- EUR/USD finds rejection just above the 1.1800 mark.

- After Powell’s speech on Friday, the pair found traction and jumped to a key zone of 1.1800.

- German inflation is the key data ahead under focus.

- Today, US home sales data may provide some impetus to the market.

The EUR/USD forecast is neutral to bearish as the pair found some selling and is retracing back below the 1.1800 mark. Although Powell led gains are still preserved.

–Are you interested to learn more about ECN brokers? Check our detailed guide-

Despite the recent uptrend in the Euro, it appears that the EUR/USD pair has hit a fairly moderate threshold near 1.1800.

The EUR / USD pair is contributing to modest gains on Friday, though a convincing move north of 1.1800 does not seem likely at the moment.

After Powell’s low-key speech at an event in Jackson Hole on Friday, spot and the rest of the risk-centric currencies gained traction, flirting just above 1.18 for the first time since early August.

Last week, the pair had an “outside day”, which allowed the rebound from lower lows in 2021 around 1.1660 on Aug 20 to continue.

The publication of data on Germany’s inflation for the current month will be the focus in Germany. At the start of the session, business confidence in Spain fell by 0.1% in August, retail sales grew by 0.1% m/m, and CPI rose by 0.4% m/m and 3.3% y/y.

In the wider Euro area, final consumer confidence fell to -5.3, while economic sentiment fell to 117.5, according to the European Commission (EC). As a result, the preliminary CPI will be in the spotlight later this week in Germany.

The US weekly calendar will be improved by pending home sales and the Dallas Federal Reserve Index.

–Are you interested to learn more about making money in forex? Check our detailed guide-

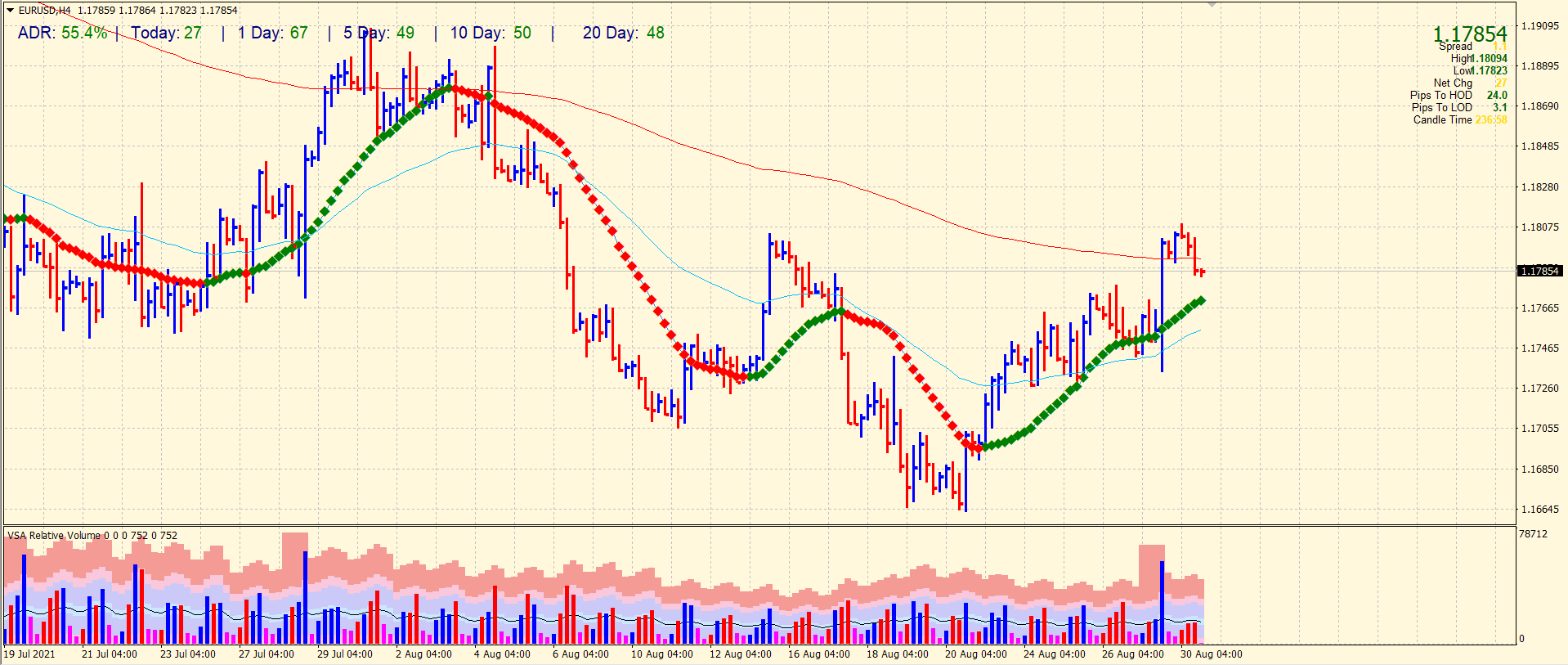

EUR/USD price technical forecast: 1.1800 resisting gains

The EUR/USD pair managed to move beyond the 200-period SMA on the 4-hour chart. The pair hit the daily highs above 1.1800. However, the pair could not sustain the gains and looks weak to follow through the upside momentum. The bearish volume is slowly emerging while the 40% average daily range is complete so far. The market is rangebound today and lacks any impetus.

On the downside, the 1.1750 support may hamper the downside ahead of 1.1700. On the upside, 1.180, today’s high, may resist gains ahead of 1.1835.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.