EUR/USD finally made a breakthrough and reached the highest levels in over a year. Is this the beginning of a longer trend? The first week of July features PMIs and the ECB meeting minutes. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

Mario Draghi talked about a move from deflation risk to reflation and also about gradually removing stimulus. This optimism from Draghi, that was very cautious on inflation so far, sent the euro higher. In the US, Yellen did not say anything regarding monetary policy, but her colleagues seem more skeptical about inflation picking up.

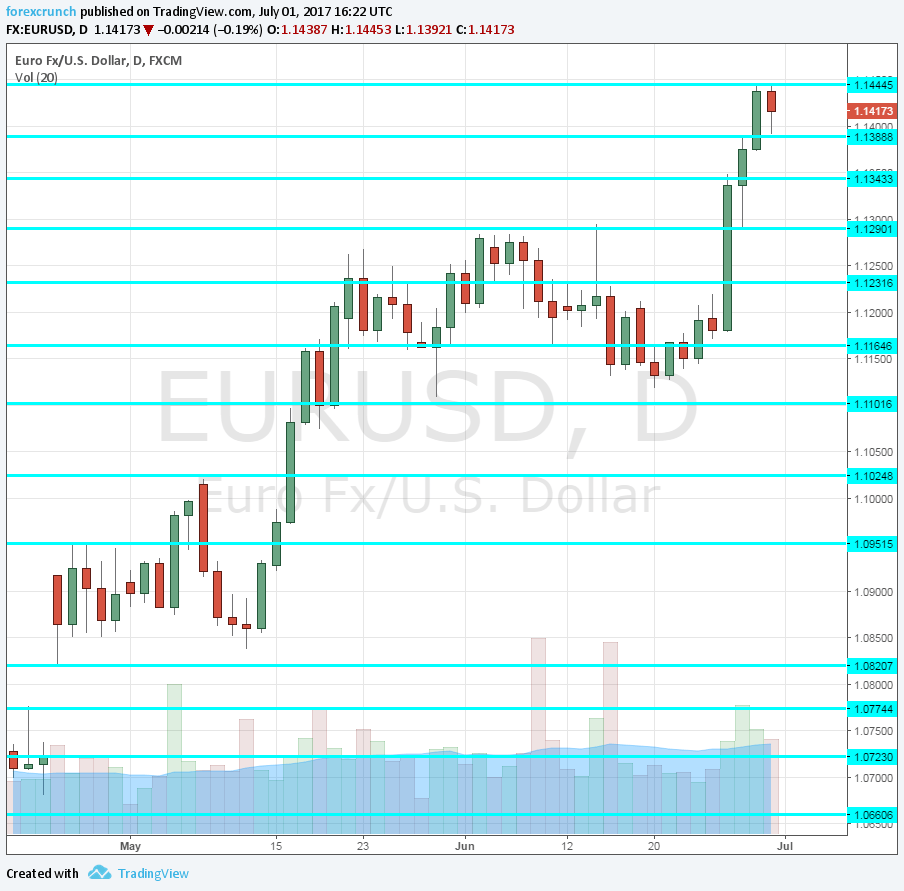

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Manufacturing PMIs: Monday morning: 7:15 for Spain, 7:45 for Italy, the final French figure at 7:50, final German read at 7:55 and the final euro-zone number at 8:00. The Spanish manufacturing sector enjoyed good growth in May according to Markit’s purchasing managers’ index, with a score of 55.4 points, above the 50-point threshold that separates growth from contraction. A score of 55.6 is expected. Italy, the third-largest economy, had 55.1 points, with 55.3 predicted now. According to the preliminary report for June, France had a score of 55, Germany enjoyed robust growth at 59.3 and the euro-zone’s score stood at 57.3 points. The flash readings for June will likely be confirmed now.

- Unemployment Rate: Monday, 9:00. The euro-zone’s unemployment rate has been sliding consistently since peaking in 2013. It stood at 9.3% in April. We now get the numbers for May. A repeat of this number is on the cards.

- Spanish Unemployment Change: Tuesday, 7:00. Spain, the fourth-largest economy, still has a high level of unemployment, but this is falling. Back in May, the number of the unemployed dropped by 111.9K. Another fall is expected for June. Note that the numbers are not seasonally adjusted. A big drop of 120.3K is expected now.

- PPI: Tuesday, 9:00. Prices at factory gates, aka producer prices, make their way into consumer prices. They remained unchanged in April. A slide of 0.2% is projected.

- Services PMIs: Wednesday morning: 7:15 for Spain, 7:45 for Italy, the final French figure at 7:50, final German read at 7:55 and the final euro-zone number at 8:00. Spain’s services sector saw rapid growth in May according to Markit, 57.3 points and 56.6 is forecast now. Italy had 55.1, also well over the 50-point threshold and 54.8 is estimated now. According to the preliminary read for France for June, the score stood at 55.3. Germany had only 53.7 and the euro-zone had 54.7 points. The last three numbers will probably bo confirmed in the final read.

- Retail Sales: Wednesday, 9:00. The volume of retail sales advanced by a modest 0.1% in April. The all euro-zone figure is released after the major countries had already published their data. Nevertheless, surprises are not uncommon here. A small rise of 0.3% is predicted.

- German Factory Orders: Thursday, 6:00. Germany is considered the locomotive of Europe. However, the volume of orders at factories is quite volatile and dropped by 2.1% in April. A bounce worth 1.8% is expected.

- Retail PMI: Thursday, 8:10. Markit’s measure of growth in the retail sector is picking up, reaching 52 points in May. The figure was in contraction territory for a long time.

- ECB Meeting Minutes: Thursday, 11:30. Four weeks after the ECB decision, we get more details. In that June 8th meeting, the made small optimistic tweaks to its statement but also lowered inflation forecasts. Since then, Draghi made his Sintra speech that was much more optimistic. Will we hear some fear in the minutes? While the report is somewhat stale, it is still eyed for future policy changes.

- German Industrial Production: Friday, 6:00. Complementing the factory orders report, the industrial output tends to go the other way. Back in April, Germany saw a rise of 0.8% in production. Will it fall now? A rise of 0.4% is forecast.

- French Trade Balance: Friday, 6:45. Contrary to Germany, France has a trade deficit. It reached 5.5 billion in April. A narrower deficit of 5.1 billion is expected.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar was initially supported at the 1.1160 level mentioned last week. It then made a sharp move, initially stopping at 1.1360.

Technical lines from top to bottom:

1.1620 was a swing high in May 2016. It is followed by the very round number of 1.15.

1.1445 is the June 2017 peak and immediate resistance. 1.1390 is the post breakout low and works as support.

1.13 is the top line seen in November before the collapse. 1.1230 capped the pair in June.

1.1160 was a low point in May, where the pair retreated to after hitting new highs. The round number of 1.11 was a siwng low in late May.

1.1025 was the initial top after the pair breached 1.10 and now works as support. 1.0950 is close by, and the most recent 2017 high.

The swing high of 1.0870 is the swing high in December and remains fierce resistance. 1.0820 was the post-French elections low.

I remain bullish EUR/USD

The consolidation has ended and the pair is on the way up. Draghi unleashed the upside, similar to how Macron’s victory did. In the US, the Fed shows some hesitation about the rate hikes.

Our latest podcast is titled Markets are finally moving – will it last?

Follow us on Sticher or iTunes

Safe trading!