghi said that “nothing has substantially changed” regarding core inflation. The euro retreated from its highs. In the US, Comey said that Trump lied, but did not rule that the President obstructed justice. While Trump remains in trouble, the trouble did not get worse and the dollar could recover.

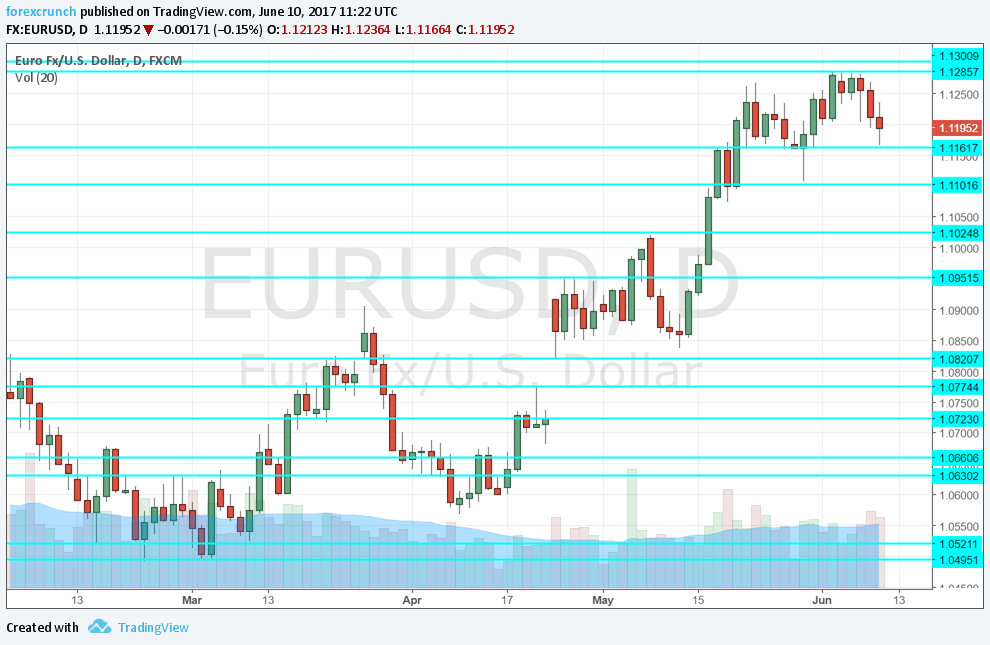

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- French Parliamentary elections: Sunday, results due before markets open. After Macron won the presidency, he needs his new party to win a majority in parliament in order to pass his reforms. The young president succeeded in attracting candidates from both the left and the right as well as non-politicians. Recent opinion polls are positive for Macron’s party La Republique En Marche. This is the first round of the elections and the second one is next week. A victory for Macron is priced in and the euro would react negatively only if he loses ground. In any case, the impact is not expected to be as strong as in the presidential elections.

- German WPI: Tuesday, 6:00. Wholesale prices eventually feed into consumer prices. The WPI advanced by 0.4% in April. A slower increase of 0.2% is projected now.

- German ZEW Economic Sentiment: Tuesday, 9:00. This is an early indicator of business sentiment in the largest economy in the euro-zone. Back in May, the score advanced to 20.6. Another increase to 21.6 is on the cards. Also the all-European number carries expectations for an increase from 35.1 to 37.2 points.

- German CPI (final): Wednesday, 6:00. The preliminary inflation measure for Germany showed a month over month drop of 0.2% in prices. This will likely be confirmed now.

- Employment change: Wednesday, 9:00. This quarterly figure comes a bit late, closer to the end of the following quarter. Nevertheless, it provides a wider picture. Employment increased by 0.3% in Q4 2016 and is expected to advance at the same scale now.

- Industrial output: Wednesday, 9:00. Despite being released after the major countries have published their own data, the indicator can surprise. Production fell by 0.1% and is now predicted to rise by 0.5%, driven mostly by a rise in German output.

- French CPI (final): Thursday, 6:45. The second-largest economy saw prices ticking up by 0.1% in May. This will probably be confirmed now.

- Trade balance: Thursday, 9:00. The euro-zone enjoys a big trade surplus thanks to German exports. A surplus of 23.1 billion was seen in March. We now get the data for April which is projected to show 22.4 billion.

- Eurogroup meetings: From Thursday afternoon and sometimes late into the night. The group of euro-zone finance ministers convenes and Greece tops the agenda. While the debt-stricken country passed the reforms that were required, its creditors are tussling over debt relief. The IMF says that without debt relief it will not participate, while the EU insists that the time is not right. Given the German elections in September, the can could be kicked down the road once again, with some kind of compromise, or “euro fudge” if you wish. The issue has been on the backburner but could take the headlines if things deteriorate. The Eurogroup meeting are followed by the wider EU28 meetings, the Ecofin group, on Friday.

- CPI (final): Friday, 9:00. The preliminary data for the Euro-zone was disappointing: a drop of headline inflation to 1.4% and core inflation fell to 0.9% after hitting the highest level since 2013 back in April. The numbers will probably be confirmed now.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar started the week by pushing higher, marking a new high at 1.284, a level that did not appear last week. Things then deteriorated and the pair dropped, closing just under 1.12.

Technical lines from top to bottom:

1.1420 was a high back in the summer of 2016. 1.1360 capped the pair in September.

1.13 is the top line seen in November before the collapse. Very close, 1.1284 is a peak seen in early June, a level that proved stubborn.

1.1160 was a low point in May, where the pair retreated to after hitting new highs. The round number of 1.11 was a siwng low in late May.

1.1025 was the intial top after the pair breached 1.10 and now works as support. 1.0950 is close by, and the most recent 2017 high.

The swing high of 1.0870 is the swing high in December and remains fierce resistance. 1.0820 was the post-French elections low.

1.0775 capped the pair in January and remains of importance. 1.0720 was also high in January.

The pair was unable to crack 1.0660 in February and it remains the high end of the range.

I am neutral on EUR/USD

Draghi’s dovish drag takes some of the momentum out of the euro. In addition, the euro suffers from Brexit uncertainty. The UK election results are mostly felt in the pound but the euro feels the collateral damage. In the US, there is temporary political relief that helps the dollar, countering the potential blow from a “dovish hike” from the Fed. All in all, the trend remains to the upside, but we could certainly see the pair taking a break.

Our latest podcast is titled US labor market and UK’s Labour comeback

Follow us on Sticher or iTunes

Safe trading!